Darius McDermott, managing director Fund calibre, looks at the pros and cons of AI and how to invest in the trend.

Artificial Intelligence (AI) is not new. In fact, it’s even older than me (no, really). It dates back to the 1950s when Arthur Samuel’s Checkers program was demonstrated to the public on television. In 1962, self-proclaimed checkers master Robert Nealey played the game on an IBM 7094 computer… and the computer won.

The next seven decades were characterised by computers beating humans in other games and puzzles such as Backgammon, Othello, Chess, Scrabble and Go.

But it was in November 2022 when the world went AI crazy. ChatGPT’s launch exploded onto the scene and the program reached 100 million users in just over a month, becoming the fastest-growing consumer application in history.

The “iPhone moment for AI” rocked financial markets and even triggered petitions calling for a pause in development in order to take stock of the socio-economic consequences.

So what do our fund managers have to say? Quite a bit as it turns out.

Solving the world’s problems

Chris Ford, who runs the Sanlam Global Artificial Intelligence fund, is unsurprisingly upbeat about the prospects. He believes AI has the potential to help solve some of the world’s largest economic and social problems. Not only that, but “companies able to capture the opportunity will enjoy considerable competitive advantages,” he said. “Opportunities exist on a global scale and across all sectors, from finance to healthcare, and retail through to media.

“AI has the potential to double economic growth rates over the next 20 years, with no country left behind. In fact, some of the countries with lowest economic growth stand to benefit most from the adoption of AI.”

James Budden from Baillie Gifford is equally optimistic about the many different ways AI could be used. “As we look forward to the next decade, we must look towards new growth frontiers,” he said. “If the growth engines of the last decade were the internet, mobile and software, the growth engines of the next decade will be based on data and artificial intelligence.

“These technologies are creating a bridge between the digital and the physical world. We already have self-checkout lanes in supermarkets and self-driving cars on the road. These are nothing more than robots becoming more intelligent over time. But if we have robots in retail stores and on the roads, why not on factory floors, in hotel receptions or hospital surgeries?”

On the latter, Gareth Powell, manager of Polar Capital Global Healthcare trust, said: “We expect AI to positively impact the sector in terms of automation and driving productivity which will become increasingly important considering the cost of delivery of healthcare. An example would be using AI to read patient scans faster, more accurately and cheaper. In R&D we again expect AI to provide efficiency but to not significantly impact the process of new targets which is most important when developing new innovative products. Generally, expect adoption to be slow due to regulation.”

Causing more harm than good?

Of course, there are a number of notable concerns about the speed at which AI is developing and then sheer potential it has to disrupt economies and society.

For example, the large language models like ChatGPT have been ‘trained’ on data from the internet, using the likes of Wikipedia and internet message boards. These are all human-produced data will and will therefore reflect human biases.

Other concerns are around data protection, deepfake content, and how AI could be used to ‘cheat’ in education, by writing essays and the like. There also environmental concerns as the data needed for AI will generate carbon emissions comparable to the amount needed for crypto mining.

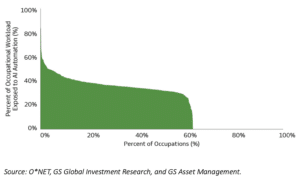

And finally, there is the fear that AI will take over our jobs. According to Goldman Sachs, AI will expose up to two-thirds of US and EU jobs to varying degrees of redundancy, with c.7% of roles vulnerable to replacement and “with particularly high exposures in administrative and legal professions but low exposures in construction and maintenance.”

The good news is that history shows that worker displacement from automation is mostly offset by the creation of new jobs. Goldman Sachs also points out that, “over the last 80 years, the technology-driven creation of new jobs has accounted for 85% of employment growth.”

Percent of occupational workload and occupations exposed to AI automation

The US leads the charge

“We think artificial intelligence is a very real opportunity, and we expect investment to explode. This has major implications for the US equity market,” commented Martin Hawtin, manager of GAM Star Disruptive Growth. “The launch of Chat GPT in November 2022 has unleashed what we term Digital 4.0, which is more far reaching than any of its predecessors. We believe this wave will profoundly change the foundations of every business. AI, together with masses of data, faster networks, and the connectivity of everything, promises to accelerate the pace of disruptive change at exponential rates. With each new technology comes greater and greater speed and adoption.

One of the biggest beneficiaries of the AI revolution so far has been US software company Nvidia, whose market capitalisation soared by approximately $200 billion. According to Martin, its Q1 2023 results were so spectacular “that they have fired the starting gun in AI investing.” The reason for the Nvidia raise was demand for large language models (LLM) the core of AI applications.

James Thomson, manager of Rathbone Global Opportunities, added “The early adoption of this technology has been nothing short of breath-taking. Nvidia, our largest holding in the fund, announced earnings upgrades of almost 75% due to demand for its AI-powering GPU processors.

Some analysts believe this is the start of a new computing era, similar to the mainframe, PC, and smartphone eras of the past. In those ecosystems, typically a single vertically integrated company has captured more than 80% of the entire market value. Nvidia has designed itself as a vertically integrated AI solution with its chips, hardware, and software, giving itself the best shot to dominate this era. The early signs look good…

Opportunities elsewhere in the world

US companies won’t be the only ones to benefit, however. According to the managers of Guinness Asian Equity Income, technology stocks account for 70% of Taiwan’s stock market index and 47% of Korea’s benchmark index. “The technology sectors in these markets rose 9.8% and 10.2% respectively,” they said.

Comgest Growth Europe ex UK’s top contributing holding in May was also ASML, whose lithography technology is fundamental to mass producing semiconductor chips. “It’s share price rose along with many other semiconductor stocks due to investor enthusiasm for companies which will benefit from the increased importance of artificial intelligence (AI),” the fund’s manager said.

Emerging markets are also not immune. According to the managers of Guinness Asian Equity Income, technology stocks account for 70% of Taiwan’s stock market index and 47% of Korea’s benchmark index.

“A most remarkable and sudden enthusiasm for all things related to Artificial Intelligence has resulted in a supercharged rally in semiconductor stocks,” added the manager of Aubrey Global Emerging Market Opportunities fund. “Inevitably perhaps, Taiwan Semiconductor and Samsung Electronics gained 12.7% and 9% respectively. They are the two largest stocks in the MSCI Emerging index, accounting for around 10% by weighting.”

Other stocks suffered, at least initially. “A few of our European companies were initially thought to be losers from AI, RELX for example,” commented Alexander Darwall, manager of the European Opportunities Trust. “However, investors are already having to reconsider simplistic assumptions. RELX, responding to initial investor concerns, has helpfully explained why they expect their legal workflow software solutions to withstand new AI competition.”

Pearson, a holding in JOCHM UK Dynamic, was also negatively impacted “on read across from US peer Chegg’s Q1 trading update, which reported adverse impacts on new customer growth from students switching from digital education resources to ChatGPT,” said manager Alex Savvides.

“Chegg management warned of future challenges to the sector from generative AI and removed their 2023 outlook guidance,” he continued. “Pearson made a statement on generative AI impacts on their own business, outlining enhancements to services and a strategy to embed the technology across products whilst reiterating confidence in the mid-term guidance laid out at the end of April, but the shares did not fully recover and ended the month 10% lower.”

And while some managers are optimistic about the changes, others are more cautious.

Bruce Stout, manager of Murray International, commented that “whilst the technology sector’s wildly exuberant reaction to future forecasts of “exponential” growth in this specialised industry is nothing new within recent history of speculative exaggerations, the timing of such market strength is arguably bizarre. Such market strength, albeit concentrated in one narrow sector, ignores the damage being done by ongoing monetary tightening and the ever-increasing risk that US interest rates may stay higher for longer following a decade of decadence in capital allocation based of cheap and easy credit conditions.”

The managers of JOHCM Global Opportunities, added “Market leadership continues to narrow. Realistically, the only way to outperform in May was to own a lot of technology. The only subsectors up in the month were the three within information technology, plus media (of which Alphabet and Meta are 55%), retail (Amazon 43%) and autos (Tesla 44%). This has all the hallmarks of an emerging bubble, and we are surprised it is happening so soon after the traumas of 2022.”

“AI will transform many parts of the economy. But it would be foolhardy to make specific predictions,” conclude the managers of Scottish Mortgage Investment Trust. “Therefore, we have time to study and learn as companies incorporate the technology into their products and services. Amid the AI hype, patience and a long-term mindset are key in deciphering signals from the noise.

“Many industry solutions already use AI, and it may surprise some to learn that Tesla is currently one of the largest AI companies in the world. This year, it rolled out initial access to its full self-driving software in the US. The software has now driven 150 million autonomous miles, providing a vast data advantage over the rest of the automotive industry. The system’s capability is already impressive, but the pace of improvement will be most important over time.”

[Main image: nasa-Q1p7bh3SHj8-unsplash]