Pensions transfer volumes have bounced back from the initial effects of the Covid-19 crisis, following a steady upward path towards pre-Lockdown levels, according to the latest data from the Origo Transfer service.

The FinTech reports that overall transfer volumes for DC pensions were rising steadily through 2019 and hit a consistent high between Q3 2019 and Q1 2020 of around 200,000 per month but then fell through April and May as the industry and consumers reacted to Lockdown.

Volumes began picking up in June and have followed an upward trajectory through Q3 and, to date, at a steeper rate of increase than was seen in 2019.

Origo managing director Anthony Rafferty says: “The steady rise in transfer volumes is good news for the industry, reflecting that following the start of the crisis in March, when consumers and the industry were adapting to the initial imposition of Lockdown, business is picking up again and volumes are fast heading for pre-crisis levels.”

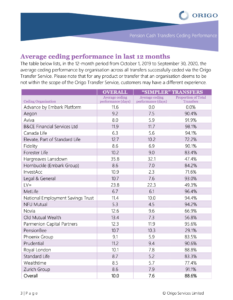

The quarterly published Origo Transfer Index (OTI), which measures transfer times of a group of pensions and administration companies when ceding DC pensions to another provider, shows average pension times took marginally longer to complete for the year to the end of Q3 2020 – see table below.

The average time to effect a ceding transfer was 10 calendar days, as opposed to 9.4 days as recorded for the year to the end of Q2. For simpler cases, the average ceding time rose to 7.6 calendar days from 7.3 days.

Commenting on the data, Rafferty says: “Transfer volumes dropped off following the imposition of Lockdown in March which, it would seem, enabled organisations to adapt to new ways of working and maintain transfer times. However, from the end of Q2 transfer volumes have begun to rise again, which has coincided with the increase in ceding times.

“From the end of Q1 to now overall average transfer times have risen by 1.2 calendar days, while average performance for simpler cases is up by 0.6 days. This is still a testament to the efficiency of providers’ systems and operations under extreme circumstances.

“It also reflects the benefits of automation and digitisation of processes within financial services. Imagine the impact of the coronavirus crisis on a paper-based system.

“I believe the crisis will act as a catalyst for the greater adoption of automation and electronic services, driven by a potent combination of operational efficiency, cost, business continuity and consumer demand.”