Dave Downie, technical manager at Standard Life, looks at three ways clients can maximise their pension saving ahead of tax year end

A pension is still one of the most tax efficient ways for clients to save for retirement.

Income tax relief on the way in, and the opportunity for tax-free cash on the way out, means that – pound for pound – pensions will usually provide a higher net income than most other investments, including an ISA.

It is, therefore, unsurprising that clients with the means to do so want to maximise their pension savings, and tax year end should focus minds to make the most of the incentives available.

With the cost of pension tax relief coming under close scrutiny it is prudent to ensure current reliefs and allowances are not wasted this year.

Here are three steps to help clients boost their retirement savings before this tax year end.

2. Make the most of tax relief

For individuals, tax relief will be limited to the higher of 100% of relevant UK earnings, or £3,600.

This year, for those employed in full or part time work, relevant UK earnings are gross earnings from the 6 April 2020 to the 5 April 2021. For the self-employed, earnings are their share of profits from the trading year ending in the tax year. Relevant earnings do not include dividends, interest or pensions in payment.

Some may find it difficult to accurately predict their earnings – particularly if making contributions early in a tax year. In these cases, it is sensible to show caution initially, then top up once an accurate figure is known.

Examples:

1. An employee with gross earnings in a tax year of £40,000 could make a gross contribution of £40,000 in the same year. Where the scheme gives ‘relief at source’, as with most personal pension schemes and SIPPs, this would actually cost them £32,000.

2. Similarly, an employee with gross earnings of £100,000 a year could make a gross contribution of £100,000 (if they had sufficient carry forward annual allowance) which, after relief at source, would cost them £80,000. Higher rate tax relief can be claimed through self-assessment – but only to the extent of their higher rate tax liability.

If they wanted higher rate relief on the whole £100,000 contribution, they could split it over two tax years. For example, they could pay £50,000 in 2020/21 and another £50,000 at the start of the 2021/22 tax year.

As a rule of thumb, to get higher rate relief on the whole contribution, you must ensure the client’s income less the gross amount of individual pension contributions made remains above their higher rate threshold. And make sure that they have sufficient unused allowance to carry forward (in both years if splitting the payment over two years).

2. Stay within the annual allowance

Paying an amount eligible for tax relief is less effective if some of that tax relief is clawed back by the annual allowance tax charge. To avoid this, clients should also stay within their annual allowance, including any annual allowance carried forward from previous years.

To work this out, unused allowances must be used up in a specific order. The current year’s annual allowance must be filled first, then the unused allowances from the three preceding years can be brought forward, starting with the earliest year.

Current year – 2020/21

The annual allowance will be reduced to £4,000 if the Money Purchase Annual Allowance (MPAA) has been triggered since the 6 April 2015. This can happen for several reasons, including when clients have taken income under flexi-access drawdown or have taken benefits under the Uncrystallised Funds Pension Lump Sum rules (UFPLS).

Before recommending further pension funding, you should check that your client has not done anything to trigger the MPAA. It is also important to note that if they are subject to the MPAA, a client cannot use carry forward to pay more than £4,000 to a money purchase pension.

The allowance could be tapered down for high earners with income over £240,000 in the tax year (for these purposes, income is ‘adjusted income’ and includes the value of employer contributions). The allowance is reduced by £1 for every £2 of income over £240,000 until it reaches £4,000. But the full £40,000 allowance could be reinstated if the client can make a personal contribution large enough so that their income (ignoring employer contributions) minus the personal contribution is £200,000 or below.

After establishing the total allowance for the year, take off the contributions already made (including those due to be made) in the tax year by both employers and individuals.

Carry forward years – 2017/18, 2018/19 and 2019/20

The standard allowance for these years was £40,000 although it could be affected by annual allowance tapering for high earners. But, for these years, the thresholds for tapering were lower – tapering applied where ‘adjusted income’ was over £150,000 and ‘threshold income’ also exceeded £110,000. Tapering stopped once the annual allowance reduced to £10,000.

If the annual allowance was exceeded in any of these years, you will need to check for previous carry forward exercises to see if these used any allowances from the preceding three years, reducing the amount available in this year for carry forward.

Example:

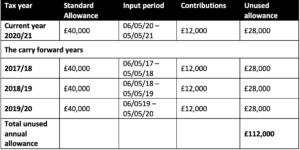

Kirsten and her employer have each paid £500 a month into her SIPP for a number of years.

Kirsten has received an inheritance and wishes to pay part of this into her pension. She is not subject to the MPAA, and her salary is £80,000. The following shows her unused annual allowances, in the order they must be used.

Kirsten’s unused allowances total £112,000 (£28,000 left for £2020/21 plus £84,000 carried forward from the previous three tax years).

But her relevant earnings are only £80,000. So, her personal contribution is limited to this. She has already paid in £6,000, so she can make an additional personal contribution of £74,000.

This would use up all of her remaining 2020/21 allowance (£28,000), all of her 2017/18 allowance (£28,000), and £18,000 of her 2018/19 allowance.

Her unused allowances to carry forward to 2021/22 are therefore £38,000 (£10,000 from 2018/19 and £28,000 from 2019/20).

DB schemes

For defined benefit schemes, the amount that counts towards the pension input period isn’t the amount actually paid in – it’s based on the value of the increase in the benefits accrued over the tax year.

The input amount is calculated by subtracting the opening value of the benefits from the closing value. These values are calculated as:

• Opening value – the pension benefits at the start of the tax year are capitalised by multiplying the accrued pension by 16. If the scheme provides a separate lump sum in addition to the pension, the accrued lump sum is added to this value (this is typically seen in older public sector schemes). This total value is then allowed to be increased by the annual percentage CPI from September of the previous year. If the CPI figure is negative, the total remains the same, it does not decrease.

• Closing value – this is the increased pension amount at the end of the input period multiplied by 16. Add in the increased amount of any separate lump sum.

Subtract the opening value from the closing value and any positive result is the pension input amount for the tax year.

Example

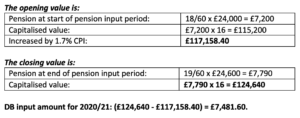

Tim is a member his employer’s DB scheme. At the start of the input period (06/04/2020) he had exactly 18 years’ service. His pensionable salary was £24,000. By the end of the input period (05/04/2021), he will have accrued an additional year of service and his pensionable salary has increased to £24,600.

The scheme accrual rate for pension is 1/60th of pensionable salary.

The CPI percentage from September 2019 was 1.7%.