The global energy crisis should serve as a stark reminder to investors of the importance of investing in sustainable projects that deliver cleaner power, says deVere CEO Nigel Green.

His comment follows the decision by the European Union to forge ahead with a partial ban on Russian oil.

Six million UK households face potential power blackouts over winter due to Russian threats that it will cut the EU’s gas supply, with the UK government now drawing up plans for rationed electricity.

Meanwhile, Green points out, US oil inventories are currently residing 14% below their five year average and China has been battling its most severe energy crisis in a decade.

Green says: “The global energy crisis is only set to deepen. It’s not going away any time soon. The crunch was started by the world economy rebounding from the pandemic faster than was anticipated, bringing to the fore supply and infrastructure issues.

“But the rebound’s impact isn’t the only reason for the international energy crisis we’re currently experiencing. Nor is the ongoing war between Russia and Ukraine, which is slashing supply globally. Intrinsic demand is also surging due to a 1% rise per year in global population growth, plus the increase in wealth and consumption of the growing global middle class.”

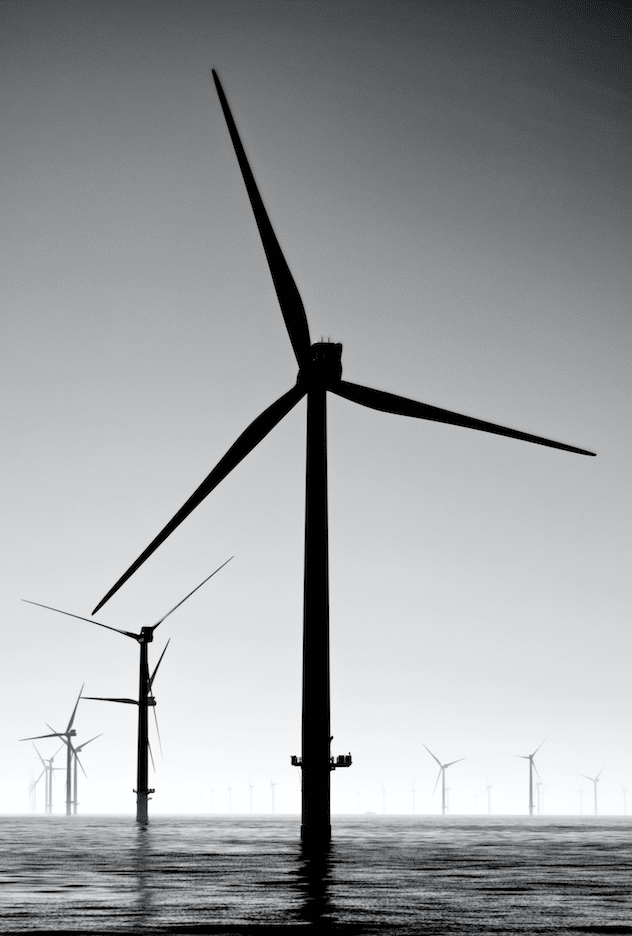

Green says the energy crisis should act as a “catalyst for the energy transition”, highlighting the need to accelerate investment into sustainable power projects over the longer-term.

According to Green, investors should be seeking out opportunities and moving quickly to have an early advantage.

He adds: “The worsening global energy crisis is a defining issue of our time, and it represents a key opportunity for investors seeking to build long-term wealth with a purpose.”