When markets are volatile, knowing how to construct long-term cash flow models can be incredibly important in re-assuring clients, says Steph Willcox, Head Actuary, Dynamic Planner.

Periods of market volatility are nothing new. Whether it’s triggered by geopolitical tensions, inflation spikes, or abrupt changes in central bank policy, the markets will always have moments of turbulence. For financial advisers and paraplanners, these are the times when clients need reassurance the most. Understandably, clients worry about their portfolios, their future plans, and whether they’re still on track for retirement, for helping their children, or for that big life event they’ve been working toward.

In these moments, there can be a strong temptation—for both paraplanners and clients—to react to short-term fluctuations by frequently updating financial plans and cash flow projections. At face value, this might feel prudent: reacting quickly to new information. But as we know from the fundamentals of behavioural finance, reacting emotionally to short-term market movements often does more harm than good.

This is where long-term cash flow modelling shows its real value.

At Dynamic Planner, we’ve always advocated for goals-based financial planning underpinned by robust modelling. When clients see their long-term cash flow projection, grounded in sound assumptions and structured risk levels, they gain clarity. Not just about their investments, but about their overall financial journey.

But here’s the key: the power of cash flow modelling lies in its consistency—not its constant adjustment.

The danger of knee-jerk revisions

Imagine updating a client’s plan every time the market dips. Suddenly, retirement looks unaffordable or the legacy they hoped to leave shrinks dramatically. Each time valuations shift, so does the plan. Rather than bringing reassurance, this can introduce new anxiety. The client starts to see the plan as unreliable, rather than a roadmap.

We should remember that financial planning is not about achieving precision down to the last penny—it’s about direction, confidence, and resilience. If the plan fundamentally changes every time the FTSE wobbles, are we helping clients stay the course, or inadvertently encouraging short-termism?

Cash flow modelling: built for resilience

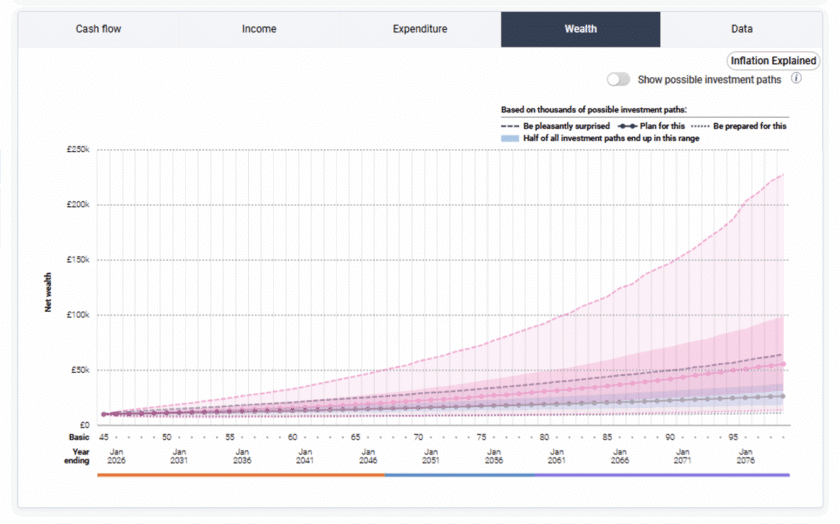

Cash flow modelling is designed to reflect risk-based return assumptions over time. When we build a plan, we’re not assuming straight-line growth. We factor in volatility, inflation, withdrawals and a range of potential outcomes. That’s the whole point. The plan anticipates storms—it doesn’t ignore them.

That’s why I encourage paraplanners not to reflexively revise cash flow models in response to short-term valuation changes. If the client’s goals haven’t changed, and their risk profile remains appropriate, the plan should remain relevant—even if markets have dipped or surged temporarily.

Annual reviews are essential and plans should evolve with clients’ circumstances, but that’s different from reacting to each market headline with a new projection.

What clients really need in uncertain times

In times of volatility, clients need two things: reassurance and perspective. A long-term cash flow model, grounded in realistic assumptions, provides both. It’s a visual, structured way to show that even with some rough patches, the journey can still be completed.

We often talk about the importance of behavioural coaching in financial advice. A well-constructed cash flow model is one of the best coaching tools paraplanners have. It helps clients see past the noise, stay focused on their long-term goals, and resist the urge to make reactive decisions that could damage their financial future.

Final thoughts

Software providers build systems designed to last. We plan for the unexpected, knowing it will come. And as paraplanners, your clients look to you to provide stability—not constant recalibration. By trusting in the power of long-term modelling, you not only guide clients through the fog—you help them ignore it altogether.

Let the model do its job. Let the plan breathe. And most importantly, let your clients stay focused on the journey ahead, not the headlines of the day.