For 2025, we’ve asked Juliet Schooling Latter, research director of FundCalibre, to mix her usual three-year track record articles with updates on interesting funds and those topical in current markets. Here she focusses on the Artemis Global High Yield Bond fund.

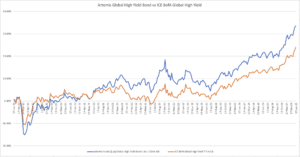

With returns in excess of 12%, there is no doubting the past 12 months have been strong for high yield bonds*, as they benefitted from both a high income and a capital boost from credit spreads tightening.

But with credit spreads now markedly below their 20-year average**, you can understand why investors may be uncertain as to how much more value they can garner from this segment of the fixed income market – especially when you can get attractive yields in lower-risk areas of the asset class.

“I believe you will have a market where there is a 95% chance our fund is going to give you a high single-digit return, and should the other 5% scenario occur – the losses would be small enough that they would not keep you awake at night. That’s why we believe our fund offers a compelling source of returns over the next 12 months.”

That’s the view of Jack Holmes who, alongside David Ennett, co-manages the Artemis Global High Yield Bond fund, a high-conviction portfolio of 60-100 names. The fund differentiates from its peers by investing slightly further down the high-yield spectrum – where they feel they can take advantage of greater market inefficiencies. Rather than invest in the 400 largest companies in the segment, they target the next 600. The team also avoid companies with ESG concerns.

Jack believes investors hold back from the high yield market in the hope they can jump in when spreads reach around 1,000 basis points (bps). The reality is that seldom occurs – with the average over 20 years well below 600bps (even this figure is distorted by marked jumps during the likes of the Global Financial Crisis – when spread approached 2,000bps)**. They are currently around the 300 mark***.

As a result of these tight spreads, the managers do not believe positioning for further tightening is the right thing to do. “I’m not saying don’t invest in high yield – far from it – but now is probably not the time for long-duration assets. You are taking on very little upside as spreads are unlikely to tighten significantly – even if we saw an incredibly bullish scenario in the next 12 months,” adds Jack.

The fund is very much positioned towards short-duration – with 93% of its holdings maturing in 5.5 years or less. This means it currently has a similar structure to the Short-Dated Global High Yield bond, also managed by the team.

Clearly not everyone agrees with this approach – some investors want long duration because it could be a once-in-a-lifetime opportunity to buy yields at these levels and bake in returns. But Jack makes a very strong case for the short-duration position.

Given the history of short-dated high yield spreads (1-5 year US BB-B credit spreads), the team says there is a strong chance the fund will produce a return in high single digits (where spreads remain unchanged or there is an early calls scenario). The only scenario where they believe the fund would lose money would be if spreads reached close to 900bps in the next 12 months. Spreads have been above this level only 5% of the time (17 months out of the last 321)****.

Even in that scenario losses would be small (less than 5%). Contrast that with global equities, which have historically delivered a loss of 30% in the 12 months in the run up to hitting that spread figure****.

CCC underweight and 400-1000 credit sweetspot

I mentioned the strong performance of high yield in 2024 – but this fund has actually outperformed despite being underweight CCC’s. This segment of the market flourished on the back of economic resilience in 2024, but the managers are still wary. “CCCs are very binary, if there is an economic downturn they will underperform spectacularly. There is a limit to how far they can go now,” adds Jack.

The team believe they get a significant edge by focusing outside the 400 largest issuers in the market – this is where the big ETF/passive players get involved, which often makes these issuers more duration sensitive. The managers believe the valuation difference is stark in medium/smaller issuers. While large issuers get 130-140bps over treasuries, they can get an extra 100bps for a company with a similar credit quality.

Examples include W&T Offshore, an oil & gas company which focuses on production in the US/Gulf of Mexico. Jack says they have strong structural forces driving production. He says: “It has 10.5% yield on a four-year bond, there are low production costs and a supportive environment with Trump in power.”

The fund can and does hold some of the larger players in the high yield space – although these tend to be either rising stars or fallen angels. A good example is Carnival Cruise Line, a company which was A- rated before Covid, before being downgraded to B-.

Jack says they spotted the opportunity a year ago. Not only is Carnival well positioned in this market, but they made developments which meant profitability was much higher than it was previously and the business has generated about $7.5bn in free cashflow in the past 18 months. All this has been used to pay off debt. Jack says the company is likely to be investment grade in the next 12 months due to some strong incentives.

He says: “Most shipping companies source their ships from South Korea, which has export financing – which is effectively a 25-year interest-free loan if you build a ship there.

“This is great financing, but South Korea restricts this to companies they believe have a strong balance sheet. Given the ships each cost about $2bn to build, Carnival is massively incentivised to get to investment grade.”

Jack says he is bullish on the economy, citing the strength of the US, which is 80% of the total high yield market. Clearly there are challenges around spreads, but he remains confident the fund has every chance of continuing to provide high single-digit returns, coupled with some alpha.

We like the unique approach behind this fund, with the managers taking advantage of the inefficiencies created by many of their peers focusing heavily on the larger players in the index. By contrast, their bottom-up approach of focusing further down the index has allowed them to consistently find hidden gems with a strong upside, helping them to outperform. High yield is clearly a riskier area of the market, but for the patient investor there will also be opportunities.

*Source: FE Analytics, total returns in pounds sterling for ICE BofA Global High Yield TR, 19 January 2024 to 21 January 2025

**Source: Janus Henderson, High yield bonds outlook: taking the scenic route in 2025

***Source: Artemis Fund Managers, at 22 January 2025

****Source: Artemis presentation, Bloomberg figures at 30 September 2024

Past performance is not a reliable guide to future returns. You may not get back the amount originally invested, and tax rules can change over time. Juliet’s views are her own and do not constitute financial advice.

Main image: john-schnobrich-FlPc9_VocJ4-unsplash