Next week the FCA is due to publish the final details of its Consumer Duty work, and is being spoken of as the biggest overhaul to financial services regulation since the retail distribution Reviews, which came into force in December 2012.

The Consumer Duty will apply to all regulated retail financial services firms – from retail platforms to insurers and financial advisers – and will set a new, higher standard for retail financial services firms, with the aim of ensuring ‘good outcomes’ for savers and investors. The FCA expects retail customers to experience improved outcomes through the provision of more appropriate products, improved service and, ultimately, better overall outcomes.

Current rules require firms to ‘treat customers fairly’ and ensure communications are ‘clear, fair and not misleading’, the FCA is replacing these principles with new ones whereby the regulator wants firms to ‘put themselves in customers’ shoes’ when designing products, setting prices and communicating.

The Consumer Duty will apply to regulated advisers and while many advisers will already be meeting the FCA’s Consumer Duty standards, compliance companies are recommending that all firms review processes and communications in light of the reforms.

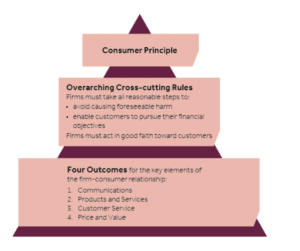

There will be new a Consumer Principle (FCA Principle 12), which will be underpinned by ‘Cross-cutting Rules’ setting out the FCA’s expectations of how firms should behave.

Source: FCA

Amongst other principles, firms will be required to:

- Avoid foreseeable harm to retail customers

- Enable and support retail customers to pursue their financial objectives

- Act in good faith towards retail customers.

The overarching Consumer Principle and Cross-cutting Rules are intended to deliver ‘good outcomes’ in four areas:

- Products and services

- Price and value

- Consumer understanding

- Consumer support

The new Consumer Duty is set to come into force in April 2023.

Commenting Tom Selby, head of retirement policy at AJ Bell, said it was “hard to overstate the potential significance of the FCA’s Consumer Duty reforms for the entire retail financial services industry.

“The introduction of the Duty – and the shift to outcomes-focused regulation – represents arguably the biggest domestic regulatory overhaul in almost a decade and will fundamentally reshape financial services in the UK.

“The FCA explicitly says the Duty represents a higher regulatory standard than the current regime, with a renewed focus on ensuring all sectors adopt a laser-like focus to achieving good consumer outcomes.

“If the Duty works as envisaged, it has the potential to lead to better informed consumers buying products and solutions, and receiving communications that are more appropriate for their needs and circumstances.

“However, for this to be achieved the FCA will need to demonstrate a credible threat of enforcement against those firms who already flout its existing rules. It will also need to keep a close watch on claims management companies, some of whom will inevitably attempt to use the new requirement to chase spurious claims against firms.”