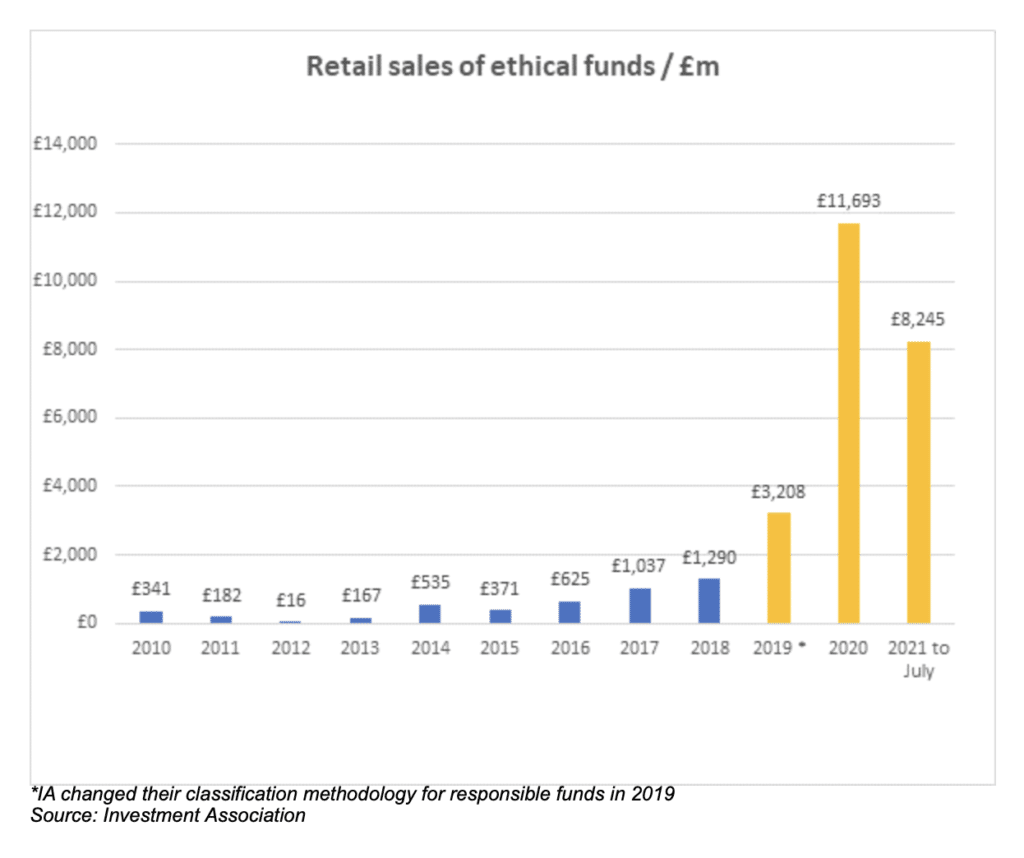

ESG funds are on track to achieve another record-breaking year of sales, amid growing demand for greener investing, says AJ Bell.

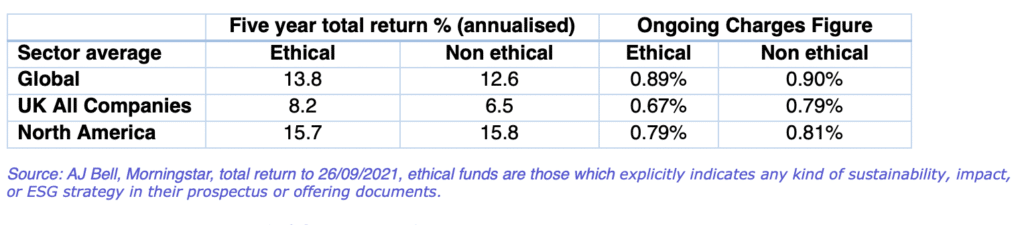

Sustainable/ethical funds have outperformed both in the Global and UK sectors, with Global sector ethical funds achieving a five-year total return of 13.8% compared to 12.6% for non-ethical.

Meanwhile, UK All Companies ethical funds reported a five-year total return of 8.2% versus 6.5% for non-ethical funds.

Laith Khalaf, head of investment analysis at AJ Bell, said: “There’s no doubting the strength of the sustainable investment tide, as last year responsible funds accounted for around a third of overall industry sales. This year looks set to be even bigger and on current trends will eclipse 2020 to post a new record for ethical fund sales.”

However, Khalaf noted that the ethical tilt of these funds is just one stylistic bias at play and other considerations over and above their ESG focus have also helped their performance over the past five years.

For instance, the make-up of the UK market means ESG funds are likely to be skewed away from mega cap and cyclical names because the FTSE 100 contains such a high weighting to oil and tobacco companies.

He explains: “This is one reason why the performance differential between ethical and non-ethical funds is so marked in the UK as in the last five years, mega cap stocks have fallen behind mid and small caps and cyclical stocks have fallen behind growth stocks.

“An underweight position in these underperforming areas of the market has therefore been a tailwind for ESG funds though the wind direction could change if the market starts to reassess the prospects for more economically sensitive areas of the market as it has done recently, most notably in the oil and gas sector.”

As such, AJ Bell believes there is not yet evidence of any ‘ESG premium’ in fund performance.

Khalaf says: “The idea of an ESG premium is intuitively appealing. As more money is directed towards higher scoring ESG companies, that could drive the share prices of ethical companies higher and lead to the establishment of an ESG premium in the performance of ethical funds. However, proving such a premium would also require a much longer time frame and a wider data set than is available at the moment.”

While the oldest ethical unit trust funds date back to the 1980s, the last three years have seen a step change in the amount of money flowing into responsible investment strategies, largely driven by the climate change agenda and growing awareness of environmental impact.

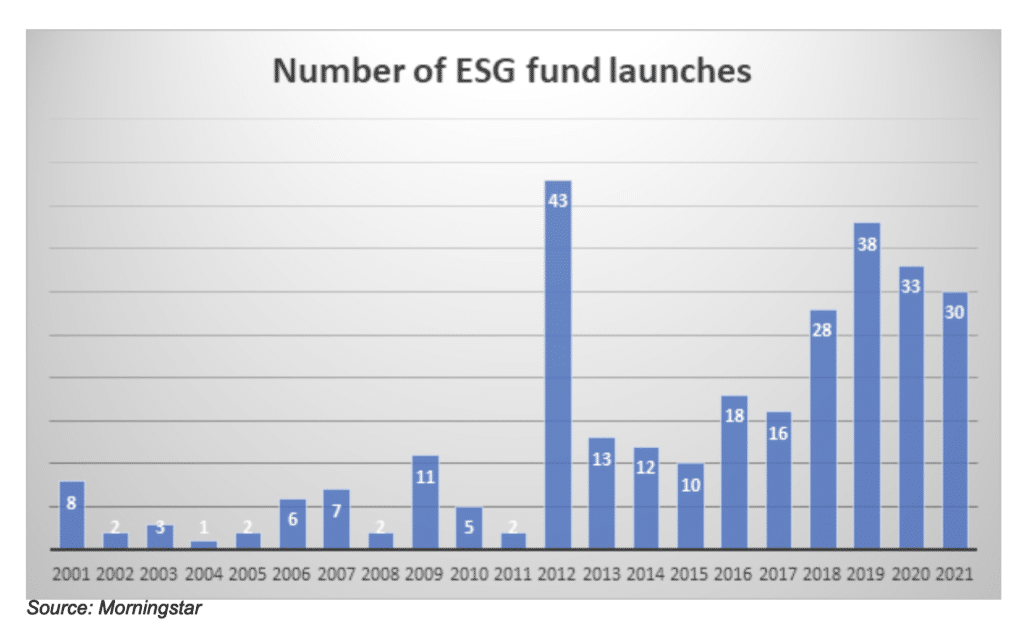

Khalaf likened the sector to a chicken and egg situation – interest from investors has led to a flurry of fund launches in recent years which has in turn created more investor awareness and demand.

He says: “A virtuous cycle has formed, swelling flows into the virtuous bit of the funds industry. We can expect this cycle to continue as fund groups put their marketing weight behind their new ESG offerings.”

However, Khalaf warned that while the majority of fund groups appear to be increasing their investment credentials, investors should do their homework when choosing sustainable funds and check that the ESG approach matches with their expectations.

“The reality is that routine fund management practices can legitimately be characterized as ESG integration, they just never used to be called that. Even so, some of the resulting portfolios would likely leave sustainable investors scratching their heads as to why their money is being funneled into oil companies and tobacco stocks.

“The situation is not helped by a variety of approaches to ethical investing, with some funds simply tilting away from the worst ESG offenders, others entirely excluding them and some funds actually seeking out companies having a positive impact on environmental and social issues.”

Khalaf points to BP aiming to be net zero by 2050 and Philip Morris committing to a smoke-free future as examples of companies seeking to curb “less palatable” practices, and says that while for some investors transitioning may be enough to be considered sustainable, for others it will not be enough.

Khalaf concludes: “Ethical investing comes with a wide variety of interpretations, both from investors and fund groups and the key is for investors to select funds whose investment policies marry up with their own ESG principles.”