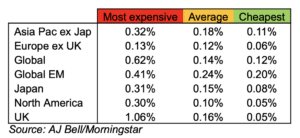

Investors may be paying far more than necessary for their tracker funds, with analysis by AJ Bell revealing a big gulf in charges between trackers.

According to the investment specialist, investors could see their gains dented by thousands of pounds over the long term, with the most expensive passive funds sometimes charging 20 times more than the cheapest option.

As an example, AJ Bell said, an investor with £10,000 in the most expensive UK stock market tracker pays £106 in investment management fees every year. In contrast, the cheapest tracker funds charge as little as £5. Over the long term, an investor holding the cheapest tracker could end up with a portfolio worth £19,580 after a decade but just £17,807 if they opted for the most expensive – a difference of nearly £1,800.

An investor holding a mixed portfolio across seven of the main investment sectors across global equity markets could be almost £9,000 better off after 10 years based on a £100,000 investment, the analysis showed.

AJ Bell warned that while some of the most expensive trackers may have originally been purchased by investors some time ago and priced with an “all-in” fee many of these funds have now been moved to a modern investment platform where it is likely investors could switch to cheaper funds.

Laith Khalaf, head of investment at analysis at AJ Bell, said: “It may come as a surprise but not all tracker funds are created equal. There can be a big gulf in charges and over time this can produce a seriously large dent in your nest egg. With no chance of outperformance because they invest passively, the difference in returns between comparable tracker funds will be largely dictated by fees.

“At the moment, platform providers can identify customers who hold higher cost tracker funds but can’t contact them to point this out as this could constitute personal financial advice. The regulator is currently reviewing the dividing line between advice and guidance and this is an example of how relaxing the rules could help investors to make better, more informed decisions.”