Professional Paraplanner’s TDQ (Training, Development and Qualifications) series, is run in conjunction with key support providers, such as Brand Financial Training, and aims to test your knowledge of the financial services market, as part of your overall training goals and exam techniques.

The following questions, which can also be found in our May 2022 issue, relate to examinable Tax year 20/21, examinable by the CII until 31 August 2022.

QUESTIONS

1. GlenMcFarrars Advisers are moving offices. When should they notify the FCA of their address change?

A. Should inform the FCA immediately

B. No requirement to inform the FCA

C. Within 6 months of the address change

D. In advance of the change in address

2. Jenna’s portfolio was valued at £30,000 at the start of the year. £3,000 was withdrawn after six months. At the end of the year, the portfolio was valued at £34,000. Jenna’s adviser is calculating the rate of return. It is true to say that: Tick all that apply.

A. Jenna’s adviser is measuring the performance of the portfolio.

B. Jenna’s adviser is evaluating the performance of the portfolio.

C. the money-weighted rate of return for Jenna’s portfolio is 3.17%.

D. the money-weighted rate of return for Jenna’s portfolio is 24.56%.

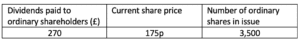

3. Brightline’s accounts show the following:

What is the dividend yield?

A. 1.54%

B. 13.5%

C. 22.6%

D. 4.41%

4. A personal independence payment (PIP) comprises of?

A. A care component and a mobility component

B. A mobility component only

C. A daily living component and a mobility component

D. A daily living component only

5. Earnings per share (EPS) is a valuable investment valuation ratio – which of the following can we say are true?

A. It is calculated as profits available to ordinary shareholders divided by the number of ordinary shares in issue.

B. It is calculated as the current share price divided by the projected earnings per share.

C. EPS is a measure of the profitability of a company expressed in an amount per share.

D. EPS measures how highly investors value a company in its ability to grow dividend yields and share price.

6. Boris took out a long-term care bond some years ago. How are any 5% ‘income’ withdrawals under the bond taxed?

A. They will all be tax free

B. The same as a normal investment bond but with no top slicing relief

C. They can be made without an immediate tax liability

D. They will be subject to Capital Gains Tax

7. What are the main factors that have been the cause of annuity rates falling in recent years?

A. Inflation and global financial crisis

B. Demise of final salary pension schemes

C. Interest rates and trends in life expectancy

D. Rate of interest on long term gilts only

8. For the first time, Julian is drawing up the accounts for his buy-to-let properties having decided that it was not worth paying an accountant to do so as he feels he is quite capable of doing them himself. He should be aware that HMRC require these records to be kept for at least:

A. 12 months.

B. 3 years.

C. 5 years.

D. 6 years.

9. Gordon has decided to save for his retirement using a Self-invested personal pension (SIPP). His adviser should make him aware that: Tick all that apply.

A. loans to an employer cannot exceed 50% of scheme assets.

B. assets such as wines and antiques could give rise to tax charges.

C. the SIPP could be used to buy a commercial property from a “connected person”.

D. loans to an employer are permitted.

10. How does Jane receive basic rate tax relief on her individual personal pension contribution?

A. She must claim the tax relief back via self-assessment.

B. She receives basic rate tax relief at source.

C. She makes a gross payment and tax relief is deducted from her total income.

D. She is only entitled to tax relief if payments are made via her employer’s payroll.