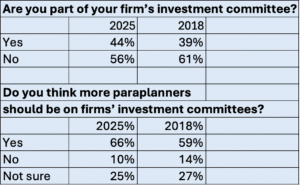

Paraplanners are becoming more involved in advice firms’ Investment Committees, with 44% of respondents to our recent Parameters survey already participating in their firm’s committee (up from 39% in 2018).

In addition, 66% of respondents were of the opinion that more paraplanners should be on firms’ committees, as having paraplanner input was seen as a major benefit for firms and clients.

As the tables below show, there has been an increase in the number of paraplanners participating in investment committees since we asked the same question in 2018 and who think there needs to be more paraplanner input to committees.

When asked what they felt were the benefits of paraplanners sitting on investment committees, respondents cited a number of reasons, from gaining a better understanding of markets and the structuring of investment portfolios, through to the input paraplanners can provide derived from their “at the coalface” experience and knowledge of delivering recommendations that help achieve the best investment outcomes for clients.

One of the most significant benefits paraplanner’s felt that their representation on committees offered was the different perspective that they bring to the table. They felt they could help committees view decisions through the lens of day-to-day application, ensuring that fund selections, model portfolios, and policies are aligned with how advice is actually delivered. In effect, providing a valuable “reality check” for committees, highlighting what is operationally feasible and what may present challenges in practice.

Paraplanners also offer a strong balance of investment knowledge, research capability, and operational understanding. While directors and senior investment professionals may focus heavily on strategy and governance, paraplanners felt they were able to complement this with hands-on experience of research tools, data compilation, and comparative analysis using platforms such as FE Analytics. Their familiarity with the full investment process, from research and fund selection through to recommendation reports, adding depth to committee discussions and supporting informed decision-making.

It was pointed out that firms using outsourced paraplanning could benefit from the external insight that outsourced paraplanners can bring. Working across multiple firms and structures can give outsourced paraplanners a wider awareness of market options, fund solutions, and best practice approaches. This breadth of experience allows them to contribute specialist knowledge and practical suggestions to the process.

Another key benefit lies in collaboration and productivity. When paraplanners are involved in investment committees, respondents said, they gain a deeper understanding of the rationale behind investment philosophy, model portfolio construction, and changes driven by market conditions. This knowledge flows directly into clearer, more consistent recommendation reports and closer alignment with advisers and ultimately, better outcomes for clients.

Paraplanners also said they can bring valuable insight into client behaviour and suitability. Their exposure to client circumstances, objectives, and reactions to market movements helps committees assess whether portfolios and strategies are appropriate for the firm’s client base. This “coalface” input ensures that investment decisions remain grounded in real client needs rather than purely theoretical models.

Finally, paraplanners felt that their involvement in investment committees supports professional development and knowledge sharing across the business. Paraplanners gain greater context around why certain funds, model portfolios, or managed portfolio services are selected, while committees benefit from feedback on efficiency, process improvements, and practical implementation. This wider spread of knowledge cam help strengthen the entire investment process and fosters a more joined-up, professional approach to managing a firm’s investment process.

Main image: benjamin-child-GWe0dlVD9e0-unsplash