Governance reform and strategic policy set the stage for another strong year for Japan, say the Amova Asset Management Japan Equity Team.

This time last year, we expected 2025 to be the year when Japanese companies would take decisive strategic steps to attract greater global investment. That view has broadly played out. Market conditions have remained constructive despite concerns about the potential impact of proposed US trade measures on Japan and the wider global economy. Indeed, the combination of positive progress in US-Japan negotiations, continued resilience in the US economy (albeit focused primarily on a small number of technology companies), and the resultant powerful upswing in artificial intelligence (AI)-related investment helped support Japanese equities. As a result, the market has delivered strong gains, with the broad market TOPIX Index rising by more than 18% year to date as of 21 November 2025.

Political developments have also helped shape investor sentiment. The unexpected formation of the Takaichi administration in October 2025, combined with strong early approval ratings for the new coalition government, has contributed to a more confident domestic outlook. Against this backdrop, we believe 2026 will be another year of growth for the Japanese stock market, with conditions in place for companies to continue building on the progress made in recent years.

Stronger ties between the US and Japan

The White House meeting between US President Donald Trump and Japan’s then-Prime Minister Shigeru Ishiba in February 2025 confirmed the strength of the US-Japan relationship. Even after tariff tensions escalated, the US-Japan alliance reassured markets, particularly as both countries committed to closer cooperation in economic security and joint development within the defence industry. These strategic ties are expected to strengthen further under Prime Minister Sanae Takaichi, continuing to anchor investor confidence in Japanese companies.

Economic growth driven by the new Takaichi administration

The formation of the Takaichi administration in October also marked a decisive shift in Japan’s political and economic trajectory. The new coalition government, under Japan’s first female prime minister, has signalled a willingness to use spending measures to stimulate domestic demand and indicated that it is focused on strengthening the supply side by formulating measures to promote public-private investments in 17 strategic areas (Table 1).

These policies are complemented by the coalition with the reform-minded Ishin party (Japan Innovation Party), which has pushed for regulatory easing and a more ambitious set of reforms aimed at younger generations. Together, these factors have helped shape expectations for stable and purposeful governance.

The administration has also emphasised close coordination with the Bank of Japan (BOJ). The central bank has already reduced an element of uncertainty by clarifying its long-term approach to unwinding its exchange-traded fund (ETF) holdings, allowing markets to focus more on fundamentals. While monetary policy is expected to remain on a normalisation path, both fiscal and monetary authorities appear aligned in supporting sustainable economic growth.

Policy tools should help restrain yen depreciation

The outlook for the yen has also become more balanced. Policymakers have acknowledged that excessive depreciation would raise import costs and place renewed pressure on inflation. As a result, there is an expectation that policy tools may be used to avoid any further sharp decline in the yen. This reduces the likelihood of extreme currency moves and provides a more predictable backdrop for corporates and investors alike.

Upcoming Corporate Governance Code revisions

Momentum behind Japan’s governance reforms is set to accelerate again in 2026. Formal discussions on the next revision of the Corporate Governance Code began at the Financial Services Agency on 21 October 2025, signalling a fresh phase in Japan’s long-running effort to improve capital efficiency and raise corporate value. As previous revisions were implemented in June 2015, 2018, and 2021, a June 2026 announcement appears highly likely. If that timeline is repeated, governance reform could become a central investment theme in the first half of 2026.

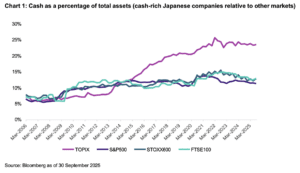

One of the areas under particular scrutiny is the use and the disclosure of cash holdings. Japan still has a significant number of cash-rich companies, and policymakers are increasingly encouraging boards to deploy capital in ways that create shareholder value. This could potentially lead to a rise in the number of corporate actions, including higher shareholder distributions, capital expenditure or restructuring. These developments should support share prices, particularly for companies where large cash balances have historically weighed on valuations.

As governance standards continue to tighten, pressure on firms with persistent surplus cash is likely to increase. This raises the prospect of unlocking value in companies previously regarded as trapped in low-valuation ranges despite having solid fundamentals.

More active environment for shareholder engagement

Regulatory changes to large-shareholder reporting add another important dimension to Japan’s governance landscape. In August 2025, the Financial Services Agency published new guidance titled “Laws, Regulations, and Q&As Regarding the ‘Act of Material Proposal’ and ‘Joint Holders’ Under the Large Shareholding Reporting Rule”. The document promotes constructive dialogue between institutional investors and the companies they own by clarifying which investor actions count as “material proposals”, and therefore when firms are required to accelerate their large-shareholding disclosures.

This greater clarity is significant for large asset managers that run both active and passive strategies. By reducing uncertainty about when a material proposal is triggered, managers can engage more confidently with investee companies without undue concern over regulatory interpretation or potential conflicts. The change, scheduled to take effect on 1 May 2026, is expected to strengthen stewardship activity, support healthier governance practices and reinforce the long-term attractiveness of the Japanese equity market.

Shareholder activism and deepening of the M&A market

Shareholder activism has become a defining feature of Japan’s equity market as corporate governance reforms have taken hold. Over the past decade, a growing number of domestic and international investors have pushed companies to improve capital efficiency and make fuller use of their balance sheets. This pressure is likely to intensify in 2026, particularly as the planned revision of the Corporate Governance Code strengthens expectations for more effective deployment of cash.

At the same time, Japan’s market for corporate control is undergoing a structural shift. METI’s 2023 merger and acquisition (M&A) guidelines have made unsolicited approaches more acceptable within a clear governance framework. This has opened the door to a broadening range of takeover tactics and encouraged companies to consider M&A as a more central strategic tool. As a result, competition for corporate control has been steadily increasing.

The Yageo–Shibaura Electronics transaction in 2025 illustrates how far the landscape has evolved. Yageo, the Taiwanese electronic component manufacturer and a major supplier for Apple, launched a tender offer to acquire Shibaura Electronics, a company known for its competitive sensor and measurement technologies. Although the approach was, in effect, a hostile bid by a foreign buyer, the Japanese government ultimately allowed it to proceed. Yageo announced on 3 October 2025, the day before the Liberal Democratic Party (LDP) leadership election, that it had secured enough shares to take control. The timing meant the deal received less media attention than it might otherwise have attracted, but it is likely to be remembered as a watershed moment for Japan’s corporate governance and its approach to foreign-led acquisitions.

The case also highlights the increasingly active environment emerging since the 2023 guidelines were introduced. Several unsolicited bids have been launched, and while not all have been successful, many have prompted strategic responses that ultimately will benefit shareholders. In some instances, initial hostile bids triggered higher counteroffers from “white knights”, resulting in more competitive pricing and improved outcomes for existing investors. In others, companies responded with governance or strategic changes to strengthen their position and raise corporate value.

Taken together, these developments suggest that activism and M&A will remain important themes throughout 2026. The combination of governance reform, a clearer regulatory framework and rising competition for corporate control is creating new avenues for value to be realised across the Japanese equity market.

Summary

Japan enters 2026 with a stronger economic and market backdrop than many expected a year ago. The Takaichi administration has helped create a more confident domestic environment through steady fiscal support, regulatory reform and alignment with the BOJ. The combination of supportive policy, clearer governance standards and a more dynamic market for corporate control provides a strong foundation for continued corporate reform and long-term growth. New rules on large-shareholder reporting should also support more effective engagement between institutional investors and companies, strengthening stewardship and governance practices.

Shareholder activism and M&A activity should also continue as Japan’s corporate landscape evolves. The impact of updated M&A guidelines and a more open stance towards unsolicited bids should create more catalysts for value, whether through successful acquisitions or higher competing offers. Taken together, these developments provide a positive backdrop for the Nikkei and suggest 2026 will be another constructive year for Japanese equities.

Important information

This information should not be relied upon by retail clients or investment professionals. Any reference to a particular security is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security.

Main image: manuel-cosentino-n-CMLApjfI-unsplash