Pension savers concerned about buying an annuity and dying early should consider opting for a ‘guaranteed period’ to protect their income, says Just Group.

The recent rises in annuity rates are prompting more retirees to consider buying an annuity but some are concerned their money will be wasted if they die too soon. To tackle this issue, opting for a ‘guaranteed period’ enables an annuitant to protect their income stream for a selected term of between 1 and 30 years and can ensure the initial cost and more is paid out, according to the pensions specialist.

Stephen Lowe, group communications director at Just Group, says: “Most people can look forward to a long retirement but will naturally worry that if they get hit by the proverbial bus and die tomorrow, those years of pension saving will be lost. In reality, it is easy to ensure that whatever happens to you, more income is paid than it cost to buy.”

Lowe says that guaranteed periods are an option on all annuities and at current rates a 15 year guarantee will ensure that the value of the initial pension pot will be more than covered by the income it pays out even if the person dies soon after purchase.

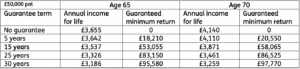

According to Just Group, a healthy 65-year-old using a £50,000 pension fund to buy a level annuity with a 15-year guaranteed period will receive £3,537 income each year for as long as they live, equating to £118 a year less than if they had not chosen a guaranteed period. If the person does not survive 15 years, the income will continue to be paid until the end of term. That results in a minimum return of £53,055, more than the annuity cost to buy (see table below).

Lowe says guaranteed periods, which are usually free from inheritance tax and income tax if the person dies before they turn 75, remain an “under rated option.”

Lowe comments: “Guaranteed periods are just one method annuity providers offer to safeguard the money from premature death, alongside joint-life annuities which provide a lifetime income for both the annuitant and a beneficiary such as a spouse, or value protection which protects all or part of the initial pension lump sum used to buy the annuity. Annuities have many more options than people might think.”

Lowe said that when seeking professional help, it is important that people provide details of their health and lifestyle which can greatly impact the amount of income offered.

Lowe adds: “Our experience is that two-thirds of annuity buyers would qualify for more than the ‘standard’ rates often published online or in newspapers.”