Rob Kingsbury reports from Ian McKenna’s AI in Financial Advice conference

FTRC’s first AI in Financial Advice conference brought together over 20 plenaries, presentations and demonstrations of AI that advice firms could now be using to undertake a range of business enhancing tasks and services.

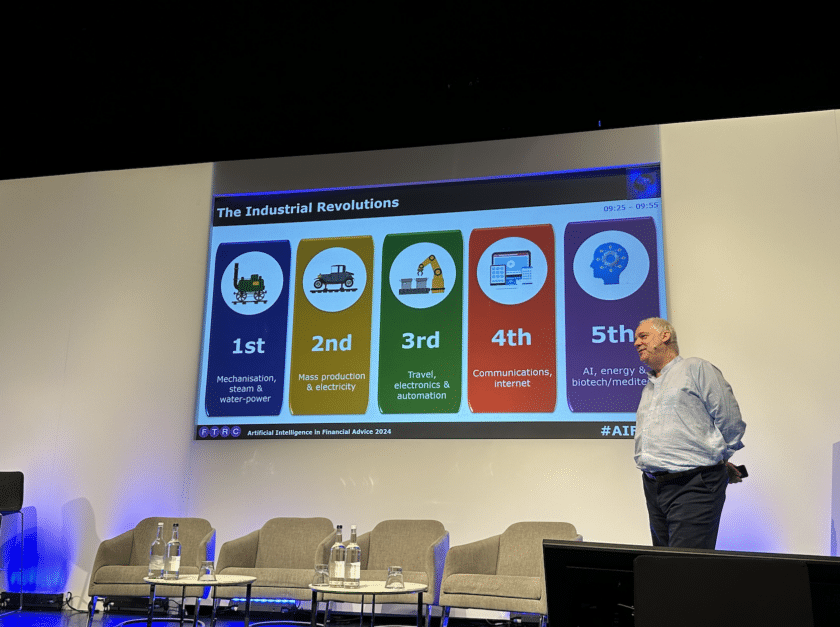

In his opening keynote, FTRC’s founder Ian McKenna warned delegates that the pace of change in AI development was 5 to 1, such that five years for this technology equated to a generation of previous technological development. “In a few years’ time advice firms will bear no resemblance to how they look today,” he predicted.

Jobs will be lost, others will change but there will be opportunities as a result of AI being incorporated into financial planning firms, he said. “What will be possible is phenomenal. And this will be accelerated with scalable quantum computing.”

“All knowledge workers will be under threat,” he warned. Technical knowledge that is instilled through years of learning will be available immediately through AI. “What has taken people years to learn will be produced in a matter of seconds.” This will affect the exam bodies and the qualifications which will be relevant to the industry, he surmised.

But it was not all doom and gloom. The opportunities offered by technology to deliver greater productivity, create better services, help more people receive financial plans and to do more interesting work, far outweighed the negatives, McKenna said.

“Think of it as moving from paper to the internet to smartphones. This is the next transformation.”

The focus for workers should be “what we can do that the machines can’t get to,” he added. Areas of emotional connection and relationship building, and using psychology and behavioural science to provide a better personal service to clients.

There will be the opportunity for greater leisure time as well, McKenna argued. “As technology makes things incrementally more efficient, 30% here and 30% there, then there will be more opportunity for people to work a four day week, for example. I’ve already told my team that if they can find the right pieces of technology to increase our productivity, incrementally, we can head that way.”

In a later session, Keith Richards, CEO of the Consumer Duty Alliance pointed out that over the past two decades the insurance industry had lost around 100,000 jobs due to technology and change but gained the same amount in new jobs as a result. It was a matter of the market adapting to the change and working out where machines and humans can deliver most value.

One significant effect of AI it was predicted, would be to act as a catalyst for mass adviser retirement. With some 50% of advice firm owners looking to exit in the next two years, the way was being left open for a new generation of advisers and new ways of working.

“Advice firms will have to adapt to the new environment,” McKenna said. “Older generations value face-to-face advice but in 10 years over 50% of the baby boomer generation will be dead. 29% are already dead but are we seeing that predicted transfer of assets? Is the fact that younger generations are not engaging with the advice market because the young view financial advice as an old-fashioned occupation?” McKenna asked.

Bearing all this in mind, he added, AI was not a silver bullet advice firms could simply drop into their business to resolve all their issues.

“AI is a tool which every advice business will use in a different way, in the way that best suits their business.”

The overarching message of the conference was that AI would be transformational for the financial advice/financial services market and it should be seen as a tool that could help firms improve their business, their service and the outcomes for clients.

Discussions and demonstrations covered a range of capabilities (see below). A noticeable difference to McKenna’s Empowering Advice Through Technology (EATT) conference in January 2024 was that whereas much of the focus then was on AI’s ability to create huge efficiencies in recording and actioning client meetings and in the onboarding process, that was now almost de rigueur within the offerings on show. The market had moved on to suitability reports, compliance file checking and evidencing, and taking advice to the next level through behavioural psychology and predictive analytics, amongst other capabilities, reflecting how the market has developed in just six months.

The conference takeaways on how advice firms must evolve in an AI-driven world, were:

• AI is going to change every business

• If you don’t embrace it you will have to work much harder to keep up

• Prompting to get the best response from AI is the new ‘super power’

• AI will probably be the catalyst for mass adviser retirement

• When the machines do things better than us, we need to focus on what they can’t do

• Psychology and behavioural science are crucial to where we go next

• Never forget data security, criminals only need to succeed once to destroy trust in your business.

The day’s discussions, presentations and demonstrations included:

• Predictive analytics: the growing influence of data analysis and how it can be used to determine not just clients’ wealth outcomes but their potential health outcomes and how that would play into financial planning

• The growing importance of behavioural science for wealth management firms

• Using AI to engage with potential clients via a firm’s website

• Behaviour mapping as ways to improve decision making and personalise client communications

• Automated suitability report generation – simple reports back to the client in a day

• Automated compliance file checking

• Automation of Letter of Authority workflow

• Voice activated financial planning workflow.