Hargreaves Lansdowne ran their Sustainable Investor Survey in December 2025 and received 1722 responses. Dominic Rowles – Head of ESG explores the findings, noting that investor attitudes to defence are shifting however, stark gender and generational gaps show the shift is far from universal.

When Hargreaves Lansdowne (HL) ran its first Sustainable Investor Survey in 2022, defence was a red line for many investors, with nearly half ruling out firearms entirely.

Three years on, attitudes have shifted. In our latest survey (December 2025), just 27% now want to exclude firearms, and discomfort with military contracting has fallen by 10%.

When we dig deeper though, we find it’s not a uniform shift. 48% of women still reject firearms, compared with just 19% of men – the largest gender gap of any issue in our survey. Similarly, a third of women avoid military contracting, versus only 13% of men.

There are stark generational divides too, with around a quarter of respondents aged 18-29 reporting discomfort with military contracting, compared with just 11% of those in the 80+ bracket.

What is causing the shift?

The world is an increasingly uncertain place. The war in Ukraine continues, tensions in the Middle East persist, and security concerns are rising across Europe.

At the same time, US President Donald Trump has suggested that Europe may not be able to rely on American military support if Russian President Vladimir Putin invades the Baltic states, which are NATO members.

European countries have increased their defence spending significantly in recent years. European defence spending reached €380bn in 2025, a rise of over 60% since 2020. Countries like Estonia and Latvia, which sit on the Russian border, have committed to spending as much as 5% of GDP on defence.

In the UK, defence spending will increase from 2.3% to 2.5% of GDP by 2027, with an ambition to reach 3.5% by 2035, though there is growing pressure for military investment to rise even further.

Bigger budgets mean stronger order books, clearer revenue visibility and, in many cases, standout share price performance. Investors who excluded defence have missed significant gains – prompting some to reconsider the sector’s place in a portfolio.

Why investing in defence isn’t right for everyone

Many investors continue to have deep ethical concerns about the defence industry.

The weapons it produces are designed for combat and can result in devastating consequences. They have the potential to kill and injure both military personnel and civilians.

These weapons can also cause extensive destruction to infrastructure, crippling essential services and facilities. The impact on local communities can be profound, often resulting in displacement and long-term social and economic disruption.

Some would also argue regimes that violate human rights and commit alleged war crimes are supported by some defence companies.

For example, it’s been alleged that BAE Systems, the UK’s largest defence contractor, has had trading relationships with 13 countries on the UK’s human rights watchlist. BAE Systems is unable to confirm who it trades with, but says it’s committed to upholding ethical standards.

Fund ideas

Whether a client wants to invest in defence, or avoid the area entirely, there are funds on the Wealth Shortlist that will meet their personal preferences.

Here are two fund ideas – one that will never invest in defence, and one that does.

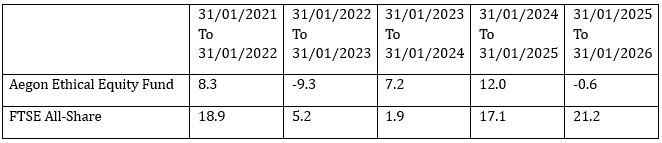

Want to avoid defence stocks? Aegon Ethical Equity

Audrey Ryan has managed the Aegon Ethical Equity fund for over 27 years. She aims to identify and understand the key environmental, social and governance risks of each company, industry and sector she invests in.

She believes companies that lead the way in governance and sustainability tend to outperform over the long run.

The fund uses a strict exclusions-based approach. It won’t invest in companies that generate significant revenues from activities deemed unethical, including tobacco, alcohol and gambling.

Companies that manufacture military armaments, nuclear weapons, or associated strategic products, are also excluded, as well as those producing civilian firearms. The fund also won’t invest in companies that operate in countries with poor human rights records if they don’t have solid policies to address this issue.

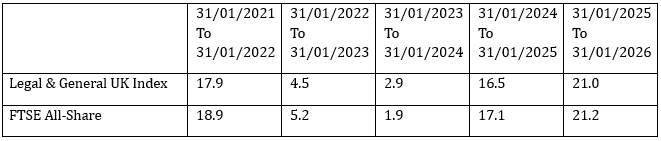

Want to invest in defence stocks? Legal & General UK Index

The Legal & General UK Index provides investors with broad exposure to the UK stock market. It tracks the FTSE All-Share Index, investing in around 550 of the UK’s largest companies, including household names such as AstraZeneca, BP and Barclays.

No sector is off limits for this fund – it invests in a variety of areas some may find controversial, including tobacco, alcohol and gambling.

The fund also invests in defence companies such as Rolls Royce, which makes engines and other components for a range of military aircraft, naval vessels and defence systems, alongside its well-known civil aerospace operations.

Defence currently accounts for 5.9% of the fund. Investors should note that as this is a tracker fund, exposure to defence companies is determined by each company’s weight in the index, so will rise and fall over time.

Past performance is not a reliable guide to future returns. You may not get back the amount originally invested, and tax rules can change over time. The writer’s views are their own and do not constitute financial advice.

This information should not be relied upon by retail clients or investment professionals. Reference to any particular investment does not constitute a recommendation to buy or sell the investment.

Main image: kelly-sikkema–1_RZL8BGBM-unsplash