Fidelity has launched a Luxembourg-domiciled (SICAV) Sustainable Reduced Carbon Bond Fund.

The fund, managed by Kris Atkinson, with Sajiv Vaid supporting as co-portfolio manager, aims to build a global corporate bond portfolio with genuine impact on reducing emissions. The fund limits the exposure to companies with the highest carbon emissions intensity and largest carbon reserves. Through an active engagement approach, the portfolio manager looks to identify companies transitioning towards a greener environment.

Atkinson, says climate change represents a huge threat but also opportunity for investors and companies globally.

“Some green investing is black and white, only considering companies with low or zero emissions. It isn’t. To tackle the threat of climate change as investors we need to embrace companies transitioning to greener business models, not exclude them. By actively engaging with companies we can reduce emissions, influence their decarbonisation strategies and move to a more sustainable future.”

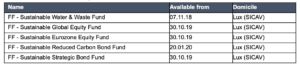

The fund forms part of Fidelity’s ‘Sustainable Family’ funds range, which consists of five products; two sustainable thematic funds focusing on carbon reduction and water and waste as well as three best-in-class equity and fixed income funds.

Atkinson joined Fidelity in 2000 as a research associate and becme a fund manager in 2013. Vaid joined Fielity in 2015 and is a fund manager in the asset manager’s fixed income team.

Fidelity Sustainable fund range