EdenTree Investment Management is 100% focussed on sustainable and responsible investing; “it’s all we do,” CEO Andy Clark, tells PP editor Rob Kingsbury

EdenTree was a pioneer of ethical and responsible investing, setting up its first ethical fund in 1988, and the company currently manages £3.5billion* in assets under management.

Founded in 1988 as Ecclesiastical Investment Management, and owned by the Allchurches Trust, an independent charity, its original remit was to provide savings products for Church of England clergy. In 2015 it rebranded to EdenTree Investment Management and has since grown into a fully-fledged asset manager, with a much wider remit, but with the profits it makes going to the charity.

Growing the brand’s presence in the wider market is where Andy Clark (ex CEO of HSBC GAM UK), and new CIO Charlie Thomas (ex Head of Strategy, Environment and Sustainability at Jupiter Asset Management) come in.

EdenTree Investment Management is an asset manager that focusses only on ESG/sustainable/responsible investing. There is a huge amount of knowledge in EdenTree, built up over the years – fund manager Sue Round was one of the first women to manage money and has been with the company for 33 years.

“Given the talent we have and the long history in this type of investing, I’d say to date we’ve been too humble and we need to show our expertise to the wider market,” Andy Clark says.

Indeed, he argues it is the company’s clear focus on responsible investing that sets it apart in the current movement in the market towards ESG and the wave of ESG fund launches. The company sets out its stall in its belief that consistent, long-term returns are more likely to be achieved by investing responsibly in sustainable businesses.

“If I had to describe EdenTree now, I’d say it is an authentic pioneer in ESG, with a heritage of over 30 years. Every part of the business is focussed on sustainable investing. Every conversation our fund managers have, every conversation I have is within the ESG sphere. All the challenges, all the debates are centred around one subject. We’re not distracted as company by any other type of investment. It’s all we do,” Andy says.

What also makes the fund manager stand out, he believes, is its long-term strategy. “The board asked me to put together one, three, five and 10 year plans. I’ve never before been asked to put together a ten-year plan. That says a lot. Our board wants a long-term business strategy because its aim is to deliver a sustainable income to the charity. That says there is a long-term vision at the top.”

To that end, EdenTree refreshed its brand and is adding to its proposition. In July 2021 it launched three multi-asset funds – the EdenTree Responsible and Sustainable Multi-Asset Cautious, Balanced and Growth funds “to give advice firms the opportunity to access responsible investing across asset classes in an appropriately risk-rated fund” – and in early 2022 it will be looking to launch two single strategy funds.

Also it has made it easier for advisers and paraplanners to access the funds, recruiting four business development managers to deal directly with the IFA market.

“I think we can do a great job for advice firms,” Andy says. “We can try to simplify this complex world of ESG with our knowledge and bring some solutions that people feel comfortable with. This is a space in which people need guidance and intelligent people with whom to talk it through. I’d like paraplanners to see us as the ‘go to’ people to talk about ESG, responsible and sustainable investing.”

Greenwashing

Given EdenTree’s long history in this market, how does Andy feel about the wave of popularity around ESG, the influx of new funds into the market and the concern around greenwashing?

“I joined EdenTree because we’re authentic in what we do,” he says. “If you’re cobbling a fund together because you see it as flavour of the month, that’s not real to me.

“But overall, we welcome the focus on the sector because it opens up the debate and it has raised the profile of ESG investing, which can only be a good thing.”

When it comes to greenwashing he believes quality will out. “The risk to advice firms is that funds are badged as ESG but there’s an element of greenwashing involved, which is exposed further down the line. I think what will happen is that rather than look at individual funds, paraplanners, analysts and financial advisers while start to look at the fund companies and the resources they are putting into ESG and their commitment to it. That will be a huge differentiator.”

In terms of what paraplanners should be aware of when researching ESG funds – which can be very difficult given the range of terminology, a lack of definitive ratings and often a lack of transparency in the market – Andy says: “I was a paraplanner when I first left stockbroking many years ago, and selecting funds then was tough but with ESG these days it is tougher because often you can’t sufficiently compare funds; so I think this is where culture and expertise will be important.

“I’d say again, look at the firm and what they do. There are some top quality ESG-focussed firms in the market – get to know them and how they go about investing responsibly and sustainably.”

The Future of ESG

Despite its current level of popularity, Andy believes ESG investing is only in the foothills of its journey. “I believe this is the way that investing will be done. At some point it won’t be called ESG investing, it will just be investing.”

He also sees considerable market advantage for advice firms that work hard to develop the skills to help clients gain clarity and invest in ESG.

“The game-keeping for advisers on ESG is massive and adds serious value to the adviser relationship. So, the time that advice firms put in now, in terms of establishing what they believe in and what their clients believe in, will be time well spent.”

Part of this is an onus on advice firms to do their homework for their client as well, he makes clear. “There are so many different types of ESG investing that people often don’t know what they want. Do they want a fund that invests in BP or not? Do they choose a fund that excludes BP or one that actively works with it for positive change? It’s going to mean different things to different people.

“So advice firms have to work out what clients want. I think it’s probably going to be reasonably big buckets, but they will be different. Then you have to match the investments to those buckets.

“For advice firms that embrace it quickly I believe there is a real upside for their businesses.”

Asked how EdenTree can make paraplanners’ lives easier, Andy says: “Part of our job is to help provide the clarity that paraplanners need, in terms of what we do. If a paraplanner can get their head around ESG and find a way to make it simpler for the client and the adviser it will be fantastic.

“We have a scary amount of knowledge here that we are willing to share. A paraplanner doesn’t have to be a client to get in touch. We’re about building relationships and building paraplanners’ knowledge of responsible and sustainable investing. It’s our passion and we can make paraplanners’ lives easier by sharing that passion.”

* AUM figure at 30 June 2021.

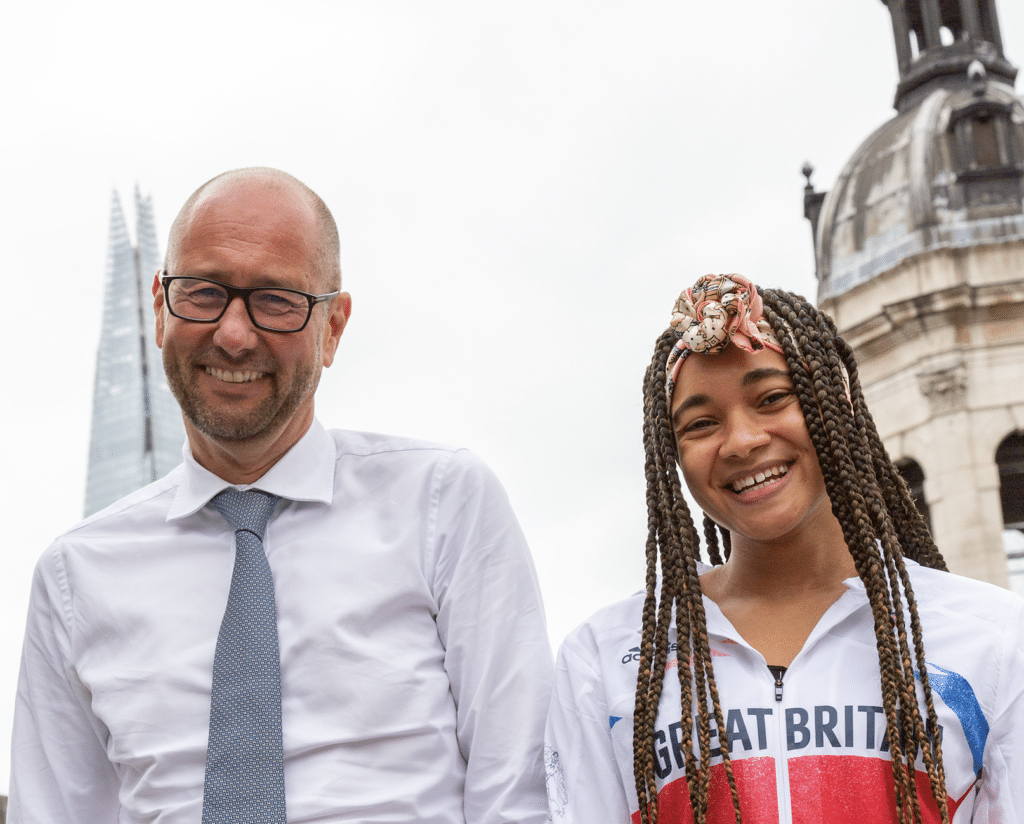

Sponsorship of Alice Dearing

EdenTree is sponsoring open water swimmer Alice Dearing – the first black woman to represent team GB in the sport. “We were pondering how we could involve ourselves with inspirational people,”says CEO Andy Clark. “We started a conversation with Alice before it was confirmed she would be going to the Tokyo Olympics, purely because she is an inspirational person. She’s authentic and she is clear about who she is and what she does; she challenges in diversity and inclusion and the environment, particularly around open water projects. We’re enjoying working with her. For us it’s also about humanising the asset management industry a bit more – it’s about the S in ESG.”