Diversification, by definition, means spreading capital across lots of different areas and therefore, risks. But holding the biggest-of-the-big would have been the best policy in this crisis, says Simon Evan-Cook, senior investment manager, Premier Miton Investors

We run a ‘best-of-all-worlds’ approach. By ‘worlds’ here, I mean asset classes, market-caps, geographical regions and investment styles. This helped our funds to generate great performance over the last decade, but over the last couple of years that kind of diversification has been a drag, not a help. This is because, by and large, only one thing has worked: a ‘biggest-of-the-big’ approach. To many, this begs the question; what is the point of diversification?

The Covid-19 pandemic has only served to exacerbate this trend. In fact, I wrote a similar article to this back in December, when Corona was still just a Mexican beer. I said then that, given how expensive the most popular assets had become, that “this was no time to be putting all your eggs in one basket”.

Well, that really came back to bite me. It turns out, given the sudden, virus-induced nature of this crisis, that putting all your eggs in that one basket is exactly what you should have done. That basket, to be clear, is the one filled largely with shares in the world’s very biggest companies (notably the US tech giants like Microsoft, Google or Amazon) or bonds issued by the world’s largest governments, most obviously US Treasuries.

Diversification, by definition, means spreading your capital across lots of different things. By extension, this means you’ll end up with more exposure to mid- and small-sized companies or assets than you’ll find in the most widely-followed benchmarks, such as the FTSE100 or the S&P500. This is because those indices are market-cap weighted, meaning they automatically allocate the most capital to the largest companies. So to have more in large caps than they do is very much a one-basket move.

Sometimes this buy-the-biggest policy can go against you: The FTSE100, for example, being weighed down by the kind of larger companies that nobody wanted before, or during, this crisis (like oil companies and banks), has fared poorly against the global index and, over the last ten years, has underperformed the FTSE Small-Cap index by more than 40% (even after the recent small-cap-unfriendly sell-off).

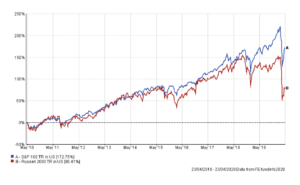

The opposite holds true in the US. Equity indices there have stood up to this crisis relatively well, and have been the major driver of global index returns over the last decade. And within the US, larger companies have ruled the roost, with the S&P100 (America’s 100 largest listed companies – more than half the US stock market by size) outpacing the Russell 2000 (smaller and mid-sized companies) by more than 90% over ten years. Nearly all of that gap opened up in the last two, helping to explain why diversified approaches have been left behind.

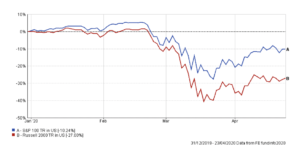

And this year, the S&P 100 is only down by 10% (at the time of writing), compared to a 27% drop for smaller US companies. I say ‘only’, because a 10% fall in a year that has seen the quickest and steepest economic contraction in our lifetimes seems a little light. Particularly as they weren’t cheap going into this.

Why has this happened? There are several causes. One is that the nature of governments’ response to this crisis has favoured larger companies. It’s easier to support them through corporate bond markets, which the central banks have stood firmly behind. Smaller companies generally borrow through banks, not by issuing bonds, so this hasn’t helped to the same extent.

Secondly, the nature of this specific crisis happens to suit today’s very largest companies. A lockdown has been disastrous for most physical companies, but those dealing in the virtual world have benefited. How much this is true in the real world, and how much of this is simply investors chasing a theme regardless of underlying fundamentals, is yet to be seen.

This second driver does, I think, help to answer the “what’s the point in diversification” question. With hindsight, clearly it would have been best to have all your eggs in this one basket. But there’s more than one type of disaster. Had this virus been digital, rather than biological, then your eggs may not have fared so well. Likewise, other threats, such as backlashes against monopoly powers and tax avoidance, would also have an outsized impact on this particular basket. Underlying all this is the fact that the valuation gap between the winners and everything else is at historically wide levels.

Markets go through phases. The most recent one has been an unusually narrow one. But this, like all before, will pass. When it does, we think a more balanced approach will again find favour.

Data source: FE Analytics