Benefits Guru has published its financial wellness ratings for workplace pension providers, which saw six providers receive a gold rating.

The ratings are designed to help benefits consultants, corporate advisers and employers review products that improve member and employee outcomes as well as improve financial wellness, the firm said.

The ratings also provide clarity on the variety of tools and services available via workplace pension providers to help advisers and employers identify the propositions that will help improve financial outcomes for members.

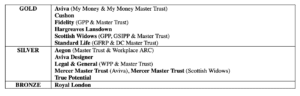

Six providers, including Aviva, Cushon, Fidelity, Hargreaves Lansdown, Scottish Widows and Standard Life, were awarded gold. Aegon, Aviva Designer, Legal & General, Mercer Master Trust and True Potential achieved silver, while Royal London was awarded bronze.

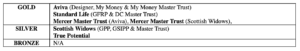

Benefits Guru also published a second category ‘Financial Wellness with Open Finance ratings’, which gave providers a separate score to take account of their open finance functionality.

Aviva, Standard Life and Mercer Master Trust were awarded gold, while Scottish Widows and True Potential received silver.

Jason Green, head of workplace research at Benefits Guru, said: “We launched the Benefits Guru Financial Wellness ratings last year to help providers, employees and advisers stay up to date on this fast-moving market, whilst also encouraging further innovation in financial wellness propositions. This year’s results show an increase not only in overall gold awards, but also in the different components being offered by the various providers.

“With interest rates and inflation rising, and the rising cost of living a point of stress for many, we call on all employers to review their workplace pension plans with their advisers to ensure they are offering their employees the most valuable, comprehensive, and innovative plans. It is also vitally important that employers communicate to their staff on exactly what they are entitled to.”

Green added: “Your workplace pension provider might not be considered the first place to turn, but as we can see, many are now offering services which help identify and address vulnerable customers and assist with short, medium and long term finances.”