In this article Albert Chu – portfolio manager at Man Group, discusses why geopolitical tensions may be overstating upside risks for oil, while masking a more constructive long-term story for natural gas.

Longer-term prospects for oil are less positive and less negative for natural gas than current headline-driven price action suggests.

“May you live in interesting times” aptly summarises the start of 2026 for energy. Crude oil markets were roiled by news of direct US intervention in Venezuela and then by possible US military action in Iran. Investors responded by buying oil and related equities, both of which have outperformed broader equity markets year to date.

However, if we look at the fundamental backdrop for both commodities, longer-term prospects for oil are less positive and less negative for natural gas than immediate price action indicates.

Oil markets initially rallied on both developments as the historical playbook calls for higher prices whenever geopolitical tensions escalate, particularly in the Middle East. Yet if we examine the actual rationale, is this really the case? The consensus fear is that a US strike will trigger retaliation by Iran, most likely by choking off the Strait of Hormuz, a narrow outlet through which approximately 20% of global oil flows. How likely is Iran to close the strait, and for how long, if their goal is to retaliate against the US?

US oil imports

First, it is important to note that the US gets close to 70% of its imported oil from Canada and Mexico, whilst Middle Eastern oil accounts for only 7% to 10% of imports. On the other hand, 90% of Iranian oil exports flow through the strait and 80% to 90% of that oil is sold to China.

Closing the Strait of Hormuz would damage the Iranian economy far more than it would disrupt US oil consumption, potentially antagonising a historical ally. Furthermore, there are ample buffers in the physical markets. China is estimated to currently hold record levels of crude inventory, and OPEC has idled production that can come quickly into the market. Any physical tightness will likely be temporary and can be quickly met with intervention.

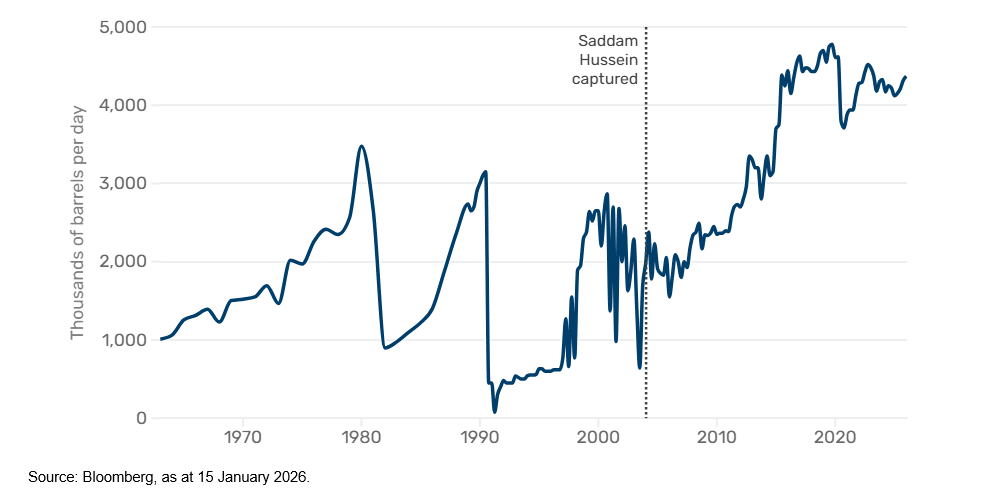

The longer-term picture for crude also fails to improve with recent Iran and Venezuela developments. Whilst the actual reserves and state of infrastructure in both countries are debatable, we know they possess significant reserves. If history serves as a guide, regime changes cause disruption, but the long-term outcome is that introducing Western financial, technological and human capital results in higher eventual crude production, with Iraq serving as precedent (see Figure 1).

Figure 1. Iraq oil production

Natural gas

Switching to natural gas, we see a different dynamic. After an initial price run in November due to cold weather, Henry Hub natural gas prices have since plummeted as December and January proved warmer than normal. Yet behind this weather-driven volatility, a structural change is happening in the global natural gas market.

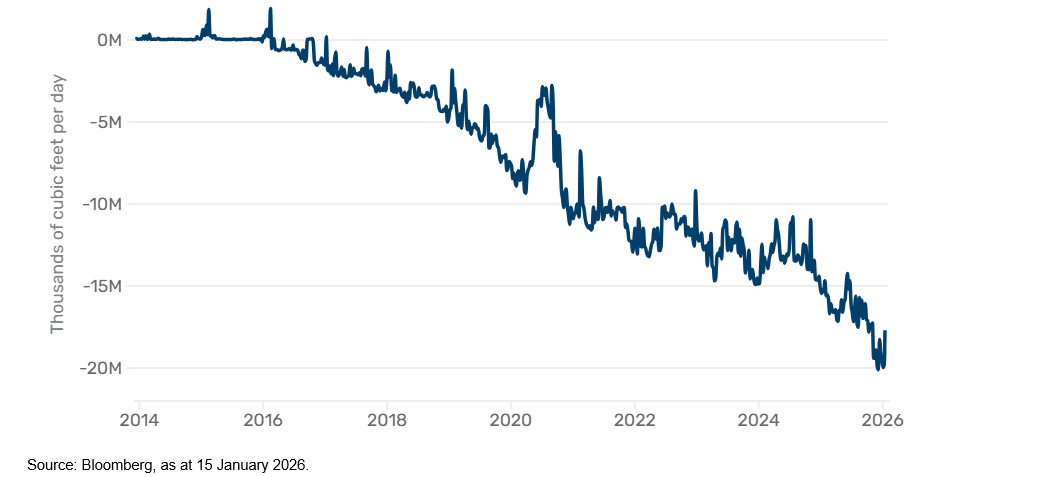

Natural gas has historically been a regional market with massive priced differentials between regions due to a lack of intercontinental pipelines. The only method of transporting gas abroad was via liquified natural gas, an expensive proposition. However, as LNG infrastructure has been developed and built, stranded North American gas is finding a home overseas in markets where prices are often significantly higher than domestic prices. This marks a monumental structural shift, creating a “British Thermal Unit (BTU) parity” event where global arbitrage will gradually push regional prices to converge, adjusted for physical costs such as transportation.

Figure 2. US LNG exports

Despite overtaking coal as the main form of power generation over the past 20 years, North American natural gas has experienced numerous boom-bust cycles as the molecules were subjected to short-term induced volatility like weather and pipeline constraints. However, the pressure relief valve of more stable Asian and European end markets should eventually lower extreme volatility and offer more attractive prices.

Volatility and news will continue to move oil and gas prices in the short term, but it is important to keep focused on longer-term fundamentals. In this instance, the commodity futures market has remained more rational.

Whilst commodity curves have little ability to forecast actual future prices, they are an important indicator of how current market participants view the future. In the crude market, where spot prices initially rose on Iran and Venezuela news, the back end of the curve has continued to be pressured lower. In the case of natural gas, whilst the front end of the curve has plummeted due to warmer weather, the back end has remained relatively unchanged.

Main Image: chris-liverani-XLFu0PM5Qsg-unsplash