How tricky can an investment bond be? When you’ve not dealt with many in the past, the answer is very, says Paula Butrynska, paraplanner, PlanWorks

I think most paraplanners realise that dealing with an Investment Bond – whether that’s reviewing an existing one, recommending a new one or completing a surrender calculation – is a tricky business. As with most of what we do, the more we deal with them, the more comfortable we get, but, as I found recently, even years of experience sometimes doesn’t help.

I’ve recently had the pleasure of reviewing an existing Investment Bond. I’ve not had much experience in reviewing existing, older legacy plans like this so what I found out blew my mind. If only the study books covered this!

Whilst I haven’t come across many Investment Bonds during my career, I read a fair bit about them whilst studying for my diploma. I expected that they would be arranged primarily as an investment (even though they are usually classed as a single-premium life insurance policy due to the small amount of life insurance upon death). However, I did not expect to see a Transact General Investment Account (GIA) and a Barclays cash deposit account as part of the Investment Bond, so at this point I took a step back and quickly reached for my CII RO2 book…

I’ve read that Investment Bonds are provided by insurance companies who usually have a variety of funds on offer. They can either offer funds that are unique to life assurance policies (i.e., With-Profit funds) or funds that are broadly equivalent to Unit Trusts and OEICs, which are usually mirror funds of those available outside Investment Bonds. Regular Unit Trusts and OEICs are also often available, but I couldn’t find any reference to platforms or cash deposits.

Restricted Vs Open Architecture

I turned to Google, and it soon became clear what was missing, i.e.that Investment Bonds can be restricted or open architecture. All new terminology to me.

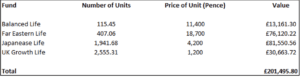

If an Investment Bond has a restricted architecture, it will usually offer insured life funds. These types of funds are generally managed by the insurance company itself, although some bond providers will offer external funds from different fund management companies. A restricted-architecture Investment Bond would typically look as follows:

However, if an Investment Bond offers open architecture, you’ll be able to choose from any fund, investment trust, ETF, cash deposit and so on.

The underlying investments might be available directly within the Investment Bond or through a GIA on a number of different platforms. Take HSBC’s Onshore Investment Bond as an example: it can be accessed directly from HSBC Life or it is available through a number of platforms, including M&G Wealth, Fusion and True Potential. Canada Life offers Offshore Investment Bonds with agreements with platforms such as Transact, Parmenion, Nucleus or Fundment, to name a few. This provides access to a much wider selection of funds, including access to Discretionary Fund Management (DFM) propositions. Canada Life’s Offshore Investment Bond can be looked after by a number of DFMs, such as Rowan Dartington, Brewin Dolphin, EQ Investors or Rathbone Greenbank.

There may also be times when it’s suitable to hold some investments in cash. Investment Bonds that have open architecture allow a wide selection of cash deposit accounts with a range of major banks and building societies. If an Investment Bond was taken out in US dollars or euros, the cash on deposit could also be held in the same currency. Different deposit accounts with different banks or building societies will have different terms and interest rates.

An Investment Bond with open architecture may therefore look as below:

What is confusing about this?

For me, the confusion starts when starting to look at and try to understand charges and reviewing the cash transactions.

Investment Bonds will always have a cash account or the potential to hold cash to allow the Investment Bond provider charges, Ongoing Adviser Charges and withdrawals to the client to be paid out.

Where a platform GIA is also held, this will often have a cash account too, with investments being bought and sold from this account and cash often being sent to the Investment Bond cash account to provide money to pay fees or fund withdrawals.

Where there is a platform GIA, the platform usually offers a report per account that details the contributions and withdrawals; however, what I quickly figured out is that these are not actual contributions and withdrawals to or from the client but to and from the Investment Bond cash account. Therefore, when looking to understand what the client has paid in or taken out, it will always be the Investment Bond cash account which you need to spend time analysing.

There can often be a lot of transactions on these types of arrangements, as many Investment Bond providers require a minimum cash balance, so will instruct auto-sells from the platform GIA. Some providers allow the cash account to go overdrawn and some providers add a charge for using this, so it is something to watch, and some do not continue paying the Ongoing Adviser Charge if the cash account is overdrawn.

Just to add further complexity, many Investment Bond providers do not have a real-time valuation of the platform GIA, whereas we are likely to be able to get one by logging into the platform, so here it is about understanding which valuation we are going to use and from were.

As I get involved in more and more complex cases, I find that this type of structure is very similar to the more complex SIPP and SSAS arrangements with assets like property within them, so understanding this structure I found can really help.