In a new monthly series, The Art of Finance team offer guidance on careers, training, development and practical skills for paraplanners.

In the first article, Holly Johnson, Training Lead at the Art of Finance, examines Uncrystallised Fund Pension Lump Sum (UFPLS), and through practical examples on how to effectively manage and withdraw a pension income.

Withdrawing a pension income.

An Uncrystallised Fund Pension Lump Sum (UFPLS) is a flexible and tax-efficient way to take uncrystallised retirement savings from a pension pot. It’s pretty much like treating your pension pot as a savings account, taking cash out as and when you need it, leaving the residual amount alone (where it’ll hopefully continue to grow in value).

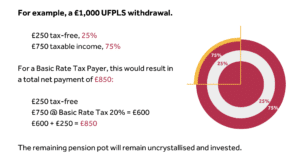

Each UFPLS is typically paid as 25% tax-free, with the remainder taxed as pension income via PAYE.

There are many ways in which a UFPLS is the most tax-efficient withdrawal option for a client. If you’ve got a nil rate taxpayer for example, looking to fully utilise their Personal Allowance…

The client could withdraw a UFPLS payment of £16,760.

• 75% will be taxable – £16,760 x 75% = £12,570

• 25% will be tax-free – £16,760 x 25% = £4,190

This means that the 75% is within their Personal Allowance and is not taxable. The remaining 25% is also tax-free. Win-win!

You may have already passed R04 or just think of yourself as a general champion of pensions. What they never tell you however, is how on earth do you arrive at the gross UFPLS figure?

So, how did we come up with £16,760?

We knew that the client has a Personal Allowance of £12,570. They want to use up this allowance. As 75% of UFPLS is taxable, we can divide £12,570 by 0.75 and arrive at £16,760.

What about if the client is receiving their State Pension, and have used £9,300 of their personal allowance, and they want to use up the remaining £3,270? Same logic applies, £3,270 divide by 0.75 = £4,360 UFPLS withdrawal.

Sadly, not every client is a dreamy and simple nil rate taxpayer.

Scenario 1

Let’s look at Mohammad who is a basic rate taxpayer. He’d like to gain access to £5,000 to go on an amazing holiday with his family. What’s the gross figure required for the UFPLS withdrawal?

Let’s break it down.

Step 1 – get rid of the tax-free portion.

For every £100, £25 (25%) will be tax-free. We need to get rid of the tax-free element.

£100 – £25 = £75.

Step 2 – tax the taxable element.

The £75 will be taxable. As Mohammad is a basic rate taxpayer, he pays income tax at 20%.

£75 x 0.80 (we’ve deducted the 20% tax here, so he’s getting 80% of the income) = £60.

That means Mohammad is paying £15 tax (we’ll come back to this!)

Step 3 – add them together.

For every £100 UFPLS, Mohammad will receive £85 net.

• 25% tax-free – £25

• 75% net after income tax deduction – £60

(remember we applied 20% tax to the taxable £75)

If we add them together…

£60 + £25 = £85

That means for every £100, £15 will be paid in tax. This means the equivalent tax rate is 15%. He will receive £85 net for every £100 UFPLS withdrawal.

Step 4 – Gross up the net payment required

We now know that the equivalent tax-rate applicable is 15%. What we have to do now is to gross up the net UFPLS withdrawal required. We can do this by simply dividing the figure by 0.85 (Why 0.85? Remember the 15% tax).

The net figure required is £5,000. £5,000 divide by 0.85 = £5,882.35 gross UFPLS.

If Mohammad takes a UFPLS of £5,882.35 from his pension, he will receive the required net figure of £5,000.

Scenario 2

Let’s follow the same steps but this time for a higher rate taxpayer.

Sam is a higher rate taxpayer. After spending an entire year locked up in her home, she has decided that a renovation is absolutely necessary. She requires £8,400 net – what’s the gross figure for UFPLS?

Step 1 – get rid of the tax-free portion.

For every £100, £25 (25%) will be tax-free. Again, we need to get rid of the tax-free element.

£100 – £25 = £75.

Step 2 – tax the taxable element.

The £75 will be taxable. As Sam is a higher rate taxpayer, she pays income tax at 40%.

£75 x 0.60 (we’ve deducted the 40% tax here) = £45.

That means Sam is paying £30 tax (again, we’ll come back to this!)

Step 3 – add them together.

From every £100 UFPLS, Sam will receive £70.

• 25% tax-free – £25

• 75% net after income tax deduction – £45 (remember we applied 40% tax to the taxable £75)

If we add them together…

£45 + £25 = £70

That means for every £100, £30 will be paid in tax. Sam will receive £70 for every £100 UFPLS withdrawal.

Step 4 – Gross up the net payment required

We now know that the equivalent tax-rate applicable is 70%. Let’s gross up the net UFPLS withdrawal required. This time we divide the figure by 0.70.

The net figure required is £8,400.

£8,400 divide by 0.70 = £12,000 UFPLS.

If Sam takes a UFPLS from her pension of £12,000, she will receive £8,400 net.

Summary

UFPLS allows pension members to take cash lump sums from a pension plan without needing to do anything else with the residual pension fund. There are no remaining funds being designated into drawdown or there’s no need to purchase an annuity. Simply withdraw the funds and the rest are left untouched. Sometimes it can be the most tax-efficient option.

Art of Finance Top Tip

Whilst UFPLS can be a great flexible option, it doesn’t mean every plan has to offer this option. Some plans may only offer UFPLS on the WHOLE pension value or, they may allow multiple partial UFPLSs. Some plans may not even offer UFPLS at all. It’s important that you check with the provider first.

We’ve found that not everyone knows what UFPLS means. This may even depend on how you pronounce it! Are you a UF-PLUS or U-F-P-L-S? If you’re checking this option on the phone, we’ve found it’s helpful describing what a UFPLS is to make sure you’ve got the correct answer.

Other things to remember with UFPLS.

• The member does not receive a Pension Commencement Lump Sum (PCLS) with an UFPLS, though 25% of the withdrawal will be paid tax-free with the remaining 75% taxed as pension income via PAYE. The exception to this is where the member is over the age of 75 and their remaining LTA is less than the UFPLS withdrawal.

• Be aware that an UFPLS is a trigger event for the Money Purchase Annual Allowance (MPAA) rules!

• It is likely that emergency tax will be deducted from the first taxable lump sum from a pension (unless the provider has been supplied with a P45).

• As the name suggests, the withdrawal must be paid from uncrystallised funds (or unused funds if over the age of 75) within a defined contribution plan.

• Member must have reached the normal minimum pension age as well.

• For pension members under the age of 75, they must have an UFPLS up to their available lifetime allowance. Any excess over the lifetime allowance will be treated as a lifetime allowance excess lump sum, with a whopping 55% tax charge.

• For pension members over the age of 75, there must be some LTA available. 25% of that LTA remaining will be paid tax free, whereas the rest of the lump sum is taxed as pension income.

About The Art of Finance

The Art of Finance is a training solution for those looking to get into, or further develop, their career in financial services, in an interesting, creative and informative way. For more information and training on all things pensions and retirement planning (particularly those studying for their R04 exams!) check out The Art of Finance’s exam support options.