UK power utilities are often seen as dependable, bond-like – maybe even boring. Does this under-estimate their growth potential? Rathbone Income Fund manager Alan Dobbie notes they’re embarking on a big expansion to clean up the grid.

The UK grid expansion: a growth bonanza?

Utility stocks are well known as important building blocks for income-generating portfolios, but did you realise some are now growth opportunities? Wild, I know.

Whether it’s electricity, gas or water, you’ll know the key attraction of these businesses lies in their relatively predictable demand and supply, often inflation-linked revenues and gently rising profits and dividends. These stable characteristics also mean that utilities typically tolerate very high debt levels – juicing lacklustre asset returns into something much more appealing to equity investors. It’s also the only way to raise the huge sums required to build and maintain such critical infrastructure.

While this rarely causes problems, when it does, the consequences can be severe. Thames Water is a cautionary tale. It demonstrated how combining excessive leverage with mismanagement can turn a dull, dependable, dividend generator into a high-risk investment. However, in this article I’d prefer to touch on something mentioned much less frequently when it comes to utility stocks – exciting growth! Because I believe excitement in the utilities space isn’t always of the negative variety.

The UK’s target to be net zero by 2050, enshrined in law since 2019, touches almost all aspects of the economy. It requires a huge, co-ordinated effort from government, industry and people. For understandable reasons many column inches focus on the changes that individuals can make – switching to an electric car, installing a heat pump or cutting down on air travel or red meat. However, critically, much of the heavy lifting must be done by further decarbonising our power system.

The new government is well aware of this opportunity and challenge. So much so that “making Britain a clean energy superpower” and having “a national mission for clean power by 2030” are high up its list of key objectives. In the recent Budget, Chancellor Rachel Reeves announced significant investments in green hydrogen and carbon capture and storage, as well as promising to fund the newly formed public energy company, GB Energy, with over £8 billion over the current five-year Parliament.

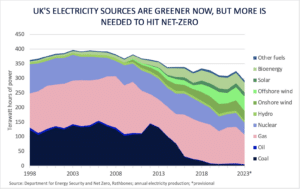

Actions like these further bolster the most visible aspect of decarbonising the power system: the massive shift needed in the electricity generation mix. While huge strides have already been made – emissions are down 65% since 2010 – more must be done. In 2023, clean energy sources such as renewables and nuclear provided for just under two-thirds of electricity demand. Shifting the mix to almost 100% clean power in just five years is a colossal challenge, given it is likely to require the doubling of onshore wind, the tripling of solar power and the quadrupling of offshore wind capacity.

While the challenge is real, and there’s often scepticism about whether it can be met, the latest report from the National Energy System Operator (in its role as strategic adviser to the Government and Ofgem) highlights how clean power by 2030 can be achieved if we adopt a “once in a generation shift in approach and in the pace of delivery”.

How to play it

From an investment point of view, while the five-year growth outlook for renewable generation is quite astonishing, picking winners among the direct renewables operators and their suppliers comes with its own challenges – especially for income-focused investors. Thankfully, the opportunity can also be grasped in a lower-risk way by taking a ‘picks ‘n’ shovels’ approach to the latest renewables goldrush.

A key bottleneck in the country’s clean power by 2030 ambition is the state of our electricity grid. This motorway-like network of overhead and underground high-voltage cables was originally designed to carry power from relatively few, large coal-fired power stations to Britain’s key industrial centres. Making the same grid work for a fragmented scattering of largely offshore windfarms means fundamental change. To reach clean power by 2030 will require the deployment of an estimated 2,700 miles of offshore and 620 miles of onshore cables. At the same time, rapid electrification of heating and transport and an expected surge in demand from power-hungry datacentres linked to the AI boom are putting ever more strain on an already creaking system.

Thankfully, a once-in-a-generation upgrade programme to our electricity transmission networks is already under way with GB grid owners National Grid, SSE and Iberdrola expected to invest £60bn in network upgrade works over the next five years.

For most companies, big investment requirements have investors running for the hills. However, in the world of regulated utilities, where monopoly providers earn a (largely) pre-agreed return on any new capital investments, this £60bn uplift represents a growth bonanza.

As a result, National Grid, which owns much of the GB grid, expects to grow its assets by 10% over the next five years. To help finance this expected growth, it recently issued £7bn of new equity, putting to bed some market concerns regarding its balance sheet. That leaves the company offering defensive returns, a reasonable balance sheet and attractive growth. Throw in an expected 4.7% dividend yield that’s set to grow in line with inflation, and the company now ticks a lot of boxes for income-focused investors. Of course, share price risks remain, most notably the threat that rising bond yields impact on valuations across the wider utilities sector. However, on balance, we think the future looks bright for this unusually growthy utility stock.

Main image: mike-kononov-lFv0V3_2H6s-unsplash