The Brand Financial Training team examine mortgages and what paraplanners need to know for a range of exams.

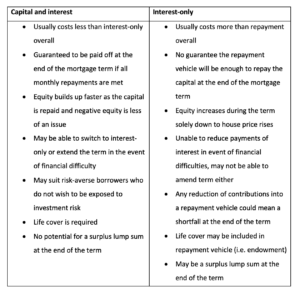

There are two main ways of repaying a mortgage – capital and interest and interest-only. Being able to identify the differences between the two and the correct type of life cover required is something that could be tested in a number of CII exams, including R01, R05, R06, R07, CF1, CF6 and AF5. In this blog, we take a look at both methods in detail.

Capital and interest mortgages

With a capital and interest mortgage, more commonly referred to as a repayment mortgage, each monthly repayment to the lender is made up of both a return of the lender’s capital (the amount borrowed) and an interest charge (the cost of borrowing).

Initially, the repayments are mostly made up of interest with only a small amount of capital being paid back. Over time, this balance changes. As the amount owed to the lender steadily decreases, less interest is payable; a larger amount of each repayment represents capital being paid back and a smaller amount of interest. Assuming the borrower keeps up repayments for the whole of their mortgage term, the debt will be repaid in full on their very last repayment.

Interest-only mortgages

As the name suggests, with an interest-only mortgage, each monthly repayment to the lender only includes the interest charge. The borrower needs to either earmark or establish a repayment vehicle to pay back the capital at the end of the mortgage term. The monthly repayments on an interest-only mortgage are therefore typically lower than for a repayment mortgage. But this is simply because there is no capital being repaid. The borrower is responsible for putting in place and maintaining a separate credible repayment plan to repay the capital. Typical examples of credible repayment plans incudes stocks and shares ISAs, pensions, investment bonds, endowments, shares and unit trusts.

Financial protection

With a repayment mortgage, the amount owed to the lender reduces over time. It is for this reason that a mortgage protection policy, a type of decreasing term assurance, is generally considered to be the most appropriate cover. At outset, the sum assured is equal to the amount borrowed. Over time, the sum assured falls in line with the outstanding debt. This makes the cover cheaper than a level term assurance.

One word of warning. The policy will be based on an assumed interest rate, for example, 6%. The borrower should ensure that the interest rate is either the same as or greater than the amount of interest they are being charged. This will ensure that the full amount outstanding will be paid in the event of their death within the term.

With an interest-only mortgage, the amount owed remains the same as the amount borrowed until the very last day of the mortgage term when it is repaid in full. A mortgage protection policy is therefore not appropriate. Instead, a level term assurance with a sum assured equal to the amount borrowed will be required.

Summary

If we compare the two methods we can see that:

Information in this article is correct as 27 January 2021.

This article was first published in the March 2021 issue of Professional Paraplanner