The Equity Release Council has announced that from 28th March, new equity release customers will be able to make penalty-free partial repayments to reduce the size of their loans.

The industry body said the development means new customers can not only reduce their borrowing but offset the interest without making any ongoing commitment to further repayments.

It marks the fifth product standard to be introduced as part of the Council’s 30th anniversary.

Stuart Wilson, corporate marketing director at more2life, said the announcement was “great news” for customers and advisers.

Wilson said: “The ability to make penalty-free ad hoc repayments will allow people to better manage their borrowing and potentially help to open up the market to a new range of customers, especially when used in conjunction with interest repayments.

“The last few years have seen real innovation in this market and this new product standard helps to highlight the hard work that the Council, advisers, lenders and other members of the industry have put into pushing the sector forward.”

At the end of 2021, 85% of plans offered the opportunity for borrowers to make penalty-free partial repayments but this latest announcement means that all new customers can benefit from this flexibility too.

Will Hale, CEO of Key, commented: “As the Equity Release Council marks thirty years of setting standards, it is a great step forward and will help to ensure that customers can actively manage their borrowing in a way that suits their individual circumstances through the lifetime of their plan.

“While the industry has come a long way in three decades, the pace of innovation has accelerated recently as increasing numbers of over-55s look to these products to support their needs and wants in older age. Today’s announcement should be welcomed but we need to keep pushing the boundaries and consider how we can adapt both products and advice for an ever more varied profile of customers looking to explore later life lending options.”

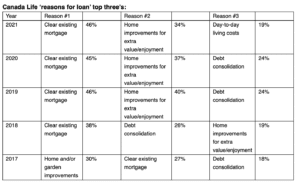

Research published by Canada Life revealed that almost half (46%) of equity release customers used the money to clear an existing mortgage – marking the fourth year in a row that this was the top reason.

A third (34%) of customers chose to use equity release to fund home improvements, while almost a fifth (19%) opted to use the funds to support the cost of day-to-day living.

Alice Watson, head of marketing, insurance at Canada Life, said: “Understanding the reasons behind releasing equity can provide an interesting snapshot into the lifestyles and needs of our customers. We can see that the desire to wave goodbye to mortgage payments continues to be a strong motivator to freeing up equity from a property. We’ve also seen a steady rise in people turning to equity release in order to cover their daily living expenses, the demand likely being driven by the current cost of living crisis.

“The variety of reasons given for releasing equity highlight the flexibility and accessibility of modern products allowing families the ability to enjoy their retirements comfortably in a way that suits them. However, equity release is a lifelong financial decision, so it is essential that people seek financial advice and talk through their decision with loved ones before agreeing to a product.”