Juliet Schooling Latter, research director, FundCalibre

For this month’s three-year track record, Juliet Schooling Latter, research director, FundCalibre, talks to the managers of the VT Momentum Diversified Income, a well-diversified, global, multi-asset income-focused fund that focuses on value investing.

“Compare today to the Covid lockdowns and we are significantly more cautious on the global economy. We saw the Covid sell-off and Brexit as an opportunity, right now is a much more complex and nuanced environment.”

VT Momentum Diversified Income co-manager Richard Parfect is refreshingly honest on the team’s outlook for the economy – citing elevated tail risks both geopolitically and economically as well as policy risk from governments and central banks.

“We have a systemic problem on our hands which has been building for years and has germinated over a short-period following the outbreak of war in Europe.”

A busy and challenging start to 2022 has resulted in the team downgrading its outlook from a top-down perspective. The team score this on a scale of one to three – where three is really bullish, one is “slam the anchors on” and two is neutral.

Over the past three months this score has moved from 2.65 to 1.95 – with the US yield curve, the OECD US output gap and Federal Reserve tightening standards all contributory factors.

That score of 1.95 is comfortably the lowest since the system was introduced following the departure of chief investment officer Peter Elston in late 2019. “It has typically been above 2.5 and could go even lower,” adds Parfect.

Elston’s departure from what was then Seneca Investment Management in 2019 was quickly followed by the acquisition of the business by Momentum Global Investment Management a year later. However, the vehicle remains a well-diversified, global, multi-asset income-focused fund that focuses on value investing.

Parfect, who founded Seneca in 2002 and leads specialist asset research; is joined on the team by Tom Delic, Mark Wright, Gary Moglione and Alex Harvey.

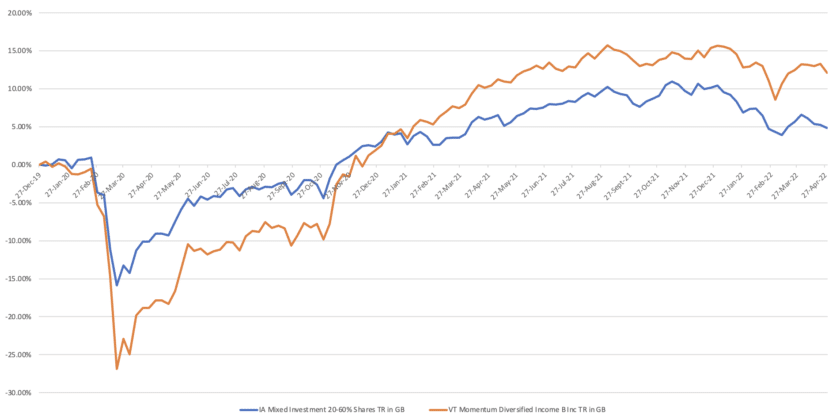

The team, which will mark its third anniversary later this year, executes its ideas via a mix of funds and direct securities, using both alternative and traditional asset classes to achieve true diversification. The fund targets CPI +5 per cent (net), with ongoing charges at 1.07 per cent*. Over the team’s tenure, the fund is first quartile, returning just shy of 11% versus a sector average of 4.1%**.

Parfect says the top-down score is a sense check and does not necessarily mean wholesale changes to the portfolio.

“Ultimately it’s always valuations which matter – we don’t have a crystal ball or an intellectual advantage over macro.”

From an equity perspective, Parfect says the UK and Japan stand out in terms of valuations – adding the fund is underweight on the asset class to its strategic asset allocation.

This is a two-pronged approach as the team is trying to express its view on valuations in terms of how much it has in an asset class in a specific geography – this is versus other points in market cycles where you do not have to be so disciplined.

“Throw a dart at the dartboard, and there is a good chance you can hit the bullseye if the bullseye is big enough. Right now, the bullseye is quite small, so we have to be more specific with what we’re doing,” Parfect adds.

The team is also cautious on fixed income, although this stance has softened to a slight degree. By contrast, there is a 6 per cent holding in a defensive asset like gold, because of the worry about tail risk.

The team has also been extremely successful within the specialist bucket of the portfolio, with the likes of property, renewables and infrastructure performing well in both capital and income terms.

Many of those specialist assets have been accessed through investment trusts. This has been a big contributor to the fund maintaining an excellent dividend income, currently standing at 4.7 per cent*.

Parfect says confidence in these specialist assets has always been there, although their performance during Covid has been a boost.

The performance of these specialist trusts was completely unrelated to the uncertainty in markets caused by the pandemic, yet the unique nature of the events saw vehicles invested in the likes of wind turbines and solar panels fall significantly, despite the wind continuing to blow and the sun continuing to shine.

Parfect says: “That price drawdown was driven by not a lot of volume and market sentiment, but crucially the NAV provided the strong anchor, which kicked in quickly. We were sanguine at the time as it was not rationale and tried to buy in certain cases.”

Although the fund does not have any direct exposure to the likes of mining and oil, Parfect says there has been some indirect benefit from these sectors so far in 2022 – not least through the renewable energy holdings, many of which have risen due to price rises in the energy sector.

This fund has a number of tailwinds in its favour. It is backed by a strong management team and is incredibly well diversified, while the attractive monthly income should also appeal to income-seeking investors with a balanced risk profile.

VT Momentum Diversified Income vs IA Mixed Investment 20-60% Shares

VT Momentum Diversified Income vs IA Mixed Investment 20-60% Shares TR in GB

*Source: fund factsheet, 31 March 2022

**Source: FE fundinfo, 27 December 2019 to 7 May 2022

Past performance is not a reliable guide to future returns. You may not get back the amount originally invested, and tax rules can change over time. Juliet’s views are her own and do not constitute financial advice.