Structured Product Review has published a new guide to structured product autocalls as the sector celebrates 20 years since the very first autocallable structured product matured.

The guide ‘A Guide to Autocalls: A 20-Year Evolution’ provides an independent review of the sector’s evolution and performance, aiming to demystify autocalls and dispel common misconceptions.

Autocalls offer tax-efficient investment options, allowing individuals to hold them within accounts such as ISAs and SIPPs. For investors with £500,000 or more to invest, customised autocalls can be created.

Ian Lowes, founder of Structured Product Review and managing director of Lowes Financial Management, said: “Twenty years of maturities and historic performance shows that autocalls have largely delivered a reliable solution for investors. The FCA’s Consumer Duty regulations are at the forefront of most advisers’ minds and we know that Principle 12 states that a firm must act to deliver good outcomes for retail customers. Autocalls have been helping advisers do so for 20 years now and are a proven successful solution for investors.”

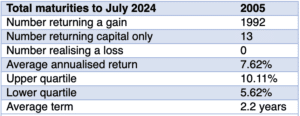

As well as celebrating 20 years from the first maturity, the UK retail sector also saw the 2,000th FTSE-only capital at risk autocall mature last month. The FTSE-linked capital at risk autocall is the mainstay of the UK sector, accounting for around 60% of autocall issuance and maturities to date.

Lowes continued: “With an impressive, largely unblemished track record, we believe it’s time to acknowledge that autocalls are a better investment approach for many individuals, at least as part of their portfolios. For those looking to beat inflation and grow their wealth, autocalls could be the way to go. They have proven their worth thus far.

“While they can be highly tailored, retail autocalls typically offer straightforward and easy-to-understand outcomes, making them accessible to a wide range of investors. We hope our guide will serve as a reference point and an educational resource for financial advisers who have yet to explore the potential of autocalls for their clients.”

Zak de Mariveles, chairman of UK Structured Product Association, commented: “The market has evolved considerably over the past two decades, and this guide shows how consistently auto calls have been used by investors to diversify their portfolios, and generate returns even when markets are falling. What’s more, it’s interesting to see how few products have matured at a loss over this entire period. The evidence supports the view that structured products have an important role to play in investors’ portfolios, allowing them to invest with peace of mind.”

UK retail FTSE* linked capital at risk autocall maturities

Main image: tech-daily-ztYmIQecyH4-unsplash