Inheritance tax receipts continue to rise, prompting warnings that more people will likely be affected over the coming years as the freezing of IHT thresholds takes its toll.

Data from HM Revenue & Customs showed inheritance tax receipts for April 2021 to February 2022 were £5.5 billion, up £0.7 billion on the same period of the previous year.

Helen Morrissey, senior pensions and retirement analyst at Hargreaves Lansdown, warned that the figure could rise to as much as £6 billion by the end of the tax year.

Morrissey said: “This is largely because of an increased number of wealth transfers throughout the year. While we hope the number of transfers will drop as the pandemic claims fewer lives, we will still see more estates become liable over the coming years as the freezing of inheritance tax thresholds continues to bite.”

Shaun Moore, tax and financial planning expert at Quilter, commented: “These ever-increasing figures demonstrate that the government is gradually increasing tax revenues without significantly increasing the burden on taxpayers. However, IHT was once viewed as a tax on wealthier individuals but due to runaway house prices more people are getting caught by the tax and many people who would not consider themselves wealthy will now face a hefty IHT bill.

“This is well reflected in the fact that London and the Southeast have the most amount of estates paying IHT, which is due to the above average house prices in the region.”

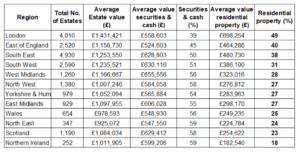

In London, 4,010 estates were subject to inheritance tax, with the average estate valued at £1.43 million. In contrast, just 347 in the North East were affected, with an average estate value of £925,072.

While the increase in house-prices may cool soon due to the onslaught of financial concerns facing the UK, including inflation, energy prices and the Russia-Ukraine war, Moore says it is unlikely to have a significant impact for some time.

Moore added: “The government is stuck between a rock and a hard place at the moment as it continues to have to cope with the significant debt it took on to cope with the pandemic but also now has the unenviable job of needing to help alleviate a cost-of-living crisis. Clawing back inheritance tax might seem like a good opportunity to refill the public coffers at this difficult time.”

Stephen Lowe, group communications director at Just Group, said: “Across the country, IHT is paid on about one in 25 estates but the numbers of estates paying the tax is higher where home prices are higher, most obviously in London and the South East. Property can be tricky when it comes to estate planning because it is providing a place to live and is often a sentimental as much as a financial asset. It is also illiquid in the sense you can’t trade or gift part of a property as easily as cash or other investments.

“Our recent FOI request found that although the average value of estates liable for inheritance tax in 2018-19 doesn’t vary much by region, the components of those estates is very different. In areas such as London and the East of England property is a much bigger proportion of the estate and relatively low amounts of cash and securities are left compared to other areas which may require a very different approach to estate planning.”