Anthony Rayner, fund manager, Premier Miton Macro Thematic Multi Asset Team, looks at the historical structuring of a defensive portfolio and why a more nimble approach is needed.

Most investors understand the importance of having a defensive element to their portfolio but what’s the best way to construct that defensive element, or indeed to construct a defensive portfolio?

Well, as ever, there’s more than one way to skin a cat but, for most multi-asset portfolios, the equity exposure tends to be the biggest contributor to portfolio risk. Therefore, from a risk perspective, the most important question will often be how, and by how much, to diversify equity beta.

There is no easy answer which is going to be right all the time. It depends on the broader investment environment, because that often drives how an asset class behaves (the volatility) and how asset classes behave in relation to each other (the correlation). It might sound blindingly obvious that the environment drives an asset class’s behaviour but investors don’t always follow this logic through when it comes to the practice of portfolio construction. Indeed, many investors have their favoured diversifiers of equity risk, often ones which have worked best in the recent past.

However, managing multi-asset portfolios for many years, we have seen time and time again that pragmatism is a good place to start when trying to understand risk. Specifically, looking at what is working now to diversify equity risk, rather than just what has worked in the past and extrapolating that forward.

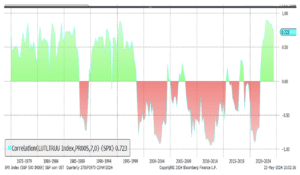

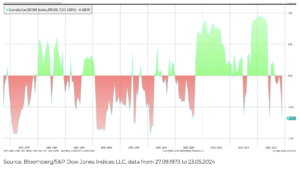

These two graphs, which look back over the last 50 years, illustrate this point very well. The first chart looks at the correlation between US equities (S&P 500) and US bonds (10 year government), while the second chart looks at the correlation between US equities and Commodities (Bloomberg Commodities Index).

There are a number of important observations we can make. Firstly, there are extended periods when bonds don’t diversify equity and, in fact, bonds have generally only diversified equity during periods of disinflation, i.e. where inflation risk isn’t elevated. Importantly, economic history, certainly over the last one hundred years, has been characterised by inflationary, not disinflationary, episodes.

Secondly, in more normal periods over the last fifty years, i.e. where inflation is elevated, equities and bonds tend to be strongly correlated to each other. Finally, in the majority of those same periods where inflation risk is elevated and bonds have been correlated with equities, commodities have proved a pretty good diversifier of equities.

Correlation between US equities and US bonds

Correlation between US equities and Commodities

Intuitively it makes sense that commodities do well when inflation is elevated, even if equities and bonds don’t. Oil and food prices are often primary drivers of inflation spikes, while gold often responds positively as an inflation hedge. This has been born out in more recent times, as both charts show, as the environment has been characterised by inflation, so bonds have been correlated to equities, whilst commodities have provided some diversification.

Recognising that the same asset class has not always been the best diversifier of equity risk over time is particularly important for a defensive portfolio but also for all multi-asset portfolios in general. Indeed, our pragmatic approach to portfolio construction has been a big driver of the strong absolute and relative returns over short, medium and long-term time frames for the entire Macro Thematic range.

However, it’s not so straight forward for many multi-asset funds. The more traditional fund managers will be looking for bonds to diversify equities, reflected in the common narrative that bonds are always good diversifiers of equity. We also know, for example, that most funds have very little in commodities like gold which, as we have shown above has been a good diversifier in recent times.

Meanwhile, index, or quasi index, funds will be drawn to have a material exposure to government bonds, and with a bias to longer duration. Funds with a sustainable bias, on the other hand, will most likely have a bias against oil, despite it being one of the best diversifiers of equity beta over time.

In short, a cursory glance at the ‘defensive’ funds on offer illustrates that many will have a fairly fixed and material exposure to bonds and actually often not be nimble enough to embrace the best diversifier of equities at any given time, whichever asset class that might prove to be.

This information should not be relied upon by retail clients or investment professionals. The views provided are those of the author at the time of writing and do not constitute advice. These views are subject to change and do not necessarily reflect the views of Premier Miton Investors. The value of investments may fluctuate which will cause fund prices to fall as well as rise and investors may not get back the original amount invested. Reference to any particular investment does not constitute a recommendation to buy or sell the investment.