Eden Tree CIO’s Charlie Thomas and Aaron Cox consider the impact of US presidential rivals Joe Biden and Donald Trump on America’s renewable energy market and uptake.

The forthcoming US election will be a pivotal event later this year. Of course, nobody has a crystal ball with which to understand its impact.

However, when it comes to climate policy and support for the clean energy transition, the battle lines are clear between the Republicans (against) and Democrats (for).

But a few simple measures from their respective incumbencies suggests the reality will be far more complex than suggested by sparring rhetoric or the risk of symbolic gestures such as pulling out of the Paris Agreement.

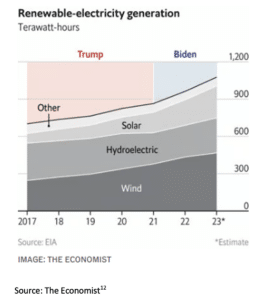

Starting with the Inflation Reduction Act, this flagship Biden policy has started to bear fruit and his administration has so far overseen greater deployment of renewables than Trump, although interestingly there was an acceleration in deployment rates in the second half of Trump’s term.

Intuitively, the IRA is something that Trump might be expected to pull back from. However, even if he could – most of the stimulus will already be allocated by then – it would be foolish to disrupt progress given Republican states are generally the largest adopters of renewable energy in the US, with some 80% of IRA subsidies supporting clean technology in those states.

In terms of asset prices, Trump presided over a bull market for renewables and bear market for fossil fuels. Biden’s time in office has seen the opposite. What this shows is that the market’s behaviour has been driven by other factors, most notably the interest rate and inflation backdrop during each president’s incumbency.

Central bank policy will remain a determinant of future market dynamics whoever wins in November – and in cases the reset has been healthy for renewables. As we’ve written before, the valuation-awareness that tends to run across our equity portfolio has meant our funds have generally avoided the sort of volatility seen among some competitor funds in this investment area.

One area we will be watching closely is how the next US president responds to the EU’s carbon border adjustment mechanism, and whether it too might adopt a similar policy.

Chart 1 source: https://www.economist.com/graphic-detail/2024/01/05/ten-charts-compare-joe-bidens-record-with-donald-trumps

See Thursday’s ESG Zone email for further comment from Eden Tree on the sustainable investment landscape.