Financial services firms must place greater emphasis on prioritising good consumer outcomes, in new consultation proposals from the Financial Conduct Authority.

The FCA recently announced plans for a new Consumer Duty that would require financial services firms across the board to ask themselves what outcomes consumers should be able to expect from their products and services; act to enable rather than hinder these outcomes and assess the effectiveness of their actions.

It warned that a combination of factors including a weaker bargaining position, asymmetries of information, a lack of understanding or behavioural biases may impair consumers’ ability to make good decisions and these may be exploited by firms to consumers’ detriment.

While the Watchdog said many firms are already delivering the right outcomes for consumers, it noted that “too many firms that are not adequately considering the needs of their customers”. It said it had seen examples of firms providing misleading or difficult to understand information; products and services that are not fit for purpose or not appropriate for consumers they are being sold to; products and services that do not represent fair value as well as poor customer service that hinders consumers from taking timely action to manage their financial affairs.

As such, the Consumer Duty would set “clearer and higher” standards for the culture of firms and the conduct expected of them. This would require all firms to focus on the actual outcomes experienced by consumers and act in a way that reflects how consumers behave and transact in the real world.

A raft of new measures would also provide firms with more certainty about the standards expected of them and provide consumers with the confidence that the financial services and products they buy are designed to deliver the benefits they expect and represent fair value.

Consumers would receive clear and understandable information from firms that would enable them to assess which products and services would best suit their needs, the FCA said.

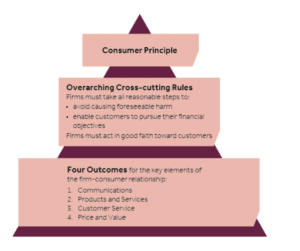

The Consumer Duty will contain three key elements; a ‘consumer principle’ which sets a clear tone and uses appropriate language; ‘cross cutting rules’ which develop and clarify the consumer principle’s overarching expectation of firm conduct; and ‘four outcomes’ which is a suite of rules and guidance that set more detailed expectations for firm conduct according to four specific outcomes for the firm-customer relationship.

Jamie Jenkins, director of policy and external affairs at Royal London welcomed the development.

Jenkins said: “In essence, the proposals raise the bar from treating customers fairly to treating customers well. As a mutual, we are wholly supportive of this aim.

“While there are certainly points of detail to debate, it’s difficult to argue against a principle that is intuitively right. And one which could help root out any lingering bad practices and improve trust in the sector. In short, we should embrace the new Consumer Duty, think of it less as a challenge and more as an opportunity.

“In fact, we believe the Duty could be extended to include a commitment from providers to invest responsibly. It’s increasingly clear that the industry has a role to play beyond just product outcomes for customers, thinking more broadly about how we can help improve their standard of living.”