Income yield is the wrong thing to focus on, says Paul Ilott, Managing Director at Scopic Research, when it comes to understanding the level of income retirees receive from an invested pension pot. It’s dividend income that matters.

We’ve seen articles purporting to be authoritative that discuss income yield as if this is what retirees can pay their bills with. It isn’t. Little wonder then that many paraplanners and, dare we say it – even some support people within fund groups – misunderstand the difference between income yield and the real lived experiences of retired clients who receive dividend income. Retirees can’t pay their bills using income yield, but they can pay them using dividend income.

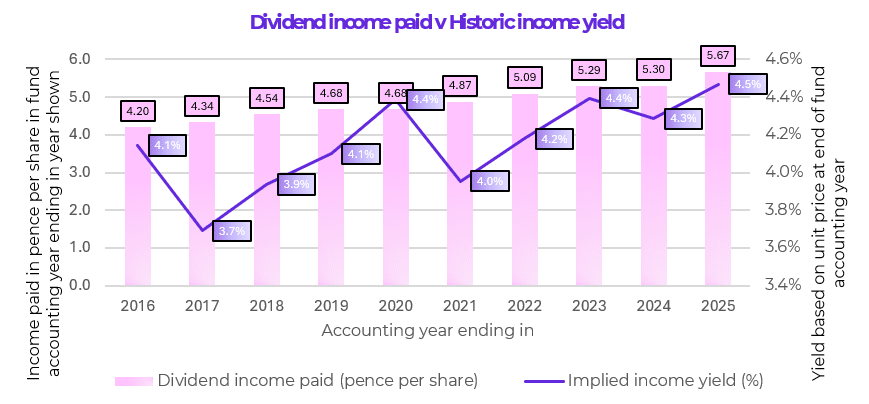

Our sole focus at Scopic Research is on multi asset funds, and below we show the difference between income paid as dividends per share (or unit) and income yield. We’ve used data for one fund in a small multi asset income cohort that we’ve identified and named as ‘Retirement income champions’. Funds in this cohort have all been specifically engineered to generate stable monthly dividend income throughout the year, with the aim of growing the total of dividends paid year on year. They’ve been remarkably successful in doing this. They include Baillie Gifford Monthly Income, BNY Mellon Multi Asset Income, Canlife Diversified Monthly Income, and Premier Miton Cautious Monthly Income.

Source: BNY. BNY Mellon Multi Asset Income Fund’s total dividends paid in pence per share v its historic income yield in the fund’s accounting years 2015/16 to 2024/25. The accounting year end is 30-June. Past performance is no guarantee of future returns. Dividend income can fall as well as rise in relation to that paid in previous years and is not guaranteed.

As the chart shows, income yield and dividend income paid are not the same thing.

Dividend income is declared on a per share or per unit basis, and therefore the number of shares or units you own determines how much income you receive – for example a dividend of 5p per share. Any fluctuations in the share price and therefore the total value of the shares you own makes no difference to the income you receive. It’s the number of shares you own and the dividend per share that matters.

Income yield is different – although not completely unconnected to dividend income. Income yield is calculated by looking at the total of dividends per share received over the past year and dividing it by the current share price – in this case the price for an individual share in a multi asset income fund in our ‘Retirement income champions’ cohort. If the price per share in the fund has fallen by a reasonable amount over the course of the year (i.e., the fund’s value has fallen), then its income yield is likely to go up and if the fund’s value has increased by a reasonable amount, then its income yield is likely to fall.

We’ve seen some resources used by advisers that show how stable or otherwise a multi asset income fund’s income yield has been. Let’s be clear, this doesn’t necessarily tell you how stable the level of income received by a retired client has actually been or is likely to be. Unlike income yield, the dividend income received by a client doesn’t fluctuate with the value of the fund.

We could also look at this in a different context to make it easier to understand. Imagine you purchase a property to let out, and you decide to keep the rental income the same no matter what. The income yield will fluctuate as the value of the property falls and rises during property booms and busts, but the income you receive will always remain the same.

When it comes to understanding how much income a retiree has available for them to spend from an invested pension pot, It’s the dividend income you need to focus on and not the yield.

This is an excerpt from the Scopic Research White Paper, “Retirement income champions and the safe withdrawal rate.” The full paper is available from the Scopic Research website at www.scopicresearch.co.uk.

Past performance is not a reliable guide to future returns. You may not get back the amount originally invested, and tax rules can change over time. The writer’s views are their own and do not constitute financial advice.

This information should not be relied upon by retail clients or investment professionals. Reference to any particular investment does not constitute a recommendation to buy or sell the investment.

Main Image: lxrcbsv-vVHXeu0YNbk-unsplash