Steve Ellis, CIO of Fixed Income at Fidelity outlines his key predictions for the asset class in 2020.

(Please note: this article was written before the latest developments with the Coronavirus – Ed)

In 2019, central banks returned to synchronised policy easing for the first time since the financial crisis. We believe this will continue in 2020 as central banks deploy whatever tools they can to stimulate growth and avoid a full-blown recession. With core bond yields likely to remain low – 10-year Treasuries below 2 per cent – we expect further inflows into areas of fixed income that offer more attractive yields. Yields in defensive investment grade are already tight, so we expect investors to diversify into higher-yielding areas such as emerging market debt. Inflation pressures continue to build in the US, which could present an opportunity for inflation-linked bonds further down the line.

Recession is a risk, but will be avoided in 2020.

The key risk for 2020 is that central bank policy fails to generate growth, governments shrink from fiscal stimulus and the global economy plunges into recession. Effects of the Coronavirus aside, we think recession will be avoided and the global economy will have a soft landing. However, if there is a recession in the US, default risk would rise, and balance sheet strength would become even more important. While spreads would widen in this scenario, this should be offset by core yields remaining very low. So on a total return basis, having duration or interest rate exposure should be positive. Another key risk for markets is the outcome of the US election, later this year.

Negative rates indicate policy limits

While we expect rates to remain low in the US and perhaps go even more negative in Europe, we are concerned about nearing the limits of what monetary policy can achieve. There are now over $16 trillion of bonds with negative yields, mostly in European sovereign debt. In October 2019, Greece – which a few years ago required the biggest ever bailout – sold a three-month government bond with a yield of -0.02 per cent, according to reports. If the economy, especially in Europe, drifts further towards recession-like territory, more rates could go negative. The European Central Bank rate is currently -0.5 per cent and expected to fall by another 10 basis points between now and the end of next year. This may or may not aid growth in the short term, but economies are unlikely to make real headway without the introduction of widespread fiscal stimulus.

Hunt for yield favours Asia, but beware EM currencies

In this climate of low and negative rates, hard currency emerging market debt, especially Asian high yield, looks attractive. Even if our base case scenario that a recession is avoided proves incorrect, any contraction is unlikely to be very deep or to restrict refinancing on a global scale as seen during the financial crisis. We would not expect defaults to rise sharply, though it could make sense to remain defensive.

We like Chinese debt, which offers a decent yield. Overall debt is rising in China, but it is manageable for now. If the trade war ramps up and conditions worsen, Chinese policy makers are likely to step in and provide fiscal reflation or monetary easing, albeit in a targeted fashion as they are doing currently. The central bank has been reducing reserve requirement ratios and overnight rates, while the fiscal deficit in China is about 6.5 per cent of GDP. Our proprietary indicators suggest the current stimulus is already having an impact.

We also think there is a case for buying Chinese government bonds: 10-year bonds are yielding around 3.5 per cent and could go lower. China is largely financed internally by very large savings. Levels of external debt financing are quite low compared to other countries – but follow a similar pattern to Japan.

On the other hand, we are more cautious about EM currencies. The asset class suffered from a strong US dollar in 2019, and although the Fed is cutting rates, other countries around the world are also easing, reducing the opportunity for dollar weakness. Finally, EM currencies are also sensitive to any growth slowdown, which is what we expect in 2020 even if we stay out of recession.

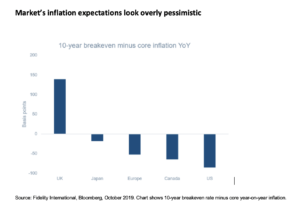

Pessimism around inflation is overdone

Inflation has been below-target in recent years, but could re-emerge to some degree in 2020 and beyond. The market is overly pessimistic about inflation, in our view, with global breakevens trading at a discount to core inflation. The exception is the UK, where inflation expectations have oscillated alongside sterling and Brexit headlines. While consensus estimates of US inflation in 2020 are 2.1 per cent, our estimate is closer to 2.5 per cent, driven by building wage pressures amid historically low unemployment and a strong US consumer.

Market’s inflation expectations look overly pessimistic

The other potential fillip for inflation is a de-escalation of the US-China trade war. While the removal of tariffs could reduce upward pressure on prices, the ensuing rebound in growth should more than offset this, leading to higher inflation overall.

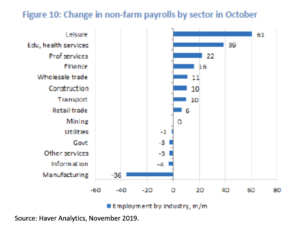

As central banks keep monetary policy loose and the global economy stabilises, inflation is increasingly likely to reappear. Consumer sectors already account for most of the employment increase in the US, allowing the country to avoid a full GDP recession even as manufacturing remains very weak. We think this presents an opportunity for inflation-linked bonds over the medium term.

Strong US consumer translates into higher employment in leisure and health

We think the outlook for fixed income in 2020 is positive, driven by the dovish policy environment and the potential de-escalation in the US-China trade conflict. We may not see the levels of return that occurred in 2019, as spreads have already narrowed significantly, but absent a recession or an inflation shock, we expect solid returns from higher-yielding areas of the global debt markets. Now may be the time to consider inflation protection while markets are so pessimistic about future price rises.

[1] FT.com https://www.ft.com/content/5dde46c4-ea83-11e9-a240-3b065ef5fc55