The Brand Financial Training team highlights key areas to understanding ESG/SRI investments when studying for financial services exams.

While potential performance is important, it isn’t always a client’s prime motivator when selecting investments. For some clients, investing in an ethical or socially responsible manner is just as, if not more, important.

ESG factors

There has been a great deal of press regarding the environmental, social and governance (ESG) factors that influence how ethical and sustainable an investment is. Indeed, sustainable finance is about including consideration of ESG factors when making decisions about investments.

You might come across the term ‘material factors’ in relation to ESG. These are the ESG factors that are likely to affect the financial condition or operating performance of a business. For example:

- fuel consumption for a distribution company;

- paper recycling for a newspaper company; or

- use of pesticide for a crop growing company.

Tackling material factors is considered to be key to a successful ESG strategy and has benefits not only for the firm itself, but also for its key stakeholders.

SRI approaches to investments

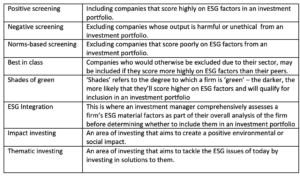

There are a number of approaches to socially responsible investments, some are more well-known than others:

Pros and Cons

While socially responsible investing and ESG in particular are very ‘flavour of the month’ right now, they are not without their critics.

Potential disadvantages include:

- Narrowing the investor’s choice of companies to invest in

- Reducing access to dividend income by excluding high-yielding companies in ethically unacceptable sectors, such as tobacco

- Increased portfolio volatility, as many larger companies are excluded leaving only small and medium size companies whose performance tends to fluctuate more widely

- Potentially higher charges as many SRI funds are actively managed

However, others would argue that companies who score highly for ESG are likely to be progressive in their thinking and successful in the fields in which they operate. There is some evidence to suggest that SRI funds have performed as well, if not better than non-SRI funds of late.

One area of concern for advisers and their clients is the concept of ‘Greenwashing’. This is where companies exaggerate their green credentials. Care should be taken, therefore, not to accept at face value what a company says they are doing in terms of sustainability. Instead, greater emphasis should be put on what they actually are doing. Such information is increasingly available online.

About Brand Financial Training

Brand Financial Training provides a variety of immediately accessible free and paid learning resources to help candidates pass their CII exams. Their resource range ensures there is something that suits every style of learning including mock papers, calculation workbooks, videos, audio masterclasses, study notes and more. Visit Brand Financial Training