Julia Peake, Nucleus, outlines important points for paraplanners to know about the role and responsibilities of trustees, especially when advising a client taking on the mantle who may have little or no knowledge of what’s involved.

Being a trustee can be a huge honour and one of immense importance. It shows that someone trusts (excuse the pun) you enough for you to take care of what they have built up for the people and causes they love and care about most. However, there is much to consider when you’re a trustee or if your clients are about to take on this role. Ensuring trustees have the necessary information to undertake their duties and responsibilities, which has become more complex over recent years, is essential in helping them fulfil this significant role.

Many of the trustees you will deal with will be lay trustees who will have no or limited knowledge of the intricacies of trust law. However, they do need to understand what their administration and reporting requirements are, how they should be investing and managing the trust property, and always ensure they are acting in the best interests of all the beneficiaries.

The rules and regulations governing trustees are laid out for them in the trust deed and legislation such as the Trustee Acts 1925 and 2000 for England and Wales, Trustee Act (Northern Ireland) 1958 and 2001, Trusts (Scotland) Act 1921 and Trust and Succession (Scotland) Act 2024, (though received Royal Assent still awaiting implementation for the trust provisions).

Bare trusts are fairly simple, as in most cases, the trustees have clear instructions as to who the beneficiaries are and how much they can benefit by, and this means that the tax payable is accounted for by the beneficiaries by the proportion by which they benefit from the trust. This is of course unless parental settlement rules apply where the bare trust has been set up by the parent and the beneficiary is a minor. If this is the case, gross income exceeding £100 will be taxed on the parents at their rate of tax.

Discretionary and Interest In Possession (IIP) trusts, (incepted since 2006) are more complex and the trustees have much more to consider, including submitting tax returns if they are liable for any taxes due.

Relevant property trusts, have additional reporting requirements over and above a tax event due on the trustees. Trustees need to report to HMRC if a lifetime transfer is chargeable to inheritance tax (IHT) at the time it’s made if the:

- Value of a new policy, together with any other chargeable transfers in the previous seven years, exceeds the nil rate band (currently £325,000).

- Value of an existing policy, together with any other chargeable transfers in the previous seven years, exceeds 80% of the nil rate band (currently £260,000).

- Value of the premiums gifted into trust, together with any other chargeable transfers in the seven-year period ending with the gift, exceeds the nil rate band when exemptions and reliefs are ignored.

- Trust reaches its ten-year anniversary (principal charge).

- Property ceases to be held by the trust (proportionate charge or exit charge).

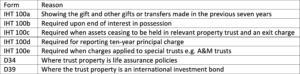

The main form used to report certain events to HMRC is the IHT 100 form, but there are also supplementary forms required depending on what the trustees need to report on.

A full list of the supplementary forms that trustees may need to use for reporting can be found here: Inheritance Tax account (IHT100) – GOV.UK (www.gov.uk)

Trust Registration Service (TRS)

All UK express trusts which were in existence on 6 October 2020, unless specifically excluded, needed to be registered on the TRS by 1 September 2022. New ones created after that date have 90 days to complete their registrations. Financial institutions, including advisory firms have a requirement to collect evidence of the trust’s registration on TRS and check the beneficial ownership information on the trust record matches the records. If there are material discrepancies or we note a trust hasn’t been registered on TRS, we have an obligation to report these to HMRC. More information about this can be found here TRSM70000 – Discrepancy reporting: contents – HMRC internal manual – GOV.UK (www.gov.uk).

The trustees for any trust, will however, need financial services expertise when it comes to recommendation about suitable investments for the trust property if they do not have the requisite knowledge themselves. This is where value can be added to your clients and to help them ensure they are doing their jobs as trustees.

The alternative is employing the services of a professional trust company. The level of service can range from administrative duties to full trusteeship. There is a cost involved for this, but some might see it is worth it especially if the trustees are dealing with complex investment or ongoing reporting requirements. Additional benefits of working with a professional trustee are:

- Expertise – They deal with trust administration every day and so will not be phased by any complexity which may arise.

- Reporting- With TRS and potential tax returns to do, a professional can do this for the trustees efficiently.

- Continuity – A professional company doesn’t pass away or become mentally incapable and so there will always be someone who is capable of managing the trust.

- Professional – to relieve the burden of keeping up with ever changing current legislation and regulation.

- Impartiality – A professional can ensure that matters are dealt with impartially, especially if there is any tension between beneficiaries. They will always act in the best interests of all the beneficiaries, they will not take sides.

Main image: milad-fakurian-nY14Fs8pxT8-unsplash