People who take financial advice feel more comfortable thinking about difficult later life scenarios, according to new research by Standard Life.

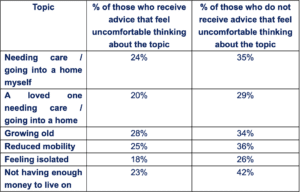

Standard Life’s Retirement Voice study found that more than two in five (42%) of adults who don’t receive advice find it uncomfortable thinking about falling ill, compared to 32% of advised clients, and nearly a third (32%) struggle with contemplating a loved one’s illness versus 24% of those who have received advice.

Meanwhile, 42% of non-advised adults feel uncomfortable talking about not having enough money to live on, with the figure dropping considerably to 23% among those who have received advice.

The research also found that advised individuals are more likely to have put plans in place to deal with difficult scenarios in the future, with twice as many having made a will compared to those who don’t receive advice.

Chris Hudson, retail advised managing director at Standard Life, said: “Our research shows that financial advice goes way beyond just number crunching. It helps create an order around issues that are difficult to contemplate such as illness in later life, care needs and financial security. These issues can have a huge bearing on your finances, so it’s important to begin thinking about them and incorporate them in a holistic plan to help ensure that you’re as prepared as possible for the eventualities of later life.”

Hudson said there was a clear difference in the levels of comfort addressing difficult topics among those who had accessed advice compared to those who haven’t, but noted that advice continues to remain inaccessible to a lot of people.

“With the FCA recognising the issues and holding a consultation into broadening access to financial advice, we’d like to see an environment where consistent, high quality and accessible guidance and advice is made available for all,” he added.

Those who have taken advice feel more comfortable contemplating these topics also: