Flexible pension withdrawals are expected to rise over the coming quarter, putting pension savers at risk of various pitfalls, according to AJ Bell.

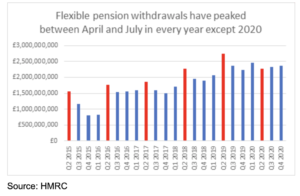

In five of the six years since the pension freedoms launched in April 2015, the first three months of the tax year has typically seen the highest volume of flexible withdrawals, with pension savers taking advantage of new tax allowances to access larger amounts from their retirement pot. However, severe market volatility during the height of the pandemic last year spooked investors, causing withdrawals in the second quarter of 2020 to drop 17% year-on-year.

Tom Selby, senior analyst, AJ Bell, said: “Before the pandemic hit withdrawals in the first three months of the financial year had been between 10% and 33% higher than in subsequent quarters. That all changed last year when retirement income investors spooked by the uncertainty of lockdown tightened their belts. This likely reflected people choosing to either delay accessing their pension, pause withdrawals or reduce the amount they were taking as income in the face of profound uncertainty.

Tom Selby, senior analyst, AJ Bell, said: “Before the pandemic hit withdrawals in the first three months of the financial year had been between 10% and 33% higher than in subsequent quarters. That all changed last year when retirement income investors spooked by the uncertainty of lockdown tightened their belts. This likely reflected people choosing to either delay accessing their pension, pause withdrawals or reduce the amount they were taking as income in the face of profound uncertainty.

“While most of us still have fewer things to spend our money on at the moment, the success of the Coronavirus vaccine and more stable market conditions mean we should expect to see a significant jump in withdrawals in the coming quarter.”

However, Selby warned that pension investors seeking to make a withdrawal over the course of the next three months faced various “pitfalls and bear traps.”

Arguably one the most important factors facing pension clients is the money purchase annual allowance which could trigger an irreversible £36,000 cut in their individual allowance to just £4,000. In addition, the MPAA will also stop clients from being able to carry forward unused pension allowances from up to three previous tax years.

Investors seeking to make a first taxable withdrawal should also understand that their withdrawal will be subject to emergency ‘Month 1’ taxation. For clients taking a regular income, overpaid tax will typically be ironed out via their tax code, however greater issues arise where it is a one-off payment and a form must be submitted to HM Revenue & Customs.

Furthermore, following a particularly turbulent year, AJ Bell warned that clients will also need to consider the sustainability of their retirement plan and have an understanding of the investment risks they are taking, particularly where large withdrawals are made at the same time as big falls in the markets.

Selby said: “Savers wanting to manage withdrawals sustainably and avoid selling down their capital at a low point in the market could use other cash resources – such as ISAs, savings or their 25% tax-free cash – in order to keep their underlying pension intact.

“Taking a natural income has also been a good strategy previously, although finding companies paying the dividends needed has been a real challenge over the past 12 months. For those who do take capital withdrawals from their pension, the key is to have a plan in place and review their income strategy regularly.”

AJ Bell said the vast majority of savers entering drawdown cite accessing their 25% tax-free cash as the main reason and this poses an opportunity for clients to review their current plans and retirement goals. According to Selby, this should include considering whether they wish to spend their pension or use it as part of their wider inheritance tax planning strategy.