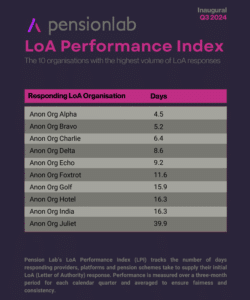

Pension Lab has launched its first ever Letter of Authority performance index, revealing the differences between the best and worst performers.

The Index, designed to help providers, platforms and pension schemes benchmark their LoA processing by publishing the response times for Pension Labs’ 10 highest-volume LoA processing organisations, has found that response times vary between 4.5 days and 39.9 days.

The index is based on data from LoAs processed monthly through Pension Lab’s digital LoA system, with over 230 different providers, platforms, master trusts and third-party administrators.

The organisations in the index are ranked anonymously, as Pension Lab says its goal is to “foster collaboration, not alienation. By working constructively with providers, we aim to build momentum for real, lasting improvements that benefit all stakeholders.”

Despite its essential role, the LoA process is fraught with inefficiencies and security risks, often taking weeks or more to complete due to inconsistent formats, wet signature requirements and repeated chasing, the firm said. Manual processing timescales can range from as little as 9.6 days to 59.5 days.

Scott Phillips, CEO and founder of Pension Lab, said: “The LoA process underpins many essential transactions, including transfers and its inefficiencies impact not just advice timescales but also providers’ ability to deliver consolidation services to non-advised consumers.

“Pension Lab’s unique position enables critical insights into LoA performance, delays and their causes. Our LPI complements our broader initiatives like Fix LoA Action Group, to help providers, master trusts and platforms prioritise improvements that benefit Consumer Duty compliance and cost savings and importantly, deliver improved servicing for advisers and consumers alike.”

Pension Lab says it intends to publish its index quarterly, with Q4 2024 data due in February 2025.