Sponsored article

Lifetime allowance tax charge – stay in or opt out? Royal London’s Intermediary Development and Technical Manager, Fiona Hanrahan explains.

The calculations and considerations

If an individual is facing a likely lifetime allowance (LTA) tax charge and leaving the scheme or stopping contributions is a possibility, the adviser will need to demonstrate whether the individual will derive greater benefit from remaining in the scheme and therefore likely paying a tax charge or a greater benefit from opting out of the scheme and potentially not paying the tax charge.

It is crucial calculations are done to ensure any advice given is sound and to ensure the client knows what to expect and agrees on a course of action on a fully informed basis.

The following case study will help in the situation where a client is close to the current LTA limit of £1,073,100 and is faced with the options to either remain in the scheme or opt out.

Meet Linda

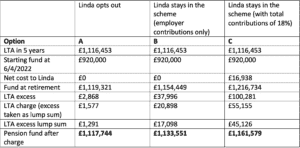

She lives in England, is a higher rate taxpayer aged 55 with a pensionable salary of £80,000. Over and above salary, Linda receives a performance related bonus each year, the first 50% of which is also pensionable. These bonuses have averaged £20,000 per year over the last 5 years. Linda plans to retire when she is 60 and is considering whether to opt out of her employer’s scheme. Her employer currently pays 6% contributions as standard and employer contributions are matched on a one-for-one basis to a maximum of an additional 6%. Her current fund value is £920,000.

Her options are to opt out of the scheme altogether, stay in the scheme with employer contributions of 6% or stay in the scheme with the combined employer and employee contributions of 18%. Her employer does not offer any alternative benefits or additional pay if she were to opt out of the pension scheme.

In the calculations the adviser has assumed the LTA increases start again from 2026/27 and CPI will be 2%. The investment growth assumption is 4% each year after charges and Linda’s pensionable salary is assumed to increase by 2.5% each year and her bonuses remain unchanged.

Linda’s adviser explains to her each of her options incurs a tax charge on retirement at age 60 based on the stated assumptions. Option C though produces a higher pension fund net of the LTA charge even taking into account the net cost of the contributions to Linda.

Her adviser explains based on the assumptions they’ve agreed about likely pay rises and investment fund growth, the potential benefits from remaining in the scheme and continuing to pay personal contributions therefore outweigh her costs even after the LTA charge. This position should be regularly reviewed though in case her situation changes or any of the assumptions need to change.

For now though, the adviser therefore recommends Linda remains in her scheme and continues to pay personal contributions of 6% each year.

Taking it further?

This case study looked at the position of someone close to the LTA on the run up to retirement. It could also be possible the client has an annual allowance (AA) tax charge in addition to a potential LTA charge. Our policy paper has many more examples including DB, those with AA and LTA tax charges as well as some public sector specific examples. Please look at this for further information.