People aged between 51- 70 were found to be the most concerned about not saving enough for retirement and with the largest mismatch between what they had saved and what they intended to spend, according to a new Global Investor Study by Schroders.

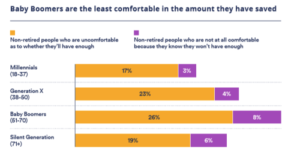

The 2019 Study found baby boomers were the least comfortable in the money they had saved, with 34% apprehensive about the amount they are putting aside, compared with 20% of millennials.

Overall, a quarter (24%) of respondents globally were nervous about the size of their retirement pot. Regionally, investors in Asia and Europe were found to be the most concerned, at 26% and 25% respectively, compared with 22% in the Americas.

Despite their misgivings, Schroders research also showed that on average, people expected to draw out 10.3% of their retirement savings each year and not run out of money, indicating a mismatch between people’s current retirement provisions and what they expect to spend in retirement. Meanwhile, a quarter of people thought they would take at least 15% a year, with those in India found to be the most confident about higher withdrawal levels.

Sangita Chawla, head of retirement savings, Schroders, said: “This disconnect is worrying and implies that people globally are not being realistic about the lifestyle they want to enjoy when retired. People are living increasingly longer in retirement and should be able to enjoy their lives after work, safe in the knowledge that their retirement savings will sustain them. However, this study suggests this may not be the case for many.

“It is imperative people start saving consistently and sufficiently as early as possible when working and, before retiring, do some serious thinking about the level of income they can afford to sustain throughout their well-eared retirements.”

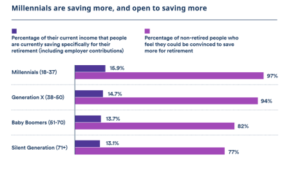

The research showed that investors in Asia were saving the most (15.9%), while those in the Americas were putting aside the least (14.5%), followed by Europe (14.9%). Despite being furthest from retirement, millennials were found to save the highest proportion of their annual income (15.9%), compared with generation X (14.7%), baby-boomers (13.7%) and those over the age of 71 (13.1%).

On the upside, almost all non-retired people globally (94%) said there were factors that would convince them to save more for retirement, with more than a third stating that more information explaining how much money they would need to achieve their desired lifestyle in retirement would help.