When formulating an income protection recommendation, there are many different factors for paraplanners to consider, says Adam Higgs, head of Research at Protection Guru, not least in respect of deferred period calculations.

When formulating an income protection recommendation, there are many different factors that need to be considered. The clients’ monthly expenditure will likely help you understand the sum assured required whilst their likely retirement age might be a good indicator of the term required.

When it comes the deferred period, the clients’ sick pay scheme (if employed) will provide a good guide. For private company workers this will usually be fairly simple with the only complication being if the employer offers a tiered approach. In this scenario the employer might offer sick pay of 100% of salary for one month followed by another month of 50% salary after which they cease paying the client. In this scenario a paraplanner might recommend a one and two month split deferred period arrangement.

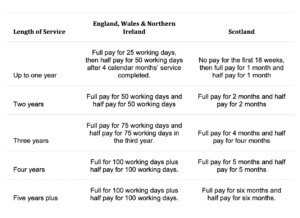

When setting out an income protection recommendation for a teacher however, things can become more complicated. Their sick pay is not only tiered, but also dependent on their length of service as the table below highlighting public sector teachers’ sick pay shows.

As can be seen, to select the right deferred period a paraplanner would need to consider various factors in terms of length of service and where in the UK they work (or what handbook their school adheres to). If they work in England, Wales or Northern Ireland their sick pay is actually calculated in days rather than weeks or months making things even more complicated.

Where the client has been working at the school for over five years and is unlikely to move, calculating the deferred period might be slightly easier. Where they are relatively new to their school or thinking of moving schools, this will be far more difficult as their sick pay will change.

Currently only LV= and Vitality provide the ability to automatically match the teachers’ sick pay scheme. Under their income protection plans if a paraplanner were to select a 12-month deferred period and notify the insurer that the client is a teacher, they will automatically apply the correct split deferred period to the plan at point of claim to match their level of sick pay.

This can provide far more comfort to the client that in the event of them needing to claim they will not face a period without income.

More income protection articles can be found on the Protection Guru website.