The Brand Financial Training team looks at the relative pros and cons of active and passive funds in respect of constructing a client’s portfolio.

A financial adviser has completed a meeting with clients who are looking for advice on investing either a lump sum or on a regular basis. They have completed a fact find and the adviser now has all the information they need in order to come up with some recommendations. This will include:

- The client’s goals, objectives and expectations

- Whether they have any environmental, social or corporate governance (ESG) considerations

- Their timescales for investment/saving

- Establishing their attitude to risk and capacity for loss

- Establishing the amount of emergency fund they would be comfortable with

The adviser or their paraplanner will now have the job of producing some recommendations that can be presented to the clients. This will involve:

- Analysing the client’s situation

- Formulating recommendations

- Taking into account the client’s tax status and use of tax wrappers

- Deciding on an asset allocation and fund selection

It’s at this final stage that a decision will be made as to whether actively or passively managed funds (or a mixture of the two) are going to be recommended.

Let’s first cover active management

An actively managed fund will involve the fund manager deciding on exactly which underlying investments their fund is going to invest in. This will initially involve the manager complying with the rules laid down in the fund description – which will depend on whether it’s a UK equity fund, a European equity fund, a US equity fund, a gilt fund, a fixed interest fund etc.

The manager will then have to decide on exactly where they are going to invest the money they are looking after. This will involve research and trading costs as the fund’s assets are bought and sold in order to maximise return on the fund. For this reason, the charges levied by an actively managed fund are higher than those that are passively managed.

A fund manager is judged by how their fund performs and will be compared against a particular benchmark. This will be a benchmark relevant to the nature of their fund. For example, the performance of a UK Equity fund may be judged against the FTSE 100 or the FTSE All-share.

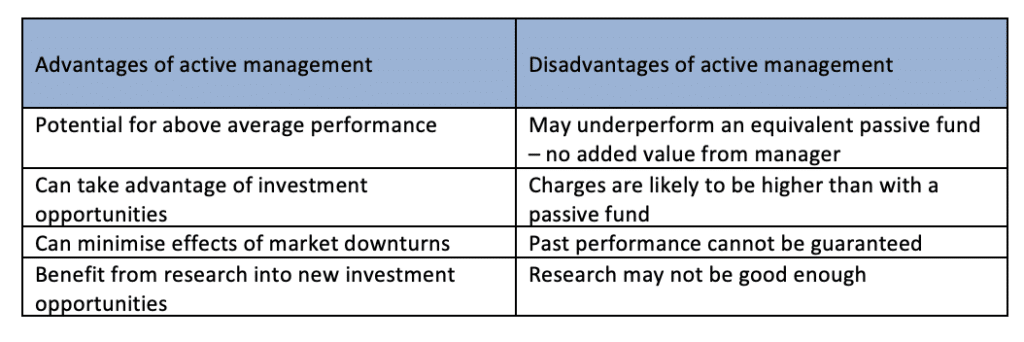

Here are the potential advantages and disadvantages of active management:

Let’s now look at passive management

A passive fund is one where the manager simply copies an index and invests in the same assets as are included in that index. They are often referred to as tracker funds and are as low or high risk as their underlying assets.

For example, corporate bond tracker funds could be rated 4 out of 7 on a risk versus return scale, whereas European equity and FTSE 100 tracker funds are likely to be rated 6 out of 7.

Tracker funds work in one of two ways; either full replication or partial replication. For instance, a FTSE 100 tracker fund working on a full replication basis would have to invest in all 100 companies that make up that index. The amount invested in each company would have to match the market capitalisation of the company (shares in existence x share price). So if the biggest company in the FTSE 100 represented 10% of the total value of the FTSE 100 then the manager would have to have 10% of his fund’s value in that company.

The first issue to consider is that if a company’s share price rose or fell significantly then the manager would have to buy and sell to re-balance their fund. This will involve trading costs and would add to the costs of running the fund.

The next consideration is that membership of the FTSE 100 is reviewed every three months. The manager would have to buy shares in companies coming into the index and sell shares in the companies being relegated to the second division (FTSE 250). Again, this will involve trading costs.

With partial replication, the fund manager invests in an agreed percentage of the companies in the index, for example 80%. So, if it is a FTSE 100 fund the manager will hold shares in 80 of the 100 companies but the amount they have invested in any one sector must match the size of that sector in the index. For example, if oil and gas companies account for 19% of the total value of the index then they must have 19% of the value of the fund in oil and gas companies but they can select which companies to invest in.

The advantage of this is that the manager can select which companies to invest in rather than blindly following the index. This of course means that research is needed which will add to the costs of running the fund but, also the manager can avoid investment in companies that are likely to fall out of the FTSE 100 and so avoid dealing charges.

Some funds are too big to use full replication, for instance the MSCI World index includes over 1,500 companies from 23 countries. It would be impossible to exactly replicate this index.

One problem with full replication index tracker funds is that, after charges, the fund will underperform the index. With partial replication there is the opportunity, through careful stock selection, to outperform the index.

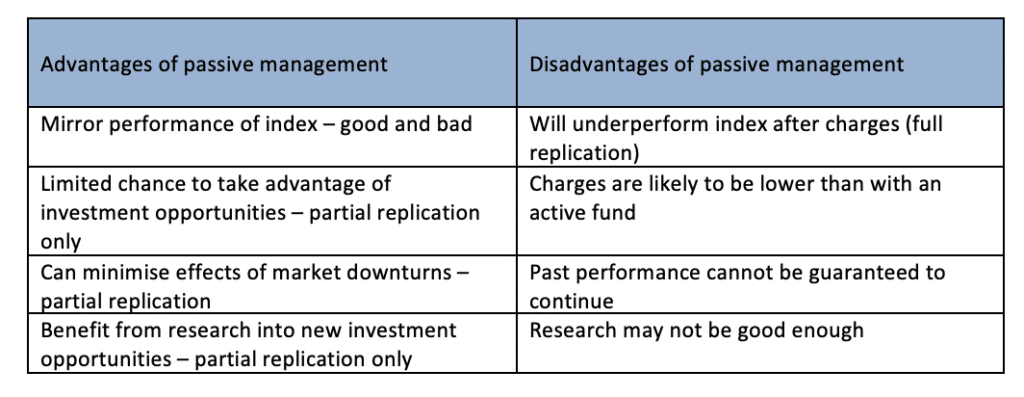

Here are the potential advantages and disadvantages of passive management:

An alternative to tracker funds – Exchange Traded Funds?

ETFs are tracker funds that are listed on the stock market so can be bought and sold any time the market is open. They can be more transparent, more flexible and more liquid so it is easier to move money in or out.

They also have the advantage that fund prices can change minute by minute whereas, with unit trusts and OEICs (active or passive funds) the unit or share price is calculated at a set time each day and that price will apply for the following 24 hours.

It should also be remembered that, while recommending an active or a passive fund, it may only represent one part of a client’s ideal asset allocation. Advisers should consider how the other asset types are to be included in a client’s portfolio.

About Brand Financial Training

Brand Financial Training provides a variety of immediately accessible free and paid learning resources to help candidates pass their CII exams. Their resource range ensures there is something that suits every style of learning including mock papers, calculation workbooks, videos, audio masterclasses, study notes and more. Visit Brand Financial Training at https://brandft.co.uk