The nature of autocall plans means that missing an opportunity to mature early is far from a bad thing, says Josh Mayne, Lowes Financial Management

2020 was a year characterised by the largest pandemic since the outbreak of HIV/AIDS, and represented a period best left in the history books – even for the most Panglossian spirits.

A notable financial repercussion of the coronavirus pandemic in the UK was the stock market correction in Q1 2020, which saw the FTSE 100 Index fall to its lowest levels since the wake of the financial crisis. Whilst at the time of writing the FTSE 100 sits above 7,000 points, and has remained around this level for some time, the recovery from the COVID correction was sluggish and metaphorized the lingering effects of long covid.

Following the correction, the FTSE 100 failed to break the 7,000-point barrier until April 2021, loosely aligning with the easing of lockdown restrictions. Consequently, investments that tracked, or derived their performance from the FTSE 100 Index may have struggled somewhat to achieve positive returns during this period.

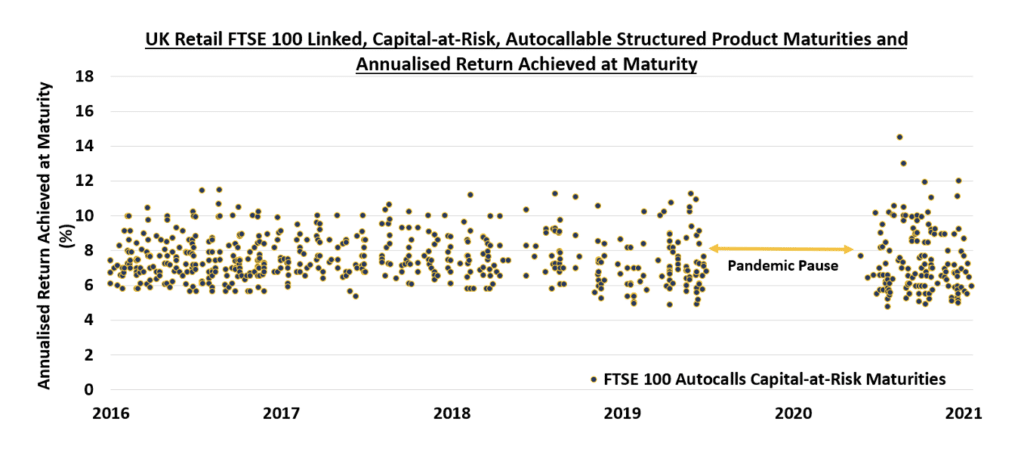

The chart below plots all FTSE 100 linked autocall structured product maturities from 2016 to date, by reference to the annualised return they achieved on maturity.

As can be seen, there is a gap in product maturities coinciding with the coronavirus pandemic and resultant market correction. In Q2 2021 alone, 70 FTSE 100 linked capital-at-risk autocall products matured returning an average annualised return of 7.79%. In stark contrast, no FTSE 100 linked capital-at-risk autocall products matured in 2020 after the 3 March. As such, all of these plans continued on to their next observation date (no plan was close to its final observation date).

However, this is certainly a case of ‘Don’t Mind the Gap’. The nature of autocall plans means that missing an opportunity to mature early is far from a bad thing. The cumulating effect of the coupons means that the longer the market takes to recover, provided it does recover sufficiently to trigger a maturity on, or before the final maturity date, the greater the return.

For example, the Investec / Lowes 8:8 Plan 4[1], which commenced in summer of 2018 when the FTSE 100 was above 7,500, failed to mature on it earliest potential maturity dates but successfully matured on 16 August 2021. The Plan returned investors’ original capital in full in addition to a gain of 23.1%, which is 7.7% more than would have been returned had a maturity triggered in August 2020.

Whilst missing early maturity opportunities under adverse market conditions will prove troublesome if there is no eventual positive maturity, an extended maximum possible investment term can help mitigate this risk. The extended term naturally allows more time to ride out a sustained bear market. Of course, by extending the term of the plan investors also benefit from an increased opportunity for accumulating coupons to be earned by adding to the number of maturity observation dates, as previously discussed.

By reference the chart above, we’d like to emphasise the performance of the FTSE 100 linked autocall structured product maturities. Despite the COVID correction, all 767 plans matured realising a capital gain for investors – no plans failed to achieve a gain, and no plans realised a capital loss. The average annualised return achieved from these plans was 7.47%, and the lowest return was still an inflation busting 4.76%. In fact, just eight of the 1,140 FTSE 100 linked capital-at-risk autocalls to mature in the sector to date have returned investors’ original capital with no further gain; 99.3% of relevant maturities earned investors a capital gain.

If the events of 2020 have proven nothing else, it is that no individual can predict short-term market movements. Another correction is possible, as is a rally from current levels. The defined nature of structured product terms helps to take the guess work out of future stock market performance – you can ignore the daily noise, focus on the defined outcomes, and Don’t Mind the Gap – or a deferred maturity because it’s not a negative!

[1] https://www.structuredproductreview.com/product/6417/

[Main image: ali-yaqub-unsplash]