Could we be at the beginning of a long-term move by international investors away from the US towards other markets, with domestic investing using up the scale? David Jane, Fund Manager, Premier Miton Macro Thematic Multi Asset Team, considers the factors at play.

The current year has seen a huge outperformance of international markets versus the previously dominant US indices. To some degree this is being driven by the unravelling of the AI bubble, but other more structural factors are also at play.

The basic plan of the current leadership in the US is to address the twin and interlinked problems of the US trade and government deficits. We have written extensively on this before. A consequence is that the US’s trading partners will have reduced surpluses to invest in US dollar assets. It follows that the US dollar must weaken.

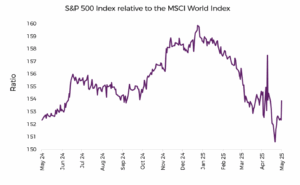

The US has underperformed global equities since Trump’s inauguration.

Source: Bloomberg 01.05.2024 to 01.05.2025

While much attention is given to foreign central bank holdings of treasuries, the majority of international holding of US securities are held by private institutions and individuals. The weakness of the US dollar and US equity markets is creating a reflexive feedback loop. Losses in local currency terms on US assets are likely to lead to further selling, particularly as the US intends to weaken the dollar in its favour. Even if foreign institutions think there is only a relatively low chance that the plan succeeds, and only a small chance that some of the more extreme elements are followed through, the risk reward has moved very much in favour of owning local markets over the US.

The question then becomes which of the non-US markets look most attractive. This is not a matter of considering the relative merits of stocks and sectors listed internationally, far from it. If that were the case the US would never have got to such a valuation premium over other markets. What we are dealing with is the reallocation of global savings pools in an era of economic nationalism.

Focus tends to fall on the large blocks of capital in the sovereign wealth funds and the huge pension schemes. The numbers here are truly huge, Norway’s sovereign wealth fund controls $1.5 trillion. However, for really big numbers the savings of private individuals should be considered. Worldwide, private individuals have $120 trillion invested in stocks and bonds. Much of this is held in accounts at the large insurance companies and asset managers. Of this the largest block is, naturally, the US. Followed by Europe. However, from the point of view of flows it is China and India where high savings rates and economic growth are leading to massive growth.

Until recently these flows of private savings have been disproportionately allocated to the US, and the big stocks of savings have been reallocated towards the US. This seems to have now reversed. The process of moving to the US has taken decades, so it is reasonable to think the process of reallocation will also take a considerable amount of time.

Returning to the question of which markets are most set to benefit, if the big blocks of savings are going to be reallocated, it might be reasonable to suggest they would be considering their local markets in the first instance. This would suggest a preference for European equities over the US in the near term, and this is clearly what has been happening.

In that context the UK market has been a laggard, although it has outperformed global indices. In our view, there are several reasons for this, the UK market is relatively illiquid and expensive to trade. Stamp duty is a deterrent.

Additionally, the UK has a much less attractive mix of shares available compared to continental Europe, being dominated largely by mature industries such as banks, pharmaceuticals, staples and resources. The dominance of index funds in the UK savings market may also be a factor, these are less likely to be making active decisions to reallocate. A final point is that continental investors tend to see the UK as an international market, so the UK is not on their radar.

Even worse than the UK has been Japan, which given it accounts for a huge block of savings might be a surprise. Japanese institutions are notoriously slow moving and therefore, may simply be taking longer to relocate.

The longer-term impacts are quite different – the emerging markets of China and India are generating a disproportionate amount of new savings and these are likely to have a preference for domestic assets in the current political environment. Indeed, it is Chinese policy to drive new savings into domestic securities rather than housing. It is known that, despite capital controls, large amounts of Chinese capital have leaked out into the US equity market, in the past. Some of this may return if the market starts to do well.

We have made a considerable switch from the US to Europe this year. Less so towards the UK, though this has increased. Our Japanese weight remains relatively low, but we do have exposure to China via Hong Kong. We feel cautious generally in this time of great uncertainty but the long-term trends may now be set.

Past performance is not a reliable guide to future returns. You may not get back the amount originally invested, and tax rules can change over time. The writer’s views are their own and do not constitute financial advice.

This information should not be relied upon by retail clients or investment professionals. Reference to any particular investment does not constitute a recommendation to buy or sell the investment.