In their latest article for professional Paraplanner, the Brand Financial Training team turn their attention to the intestacy rules in the UK and key facts in exam preparation.

When someone dies without leaving a valid will they are said to have died intestate and in these circumstances the law decides who will benefit from that person’s estate.

Intestacy rules in England and Wales

In England and Wales the legislation is contained in the Inheritance and Trustees Powers Act 2014. There are similar Acts that cover the position in Scotland and Northern Ireland – these will be covered later.

But first, a quick reminder of the necessary requirements for a will to be valid:

- The person making the will (testator) must be 18 or over (12 or over in Scotland)

- They must also be of sound mind

- They must not be acting under any form of duress

- The will must be in writing – handwritten or typed

- There must be a clear intention to dispose of assets

- The will must be signed by the testator in the presence of two witnesses

- The witnesses must be independent, for example, not executors or beneficiaries

- The witnesses must sign the will in the presence of the testator (for wills made between 31 January 2020 and 31January 2022 the ‘presence’ of those making and witnessing wills includes a virtual presence via video-link).

Factors that could affect an existing will

Divorce or the dissolution of a civil partnership does not invalidate a will, but the ex-spouse or ex-civil partner would not be able to act as an executor or be a beneficiary. The rest of the will is still valid.

Marriage and civil partnership however does invalidate an existing will – unless that will had been drawn up in ‘anticipation of the marriage/civil partnership’. You should note that this rule does not apply in Scotland – covered later.

Restrictions of the laws of intestacy (England and Wales)

None of the laws of intestacy that apply in the UK make any provision for those couples that are co-habiting (common law spouses as they are often referred to). If someone had been financially dependent on the deceased person they would have to go to court in order to benefit from their estate. The legislation that covers this in England and Wales is the Inheritance (Provision for Family and Dependants) Act 1975.

Only children or legally adopted children can benefit under the laws of intestacy of any country in the UK. They do not provide for step-children or fostered children.

A will and the laws of intestacy can only apply to assets that were owned solely by the deceased. Anything owned as ‘joint tenants’, for example, bank accounts, investments, property, will automatically pass to the co-owner. The exception to this is property owned as ‘tenants in common’ where the share (not always 50%) will pass according to the will of the deceased or the laws of intestacy.

What to do if someone dies without leaving a valid will

The ‘most entitled inheritor of the deceased’s estate’ (their closest living relative) should apply to the Probate Registry for a ‘Grant of Letters of Administration’. Once this is granted, they can then administer the estate according to the laws of intestacy.

If this person does not wish to act they can either appoint an attorney to act on their behalf or complete an ‘intestate’ form which enables them to nominate up to two people to be the next most entitled inheritor(s).

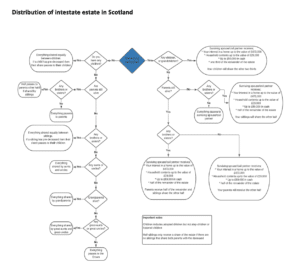

Intestacy in Scotland

The law that applies in Scotland is the Succession (Scotland) Act 1964.

The surviving spouse or civil partner has ‘prior rights’ – this includes property, household effects and cash. This is followed by ‘legal rights’ which provide for the surviving spouse/civil partner and children. The ‘free estate’ is the remainder of the deceased’s estate.

Unlike in England and Wales, getting married does not invalidate a will in Scotland. So if someone creates a will before they get married, this will still be valid after the marriage both regarding the executors that have been appointed and the way the will specifies the distribution of the estate. In these circumstances and under their ‘legal rights’, the spouse or civil partner could claim a share of moveable assets such as investments, cash and furniture, but not a property.

As in England and Wales, the laws of intestacy in Scotland do not recognise children other than natural or adopted, or co-habiting partners. If financially dependent, they would have to make a claim under the Family Law (Scotland) Act 2006

To seek a ‘grant of confirmation’ (which is the equivalent of probate in England and Wales) it is necessary to apply to the courts to be appointed as an ‘executor-dative’. The usual order of preference here would be, spouse or civil partner, a child, a sibling or parent of the deceased.

Intestacy in Northern Ireland

The law that applies in Northern Ireland is the Administration of Estates Act (Northern Ireland) 1955 (modified in 1981 and in 2007).

The situation in Northern Ireland is very similar to that applying in England and Wales:

- Only natural children and adopted children can benefit

- There is no provision for co-habiting partners

- An application would have to be made to the Probate Registry for a Grant of Letters of Administration in order to administer the estate

- Property could be owned as joint tenants or tenants in common with the same implications

- Someone that was financially dependent on the deceased but unable to benefit underlaw would have to apply to the courts under the Inheritance (Provision for Family and Dependants) (Northern Ireland) Order 1979

- One difference (see chart) is that if the surviving spouse/civil partner is to benefit then they must survive the deceased by 28 days.

About Brand Financial Training

Brand Financial Training provides a variety of immediately accessible free and paid learning resources to help candidates pass their CII exams. Their resource range ensures there is something that suits every style of learning including mock papers, calculation workbooks, videos, audio masterclasses, study notes and more.