It pays to be dogmatic about ensuring portfolios are diversified, but pragmatic about how it’s done, says Anthony Rayner Fund Manager, Premier Miton Macro Thematic Multi Asset Team.

At a simple level, diversification is about ensuring enough elements in the portfolio behave in different enough ways across most probable scenarios. In practice, of course, most portfolios need to make positive returns over time too, so there shouldn’t be so much diversification that any return potential is too constrained, this is sometimes referred to as “diworsification”. It goes without saying that there is an important balance to strike here: not taking enough risk can be as harmful as taking too much risk.

In truth, diversification really comes into its own during risk-off events, where enough capital needs to be protected to enable a decent recovery for the inevitable bounce back in markets. In most multi asset portfolios, equity risk will tend to be the dominant risk, and so often it is about ensuring enough of the portfolio is diversifying equity risk.

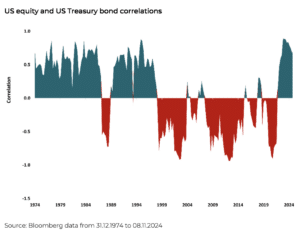

We think it’s very important to be pragmatic in all areas of investment management but particularly so when looking at diversifiers. For example, many investors believe that developed government bonds are always the best diversifiers of equities. However, this is simply not the case. As the graph below shows, over 50 years, there are indeed extended periods when US government bonds do diversify US equities very efficiently (red shading) but, for a roughly equal amount of time, they are actually positively correlated with US equities (green shading).

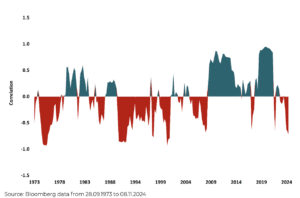

However, all is not lost, there are other diversifiers out there, for those that are prepared to look. The second graph shows that in most of the periods where bonds are positively correlated to equities, commodities act as good diversifiers of equity.

US equity and commodity correlations

There are many good reasons for the changing dynamic as to what best diversifies equities but, digging into the data, one of the main drivers is inflation. When inflation is not a key risk, as in most of the last three decades, central banks can cut rates in the event of an equity market correction, to mitigate the impact on the wider economy, and this benefits bonds as equities correct, hence their diversifying power in that period.

However, the disinflationary period of the last 30 years is not typical. Normally, or during the 20th century at least, economic history is characterised by inflation. In this environment, often inflation is either the key risk or an important background risk, so central banks can’t afford to cut rates during an equity market correction, doubly so if inflation is the cause of the correction (which it often has been).

So, whilst bonds do not act as diversifiers to equities in periods of inflation, other asset classes do. The second chart shows how, during inflationary periods, commodities come into their own and help diversify equity risk. That makes intuitive sense, as oil is often a driver of an inflationary episode and gold is often a good safe haven in inflationary times.

We’re not saying that it will always be either commodities or bonds and we’re not even saying we will know what will best diversify equity. We are saying, though, that we should expect diversifiers to change as the environment changes. Being pragmatic and looking at the real world, and what is going on in the here and now is crucial.

This approach informs how we are structuring portfolios currently. We believe that, whilst inflation has fallen sharply, for many structural reasons it will likely reaccelerate in the medium term to levels that are uncomfortable for central banks. Reasons include deglobalisation (for example trade wars and tariffs), resource prices (as investment in supply has recently been subdued in many areas) and a lack of fiscal discipline, as governments become increasingly populist, with government debt burdens already historically high.

As a result, we have some bonds in the portfolios that are generally fairly short duration, which provides some income, but also dilute volatility, but we also have some commodities, such as gold, as a diversifier. Within equities we are also pretty diversified away from the key concentration risk of big tech, where we have limited exposure. As visibility improves around the inflation picture, so we will adjust portfolios to ensure they are best diversified, whatever that means in practice.

Main image: eran-menashri-zfVIh4cX_4c-unsplash