The number of advisers exiting the industry could be set to grow substantially over the next few years, according to research by Canada Life.

A large number of advisers are considering selling their business amid the pressures of regulation, economic volatility and cybercrime, the research shows.

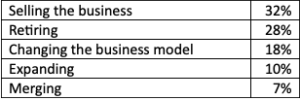

Of 185 advisers surveyed, a third (32%) said they were considering selling up, with four in ten (38%) expecting to do so to a larger organisation. Meanwhile, nearly two in five (37%) are considering withdrawing from certain markets, while one in three (28%) is eyeing up retirement.

According to Canada Life, the findings suggest a new wave of consolidation is “primed to grip the industry”.

Table 1: Measures advisers are considering in response to industry risks

Neil Jones, tax and wealth specialist, Canada Life (pictured), said: “There is a clear signal that advisers are feeling under pressure, which is catalysing change in the industry.

“When they look at the future, advisers who are looking to sell expect to be acquired by a larger organisation, rather than merge with a smaller firm. In short, the industry looks set for a fresh wave of consolidation. The benefits of scale are clear, but it may also be possible for advisers to gain some of those benefits by forming networks and strategic alliances.”

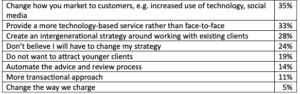

The research also found that many advisers focused on attracting younger clients felt they would need to change strategy. Over a third (35%) said that appealing to millennials would require a change in marketing strategy, while 33% believed a more technology-based service, rather than face-to-face meetings, would appeal to a younger generation. A similar proportion (28%) said creating an intergenerational strategy around working with existing clients would appeal to millennials.

Table2: Measures advisers would take to attract younger clients

Interestingly, a quarter (24%) of respondents said they did not believe they needed to change their strategy and only 5% felt it would be necessary to change the way they charge for their services to appeal to younger generations.

Commenting on those advisers who would retain their current strategy, Jones added: “This suggests that they have either already changed their strategy to attract younger clients, or that demographic isn’t a priority. Regardless, advisers know that times are changing and creating an intergenerational strategy around existing clients is a great way to capture the next generation.

“In fact, there are some advisers whose yardstick for success is ensuring they capture all the family business – that means dealing with existing clients and their beneficiaries both individually, for their own needs, and collectively. This is hard work but pays dividends when it comes to building a business for the future.”