“I can get almost 5 per cent in cash. Is there enough risk in these funds to beat this type of return? I’d argue in this market absolute return funds are irrelevant.”

The above quote is from a fund manager I met earlier this year who questioned the upside these vehicles could take versus the downside in this environment. Absolute return funds are a broad church – the sector is home to over 100 funds of all different shapes and sizes.

The sector is the choice when things look like they’re getting nasty. We saw that in early 2023 when inflows rose amid banking collapses and recessionary fears. But as fears have calmed, outflows have returned with some £4.3bn pulled by retail investors in the past 12 months*.

But are investors missing a trick – provided they can find the right fund?

“I’d argue the opposite is true – higher rates are an opportunity for long-short absolute return funds. The pressure of QE has been released, gone are the days when growth dominated everything. Bond yields were the determining factor and differentials between sectors and markets were put on the back burner. There are now more alpha opportunities and dispersion in pricing – and that means our run-rate of returns increases.”

That’s the view of Luke Newman, co-manager of the Janus Henderson Absolute Return fund, when I mentioned the above views of another manager on the sector. Newman has managed the long-short fund with Ben Wallace since launch. It aims to make a return in all market conditions, with two thirds of the portfolio typically invested in short-term tactical positions where the managers believe a surprise is imminent. The remainder of the fund is in long-term, core holdings. The fund can also invest up to 40 per cent outside the UK. The fund does carry a performance fee.

This version of the fund launched in 2009 but has a track record as a hedge fund dating back to 2004.

Performance – welcome to stage three of this fund’s life

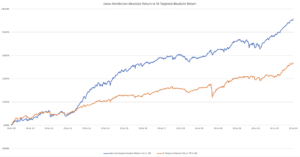

The history of the fund supports Newman’s views on the current environment, where there is no longer a dominant macro-factor. Today’s environment is similar to the first stage of the fund’s life (2004-2013), where the risk-free rate was less than 2 per cent and equity dispersion was high. In this period the return over the risk-free rate was 8.2 per cent**.

The impact of QE saw the fund struggle between 2014 and 2020 with the risk-rate greater than 2 per cent. Newman says: “The spread of the risk-free rate on the fund fell to 1.1 per cent. The challenge for us was how to dial down risk in the QE world – meaning more work around the bond market. We operated with less patience and booked profits sooner. All these things put a cap on deployed capital.**”

But October 2022 marked a new dawn for the fund, as the curtain came down on QE. With markets less correlated to monetary policy it released multiple factors to the team. Newman says re-ratings due to lower rates are now a thing of the past – dispersion is here.

He says: “The current environment suits humans more than machines because it is back to identifying relatively attractively valued businesses, with positive catalysts, sound management and good balance sheets – while the reverse is true of the short book.”

This has started to come through in performance. The fund has produced a positive return in 20 of the past 21 months (the last month was flat!); with returns over the risk-free rate at 4.8 per cent**.

Portfolio construction – pair trades, UK and special situations

Although the portfolio typically has two thirds in tactical positions, Newman believes this is now an environment where the split between tactical and core could move to 50/50 – something he says has historically coincided with stronger performance.

The short book currently has around 50 names. The US consumer is one of the underlying themes here, with retail names, DIY businesses and consumer staples as well. There are also some technology names within this part of the portfolio.

The long book has seen an increased exposure to UK names – with cheap valuations, increased buybacks and M&A activity growing. There has also been a host of special situation opportunities appearing, such as Rolls Royce, Smith & Nephew and Pearson.

Newman says: “Pearson is a great example. They have a new CEO from Microsoft who we expect will say the business can run harder and grow faster than we’ve seen before.”

Newman says higher rates have given everyone a timely reminder on how to value sectors. Rather than relying on growth at any price – return on equity and price-to-book are essential once again. He says this is exciting for banks and financials in the likes of the UK.

“A number of these businesses are trading at 1x book. They are going to be crucial to any new UK government plans, have huge excess capital, and the deposit flight from everyone buying gilts is abating,” he says.

There has also been an increase in pair trades in the portfolio, something Newman says almost stopped in the QE era as it became such an irrational, correlated market.

“We are now able to pair off lots of different companies within industries, with a view to the likes of margin/balance sheet structure,” he says.

Newman is not worried about rates peaking, citing the fund being in a sweet spot, with rates between 3-6 per cent. “It may impact positions, but the outcomes don’t change” he says.

There is an argument that equity long-short investing is an asset class in its own right. The managers have achieved steady returns, with very few down years. It is a strong consideration for investors looking for a core holding with good risk management characteristics.

*Source: Investment Association, May 2024

**Source: fund presentation, 31 May 2024

Past performance is not a reliable guide to future returns. You may not get back the amount originally invested, and tax rules can change over time. Juliet’s views are her own and do not constitute financial advice.