With central banks walking a tightrope between inflation and recession, Bevan Blair, chief investment officer of One Four Nine Portfolio Management, gives his investment outlook for the rest of 2022.

The news over the last few months has certainly turned up the rhetoric. Train strikes, postal strikes, energy price hikes, hosepipe bans. It’s overwhelming and feels like no end is in sight. But what’s the answer when it comes to investments?

Quite simply sit tight, stay calm and ride out the storm.

As I write this, we’re told a recession is imminent and that inflation will hit 13% before the end of the year, but this isn’t isolated to the British Isles. The US has already entered a technical recession following two consecutive quarters of negative economic growth. What happens in the US tends to happen in the UK and Europe and so even though it is a shallow recession in the US it is a poor outcome for the world economy in general.

The genesis of the low or negative growth environment has been in the higher-than-normal inflation we have experienced in the past year. Inflation started to creep up last year as economies reopened after the pandemic and all the excess savings and pent-up demand from staying at home was released. This has been exacerbated by constrained supply chains, low labour mobility and shocks in the price of energy, in particular oil and gas.

Central banks, the financial institutions responsible for overseeing an economy’s monetary supply and controlling inflation, have responded to this inflationary environment by raising short-term interest rates. Higher rates should make money more expensive, encouraging both businesses and consumers to save more and spend less, thereby cutting back demand and in doing so reducing the rate of inflation.

This is fine when the economy is growing, and that growth is well established. The problem has been that the growth after the pandemic was fragile and the effect of reducing demand, brought about by increasing interest rates, also impacts a country’s economic growth. If growth is restricted too much, the economy can fall into recession. By increasing interest rates at the speed and volume they have, the central banks around the world have effectively taken the decision that recession is a lesser evil than inflation.

There are signs that central banks’ policies are starting to influence the rate of inflation. Production costs are either stagnating or starting to fall, especially energy, and the money supply has done likewise. This should start to feed through into falling rates of inflation, but it may take till the end of the year to show through in the headline inflation data. Worldwide markets have already begun forecasting lowering interest rates as early as quarter one of 2023, although the probability of implementation is low and therefore high interest rates may stay in place a little longer.

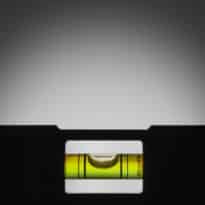

Central banks have essentially been walking a tightrope between inflation and recession and understandably markets reacted to this situation by selling off significantly in the second quarter of 2022. While it might be tempting to follow suit, it is important not to make rash decisions, but to view the situation with a long-term lens and a level head.

Once we own an investment, it is easy to let emotions such as fear or anxiety take over and get in the way of good judgement. This can also lead to the misconception that selling investments can give some control over market movements. However, history shows us that the market’s worst days tend to be followed by its best, and as such investors may miss out on recovery if they sell amid periods of high volatility. For example, those who did exit the stock market earlier in the year will have crystalised their losses and may have missed out on the recovery rally enjoyed throughout July.

This hasn’t been the first time we’ve experienced these cataclysmic changes in markets. Over the years and decades events take place that trigger us to react to mitigate what is going on in markets, but markets are very resilient, and recoveries can be swift when sentiment changes. Often, the best way to get through it is by sitting tight, staying calm and riding out the storm.