The M&G technical team look in depth at the Lifetime Allowance, what it is and how it works.

For pensions, the Lifetime Allowance (LTA) is the overall limit of tax privileged pension funds a member can accrue during their lifetime, before a Lifetime Allowance tax charge applies. The standard Lifetime Allowance is currently £1,073,100 (2022-2023).

Lifetime Allowance rules – what do you need to know?

There is no limit on the benefits an individual can receive – or ‘crystallise’ – from registered pension schemes. However, there is an overall limit of tax privileged pension funds a member can accrue during their lifetime – called the ‘Lifetime Allowance’ (LTA)

When a member takes certain benefits, and at some other times (such as attaining the age of 75 or on death before 75) the amount of LTA they have used is tested

When the members’ benefits, along with any other benefits they have taken, are over the LTA, a ‘Lifetime allowance charge’ is applied to the value in excess of the LTA.

There are a number of different LTA protections available and these are covered in various protection articles within the Knowledge library on PruAdviser.

From 6 April 2006 pension rules changed significantly, in particular the rules around the maximum benefits payable under UK tax approved pension schemes.

Although there are no limits on the benefits an individual can receive – or ‘crystallise’ – from registered pension schemes, there is an overall limit of tax privileged pension funds a member can accrue during their lifetime – called the ‘Lifetime Allowance’ (LTA).

When a member takes certain benefits and at some other times (such as attaining the age of 75 or on death before 75) the amount of LTA they have used is tested.

When the members’ benefits, along with any other benefits they have taken, are over the LTA, a ‘Lifetime allowance charge’ is applied to the value in excess of the LTA.

Level of LTA

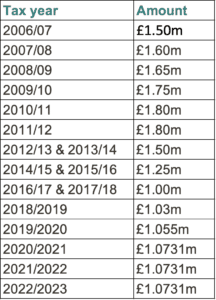

The standard LTA is an amount fixed in legislation for specific tax years (6 April to 5 April).

The ‘standard LTA’:

From tax year 2018/19 the LTA was increased annually by the Consumer Prices Index (CPI), this was until the 2020/21 tax year as from the 2021/22 to 2025/26 tax years the chancellor has frozen the increases. Although there is no way of predicting future rates of CPI, the chart at the end of this article may provide some assistance in estimating future LTA.

Impact of LTA

When members take benefits from registered pension schemes (crystallise benefits), they use up a proportion of their LTA. If the individual takes more benefits later, the additional benefits are tested against the remaining proportion of the member’s LTA.

Where given as a percentage it is rounded down to two decimal places e.g. 28.777 is 28.77% NOT 28.78%. However, care should be taken when using only the percentages as this will prove inaccurate in certain conditions (see below for example).

Pension Tax Manual PTM081000 & PTM164400

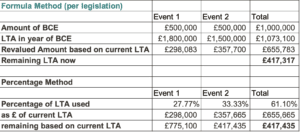

The correct method for calculating LTA usage requires the past crystallised amount be indexed at the same rate the standard LTA has been indexed. This is done with the formula:

RUA x (CSLA/PSLA)

Where:

RUA – Relevant Untaxed Amount – the amount of the previous BCE

CSLA – Current Standard Lifetime Allowance – Standard LTA today

PSLA – Previous Standard Lifetime Allowance – LTA at the time of the previous BCE

[Finance Act 2004, Section 219]

Example 1: Standard Lifetime Allowance

Mark takes benefits with a value of £500,000 when the standard lifetime allowance is £1.8m. He then takes a further £500,000 when the standard lifetime allowance is £1.5m.

Mark would now like to know how much he can crystallise without incurring a lifetime allowance tax charge today. The table below shows both ways of calculating this.

In this example the ‘shorthand’ way of using the percentages and the technically accurate way produce a slightly different result. As such the method specified in the legislation is preferred.

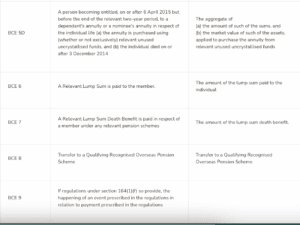

Benefit Crystallisation Events

When a BCE occurs, the value crystallised must be measured for LTA purposes – the capital value of this amount depends on the type of event taking place – see below.

There were originally 9 BCEs and now there are 13.

The table below summarises all the Benefit Crystallisation Events and the value for LTA test purposes.

1 – RVF = Relevant Valuation Factor, i.e. 20 or if higher, an alternative factor agreed with HMRC

2 – P = the amount of the pension which will be payable to the individual in the period of 12 months beginning with the day on which the individual becomes entitled to it (assuming that it remains payable throughout that period at the rate at which it is payable on that day).

3 – XP = the amount by which:(a)the increased annual rate of the pension, exceeds (b)the rate at which it was payable on the day on which the individual became entitled to it, as increased by the permitted margin.

4 – DP = the annual rate of the scheme pension to which the individual would be entitled if, on the date on which the individual reaches 75, the individual acquired an actual (rather than a prospective) right to receive it.

5 – DSLS = the amount of any lump sum to which the individual would be entitled (otherwise than by way of commutation of pension) as would be paid to the individual if, on that date, the individual acquired an actual (rather than a prospective) right to receive it.

Notifying Lifetime Allowance usage

The lifetime allowance system is supported by an information exchange and reporting regime. There are different systems for reporting and paying the lifetime allowance charge depending on whether the BCE occurred during the member’s lifetime or as a result of a BCE after the death of the member. The member needs to be told by the scheme administrator (or an insurance company if they administer the scheme), via a BCE statement the following information:

• how much lifetime allowance has been used up by the BCE. This information will be required so that the member can work out the remaining LTA available for future BCE’s and correctly complete any tax returns

• if there is a liability to the lifetime allowance charge and if so, whether the scheme administrator has paid or intends to pay part or all of the tax due

If an insurance company is paying a scheme pension or lifetime annuity using funds that derived from a registered pension scheme, they must tell the member annually how much lifetime allowance has been used up in respect of those benefits, including:

– scheme pension or lifetime annuity not provided from drawdown funds

-part of a drawdown fund used to provide the scheme pension or lifetime annuity

-whole drawdown fund used to provide the scheme pension or lifetime annuity.

Where the scheme administrator isn’t required to provide an annual BCE statement for the tax year, they are required to provide the required information within three months of a BCE that has occurred under the scheme in respect of the member.

Where, following the death of a member, the scheme administrator pays a defined benefits lump sum death benefit, or an uncrystallised funds lump sum death benefit they must supply the following information to the deceased members personal representative within 3 months of making the payment:

• The amount of lump sum

• The payment date

• The percentage of the standard LTA used by the payment.

Where, following the death of a member, funds are designated to provide a dependant’s or nominee’s flexi-access drawdown fund (BCE5C), or the beneficiary(ies) becomes entitled to a dependant’s or nominee’s annuity from unused uncrystallised funds (BCE5D) the scheme administrator must provide the following information to the deceased member’s personal representative with 3 months (remember the scheme administrator is not responsible for deducting any LTA excess tax charges from these BCEs, you can read more about this in death benefits from defined contribution schemes:

The information that must be provided on the BCE 5C is:

• the amount designated

• the date of designation, and

• the percentage of the standard LTA used up by the BCE 5C.

The information that must be provided on the BCE 5D is:

• the amount or market value of assets applied to the purchase of the annuity

• the date the person became entitled to the annuity, and

• the percentage of the standard LTA used up by the BCE 5D.

Effective Date of a Benefit Crystallisation Event

This is crucial as it will determine which year’s LTA the event is tested against.

Pension benefits

The effective dates are as follows:

BCE 1 – the date the funds are designated as being available to provide the member with drawdown pension

BCEs 2, 3, 4 and 6 – the date the member acquires an actual (as opposed to a prospective) entitlement to payment of the relevant authorised pension benefit under the arrangement concerned.

BCE 5, 5A, 5B – the effective date of the BCE is the member’s 75th birthday.

BCE 5C – the date the deceased member’s funds are designated as being available to provide the dependant or nominee with drawdown pension

BCE 5D – the date the dependant or nominee acquires an actual entitlement to the annuity

BCE 7 – is the date the relevant lump sum death benefit is paid

BCE 8 – is the date the overseas transfer is made

BCE 9 – the effective date of the BCE varies according to which regulation of The Registered Pension Schemes (Authorised Payments) Regulations 2009 – SI 2009/1171 the payment is made under.

Pensions Tax Manual PTM088220

Pre-commencement pensions

This relates only to tax approved pension payments from UK tax approved pension schemes or policies, so excludes any state benefits.

Pre-commencement pensions already in payment before 6 April 2006 are treated as if they crystallised immediately before the first BCE on or after 6 April 2006.

Pre A day pensions in payment should be multiplied by 25 (not 20) times the yearly rate in force on the same day as the first BCE occurring after 6 April 2006.

However, for a pre-commencement pension in capped drawdown, where the first BCE occurs after 5th April 2015. The amount of maximum GAD needs to be multiplied by 80% to reduce the new maximum GAD of 150% back down to the 120% GAD figure (120/150 = 0.80).

Example

A member had drawdown income from a contract started before 6th April 2006. As at 10 June 2016 the maximum income payable from the plan was £20,000 but the member was only taking £15,000.

The member has not taken any other benefits since and decided to vest the rest of the pension benefits.

Therefore, the drawdown contract used up: (£20,000 x 0.80) x 25 / £1.00m = 40% of LTA leaving 60% available for the benefits being vested.

Prevention of overlap for Drawdown Pensions

Drawdown pensions (other than those established prior to 6 April 2006) are tested against the LTA twice.

The first test is through BCE 1 when the funds are first designated and then again either on:

• Scheme pension (BCE 2), or

• Annuity Purchase (BCE 4), or

• reaching age 75 (BCE 5A), or

• on transfer to a Qualifying Recognised Overseas Pension Scheme (BCE 8).

To ensure there is no double counting only the increase in funds crystallised under BCE 1 are tested at the second designation. i.e. investment growth less payments of income made. Any income taken is not added back in, simply the arrangement value at age 75 less the original BCE 1 amount will use LTA.

Example

In August 2006, the member designated £300,000 as a drawdown (unsecured pension at the time) fund.

This used up £300,000/£1,500,000 – 20% of the standard LTA.

The member then decided to buy an annuity with those funds in June 2017. At that time the funds had grown to £350,000.

This used up a further (£350,000 – £300,000) / £1,000,000 – 5% of the standard LTA.

Where partial uplifts are done or multiple designations have been made the calculations are done proportionately.

A negative amount does not result in an increase to the member’s LTA.

Lump sums

A pension commencement lump sum (i.e. tax-free cash – BCE 6) is always deemed to arise immediately before the entitlement to the linked pension.

This applies even though there is no requirement that the pension and the linked tax-free cash are paid at the same time.

While people will normally want their tax-free cash as soon as possible, payment is allowed up to 6 months before and 12 months after the start of the linked pension.

Finance Act 2004 Sch 29, Pt1 Para1-(1C)

Lump Sums on death

Where the member has died, any crystallisation events occurring under BCE7 (relevant lump sum death benefit) are treated as occurring immediately before the death of the member.

Where relevant lump sum death benefits are paid to more than one recipient, the BCE for each are treated as occurring simultaneously. This is to ensure any LTA charge which may be applicable is proportioned between all the recipients.

Lump sum death benefits (BCE 7) are normally tested against the LTA in the tax year they are paid. However, where a death benefit is paid after 5 April 2016, i.e. when the LTA reduced to £1.0m, but death was prior to this date the lump sum is tested against £1.25million. There was no similar provision when the LTA reduced from £1.8m to £1.5m and from £1.5 to £1.25.

Any death payment to a beneficiary doesn’t count towards the beneficiary’s LTA.

Age 75

All benefits must have been tested against the member’s LTA by the member’s 75th birthday.

This will be through either BCE 5, 5A or 5B.

The only BCE that can be triggered after age 75 is a post-retirement scheme pension increase beyond the permitted margin (BCE 3).

For unvested funds even though there is a BCE at age 75 where benefits are subsequently taken post 75 the BCE percentage ‘crystallised’ at age 75 is ignored for the purposes of calculating benefits.

If the member has uncrystallised funds on their 75th birthday any excess over the LTA will be charged at 25%. The funds will technically become crystallised at that point, but subject to remaining unused LTA (as per the paragraph above), PCLS and UFPLS may still be available.

If the member wishes to take an LTA excess as a lump sum they must choose to take the excess to provide this (if the scheme allows this) before they reach 75 (they must have used or will use up 100% of the LTA to do this).

Simultaneous Benefit Crystallisation Events

When BCEs occur simultaneously, the member must decide the order the BCEs take for the purpose of the LTA test. BCE6 (payment of a pension commencement lump sum) occurring alongside BCE1, 2 or 4 will always be deemed to have occurred first. This is important where benefits will be over the LTA to ensure the scheme(s) with the most valuable benefits can be vested without an LTA charge.

Where 2 or more BCE7s occur upon the death of the member, these are treated as occurring at the same time.

Transfer after a Benefit Crystallisation Event

Regulations allow registered pensions schemes and insurance companies to transfer sums and assets representing pensions in payment. These are not in themselves BCEs unless they are to a QROPS.

Exemption for Drawdown contracts in existence before 6 April 2006

Drawdown contracts that started before 6 April 2006 are exempt from any further BCEs (other than at the first BCE after April 2006, to determine remaining LTA, as detailed in the pre-commencement pension section above).

Lifetime Allowance Charge

If the member is alive, the Scheme Administrator must check the amount crystallising each time there is a BCE to ensure that the appropriate tax is paid on any funds taken above the LTA. The Scheme Administrator must calculate the capital value of the benefits coming into payment, to verify the percentage of the LTA being used. As discussed above, the method of doing this depends on the BCE.

If the percentage of the LTA crystallising is greater than the percentage available, the excess becomes a ‘Chargeable amount’ and the ‘Lifetime allowance charge’ is applicable.

The tax rate depends on whether the excess is paid as a lump sum – called a Lifetime allowance excess lump sum and charged at 55% – or if retained to pay pension benefits, charged at 25% (tax is then payable on the income the member receives at their marginal rates).

If the member is alive, the liability for paying the LTA charge falls jointly on the Scheme Administrator and the member. Normally, the Scheme Administrator is obliged to deduct the tax charge before a ‘retirement’ payment is made. If, however, the charge arises on the member’s death, the recipient of the payment is liable.

The scheme administrator must pay, and account for, the LTA charge to HMRC on a quarterly basis (through the Accounting for Tax Return).

Where a chargeable amount applies, the scheme administrator must send the member a notice showing;

• the level of the Chargeable amount;

• how this was calculated; and

• the level of LTA charge deducted (or how they propose the tax due should be paid).

The scheme administrator must give a BCE statement to the member (or if the member has died to their personal representatives);

• at least once every tax year if the member is receiving a pension from the scheme (this includes the member having designated funds to provide drawdown pension); or

• where the scheme administrator isn’t required to provide an annual BCE statement for the tax year, within three months of a BCE that has occurred under the scheme in respect of the member. This doesn’t include a statement in respect of a BCE 5C or BCE 7 as the scheme administrator is required to notify the member’s personal representatives of this under the Provision of Information regulations – see PTM165100.

[Read more in section PTM164400 of the Pension Tax Manual on the Gov.uk website]

The provider may become liable for any LTA charge not paid. The provider may also be liable, potentially, for additional charges and fines, unless they have evidence that they acted on information from the member that was believed to be reliable.

In these circumstances, specific information must be provided to HMRC within certain time limits. If they consider that the scheme administrator acted in good faith, then the member becomes solely liable for the charge.

[Finance Act 2004 – S214 – 226, Sch 32]